(Bloomberg) — The fallout for publicly-traded companies exposed to cryptocurrencies has been a boon for investors betting against them, delivering roughly $469 million in paper profits for November alone.

Most Read from Bloomberg

GOP Retakes US House by Slim Margin in Washington Power Shift

Xi Looks Away From Putin Toward West in World Stage Return

FTX’s New Boss Reveals Chaos Left Behind by Bankman-Fried

Elizabeth Holmes Says US Is Wrong to Suggest She Marry Her Partner to Pay Debts

Xi Confronts Trudeau Over Media Leaks in Heated Exchange Caught on Camera

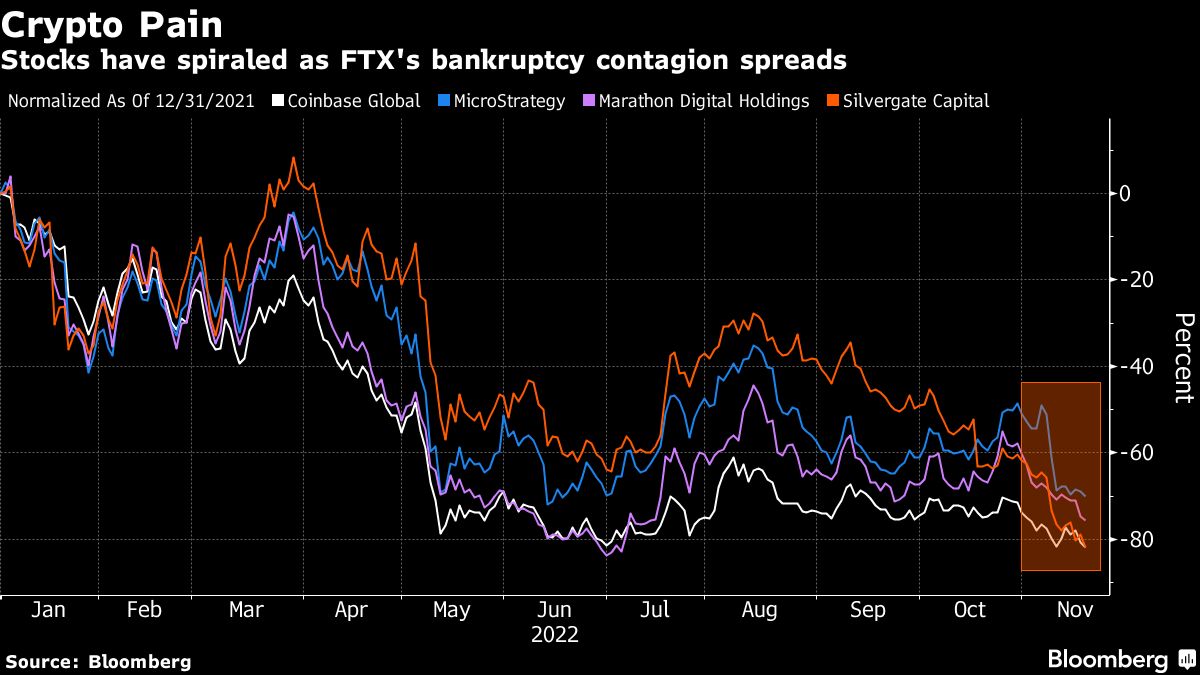

MicroStrategy Inc. is down 37% this month through Wednesday’s close, handing shorts $286 million in mark-to-market profits, while Coinbase Global Inc.’s 26% decline delivered another $229 million in gains, according to financial analytics firm S3 Partners. Huge losses for other peers, including Marathon Digital Holdings Inc. and Silvergate Capital Corp., have helped drive profits in November for investors betting against the industry through short sales, Ihor Dusaniwsky, S3’s managing director of predictive analytics, wrote in a note.

The group of stocks has tumbled as investors weigh how far reaching the fallout from the collapse of Sam Bankman-Fried’s FTX Group will be across the cryptocurrency ecosystem. Contagion from FTX’s bankruptcy has forced management teams to attempt to distance themselves from the company, with exposed stocks following tokens, including Bitcoin, lower. The largest cryptocurrency by market value has fallen nearly 20% so far this month, compared with a 1.1% gain for the S&P 500 Index.

