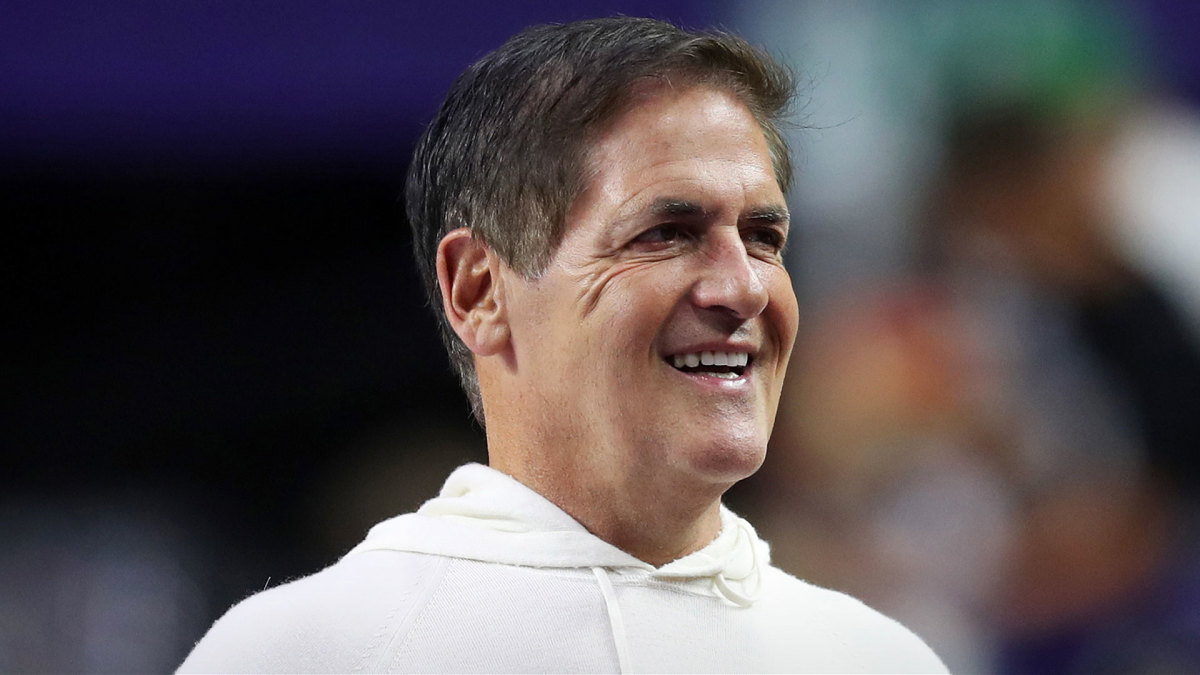

Mark Cuban is not happy and makes it known.

The successful entrepreneur seems, like most business circles, to have been shocked by the implosion, in less than a week, of FTX, one of the big players in the crypto sphere.

The cryptocurrency exchange filed for Chapter 11 bankruptcy on Nov. 11, after three turbulent days, which saw a company valued at $32 billion in February urgently calling on its rivals for help.

But FTX's financial situation was too dire for a potential savior to try and rescue it. Binance, the biggest crypto exchange and big rival of FTX, tried but finally gave up.

"As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged U.S. agency investigations, we have decided that we will not pursue the potential acquisition of http://FTX.com," Binance said on November 9.

"In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help."

As a crypto exchange, FTX executed orders for their clients, taking their cash and buying crypto currencies on their behalf. FTX acted as a custodian, holding the clients’ crypto currencies.

FTX then used its clients’ crypto assets, through its sister company’s Alameda Research trading arm, to generate cash through borrowing or market making. The cash FTX borrowed was used to bail out other crypto institutions in the summer of 2022.

At the same time, FTX was using the crypto currency it was issuing, FTT, as collateral on its balance sheet. This represented a significant exposure, due to the concentration risk and the volatility of FTT.

Once this exposure came to light, clients, fearing an FTX collapse, rushed to liquidate their crypto positions and get their money back. On Nov. 6, customers withdrew a record $5 billion. It was a run on the exchange. This led to the insolvency of FTX, since it did not have the crypto assets, now on loan or sold, to honor its clients’ sell orders.

The panic caused cryptocurrency prices to plummet. Shares of crypto companies like Coinbase (COIN) – Get Free Report, MicroStrategy (MSTR) – Get Free Report and Robinhood (HOOD) – Get Free Report are being sold by investors, who fear a contagion effect. The question now is which companies will be impacted.

The search for responsibility has also begun, trying to understand how a company of this size can implode, without the regulators realizing the risk, especially since its former Chief Executive Officer, Sam Bankman-Fried, was whispering in the ears of these same regulators and politicians to define what regulation would be adequate for the sector.

Mark Cuban, who has invested in several cryptocurrency-related firms and projects, believes regulators have not done their job. He is targeting the U.S Securities and Exchange Commission (SEC) in particular.

For the billionaire, contrary to what people say, the crypto industry is regulated. It just so happens that the SEC failed in its role. This is what he just said on Twitter.

"Everyone is saying that crypto is unregulated," the Shark Tank star said on Twitter on Nov. 12. "Not true. The SEC says that they regulate crypto. Ask Kim Kardashian and the tokens they have sued or settled with."

He continued: "The question is, given the visibility of the central exchanges , why hasn't the SEC already knocked on their doors ?"

FTX was a centralized exchange.

The owner of the Dallas Mavericks refers to sanctions and fines imposed on cryptocurrencies or projects by the SEC. For him, if the SEC sees fit to punish Kim Kardashian for promoting scam coins, it clearly means that the federal agency regulates the sector. Part of the responsibility for the FTX debacle therefore lies with them.

Last month, the SEC charged Kardashian for promoting on social networks a cryptocurrency that turned out to be a scam. The reality-TV star agreed to pay $1.26 million in penalties to settle the investigation.

The crypto industry is particularly suspicious of the regulatory agency, accusing it of deliberately refusing to enact clear rules. The federal agency prefers regulation by enforcement, crypto players criticize.

Contacted by TheStreet, the SEC did not immediately respond.

"I think that investors need better protection in this space. But I would say this, this is a field that’s significantly non-compliant," SEC Chair Gary Gensler told CNBC on Nov. 10. "But it is got regulation and those regulations are often very clear and we have multiple paths."

"And one path is working with those crypto exchanges, crypto lending platforms, and to get them properly registered and why that matters is that so the public is protected. But we have another path which is enforcement. We’ve brought between my predecessor and the teams now at the SEC at least 100 actions in this case and we’ve been very clear in these various enforcement actions and we had a big win."

The SEC, the Commodity Futures Trading Commission (CFTC) and the Department of Justice (DoJ) have opened investigations into FTX. Regulators are under pressure from lawmakers.

Senator Elizabeth Warren has called for "more aggressive enforcement" of consumer protection laws.

Author

Administraroot