“We expect increased short selling in these stocks as the possibility for broader sector wide price weakness increases,” Dusaniwsky wrote. With the underlying cryptocurrency market in temporary disarray, he expects shorting activity to “see-saw between shorting and covering as momentum trading overtakes fundamental investing in these stocks.”

Skeptics have added to bearish bets over the past week, driving almost $93 million of new short selling, according to S3 data. More than one-quarter of MicroStrategy shares available for trading are currently sold short, while Marathon Digital, Bakkt Holdings Inc. and Coinbase each have short interest levels above 15% of the shares available for trading, the data show.

Despite the industry fallout, Cathie Wood’s funds have continued to pile onto bets in Coinbase, Silvergate Capital and Grayscale Bitcoin Trust. Funds run by Wood’s Ark Investment Management have been on wild rides this year as growth stocks have been battered by Federal Reserve interest rate hikes and fears of a recession.

Most Read from Bloomberg Businessweek

Fatal Crashes Highlight Rising Danger of Illicit Charter Flights

North America’s EV Future Hinges on a North Carolina Turtle Pond

FTX Was an Empty Black Box All Along

Twitter’s Layoffs Are the Perfect Example of How Not to Fire People

Google’s Moonshot Lab Is Now in the Strawberry-Counting Business

©2022 Bloomberg L.P.

Related Quotes

The market is volatile, but top companies are rolling their sleeves up and working on growing their businesses.

The Ulta vet is settling in at the retailer with a little joy — “sneakers are fun,” she said.

In this article, we will discuss 16 Best Gambling Stocks To Buy Now. You can skip our detailed analysis of the gambling industry and go directly to 5 Best Gambling Stocks To Buy Now. The gambling industry, like many other industries around the world, was severely affected by the COVID-19 pandemic and still continues to […]

John Ray, who was named FTX's chief executive after the company filed for bankruptcy on Nov. 11, said in a court filing that the lapses in oversight, security and corporate governance he identified were greater than in any other process he has managed in his 40 years as a bankruptcy specialist, including at Enron. "Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here," Ray said in the filing, with the District of Delaware bankruptcy court. FTX collapsed after its founder Sam Bankman-Fried used $10 billion in client funds to prop up his hedge fund Alameda Research, which had suffered losses when its bets on crypto ventures soured, Reuters has previously reported.

(Bloomberg) — Oaktree Capital Group LLC co-founder Howard Marks is gearing up for one of the best buying opportunities since the global financial crisis as higher interest rates and a looming recession push more companies into distress.Most Read from BloombergGOP Retakes US House by Slim Margin in Washington Power ShiftXi Looks Away From Putin Toward West in World Stage ReturnFTX’s New Boss Reveals Chaos Left Behind by Bankman-FriedElizabeth Holmes Says US Is Wrong to Suggest She Marry Her Part

DraftKings was initiated at Overweight by analysts at Piper Sandler who said the stock’s current level represents “an attractive long-term entry point.” The analysts also put a price target on the stock of $21. DraftKings (ticker: DKNG) was rising 2.5% on Friday to $15.27.

An expert review of FTX’s audited financial statements reveals a series of red flag related-party transactions that should have led to more scrutiny of the company’s operations.

(Bloomberg) — BHP Group Ltd. made an improved A$9.6 billion ($6.4 billion) offer to acquire copper producer OZ Minerals Ltd. as the world’s top miner seeks more exposure to rising demand from clean energy and electric cars.Most Read from BloombergMusk’s ‘Hardcore’ Ultimatum Sparks Exodus, Leaving Twitter at RiskFTX’s New Boss Reveals Chaos Left Behind by Bankman-FriedGOP Retakes US House by Slim Margin in Washington Power ShiftXi Looks Away From Putin Toward West in World Stage ReturnElizabeth

FTX's downfall revealed it to be a company shrouded in dishonesty. Fortunately, a transparent exchange still exists in the world of decentralized finance.

Visa Inc on Thursday named its president, Ryan McInerney, as its new chief executive officer to steer the company through a challenging period for the payments industry as consumers tighten their belts. McInerney will take the helm in February, replacing Alfred Kelly Jr, who has been CEO since 2016. "Ryan's challenge as a CEO during this time is that we're in inflationary times," said Darrin Peller, managing director at Wolfe Research, told Reuters.

(Bloomberg) — Chinese President Xi Jinping pressed ahead with efforts to repair ties with key US allies at the Asia-Pacific Economic Cooperation summit, even as he pitched competing security and development models for the region. Most Read from BloombergGOP Retakes US House by Slim Margin in Washington Power ShiftXi Looks Away From Putin Toward West in World Stage ReturnElizabeth Holmes Says US Is Wrong to Suggest She Marry Her Partner to Pay DebtsFTX’s New Boss Reveals Chaos Left Behind by Ban

The prices of the exchange’s stock and bonds reflect anxieties after the collapse of rival FTX and sharp declines in bitcoin.

U.S. exchanges and Wall Street's top cop on Thursday warned about a heightened threat of fraud mostly involving the initial public offerings of small companies, driven in part by a social media-driven pump-and-dump scheme called "pig butchering." Some investors harmed by the pump-and-dump schemes appear to be victims of an evolving social media scam called "pig butchering," Finra said.

Asian stocks were mixed Friday after Wall Street declined following indications the Federal Reserve might raise interest rates higher than expected to cool inflation. Wall Street's benchmark S&P 500 index lost 0.3% on Thursday after a Fed official indicated the U.S. central bank might need to raise its key lending rate as high as almost double its already elevated level to rein in price increases. Officials warned previously that rates might have to be kept high for an extended period, but traders hoped signs of slowing economic activity might cause the Fed to back off those plans.

The market continues to worry about the fallout of FTX's bankruptcy last week, which is hurting cryptocurrency-related stocks today. Shares of Silvergate Capital (NYSE: SI) fell as much as 16.9% in trading on Thursday morning, Coinbase (NASDAQ: COIN) was down as much as 7.5%, and Block (NYSE: SQ) was even down 4.6%. John J. Ray III, who is leading the team administering FTX in bankruptcy, filed with the court this morning, outlining the financial situation of FTX and its related entities.

NetEase, Inc (NASDAQ: NTES) reported third-quarter FY22 revenue growth of 10.1% year-on-year to $3.4 billion, missing the consensus of $3.48 billion. Segments and margins: Games and related value-added services revenues grew 9.1% Y/Y to $2.6 billion. The corresponding gross margin expanded by 370 bps to 65%. Youdao, Inc's (NYSE: DAO) revenue rose 1.1% Y/Y to $197.2 million, and the corresponding gross margin contracted by 240 bps to 54.2%. Cloud Music's revenues were $331.4 million, up 22.5% Y/Y

The FTX founder has signaled his support for a dueling bankruptcy filing from the Bahamas seeking to take control of certain assets.

The entire crypto industry has been struggling after the major crypto exchange FTX filed for bankruptcy last week following a liquidity crunch and opening of federal investigations into the actions of its founder, Sam Bankman-Fried. The crypto bank Silvergate Capital (NYSE: SI) has been hit particularly hard, with its stock down about 47% since the news about FTX started to break last week. Now there is chatter that Silvergate could be facing a run — when customers rush to withdraw their deposits because of concerns about the survival of the bank.

As of 10:20 a.m. ET, shares of Chevron (NYSE: CVX) are trading 1.8% below Thursday's close, while oil industry bellwether ExxonMobil (NYSE: XOM) is down 2.1%, and independent oil producer Diamondback Energy (NASDAQ: FANG) leads the pack lower with a 5.6% loss. Valued at just 6.5 times earnings, and paying a rich 5.5% dividend yield, Diamondback's dividend alone seems nearly enough to justify the stock's price, even assuming zero growth in earnings.

It's not a secret that every investor will make bad investments, from time to time. But it's not unreasonable to try to…

Author

Administraroot