This post was originally published on TKer.co

Stocks rallied last week, with the S&P 500 surging 5.9%. The index is now up 11.6% from its October 12 closing low of 3,577.03 and down 16.8% from its January 3 closing high of 4,796.56.

A big driver of the recent market move was Thursday’s cooler-than-expected consumer price index (CPI) report, which was followed by one of the biggest single-day stock market rallies in history. (More on the CPI report below.)

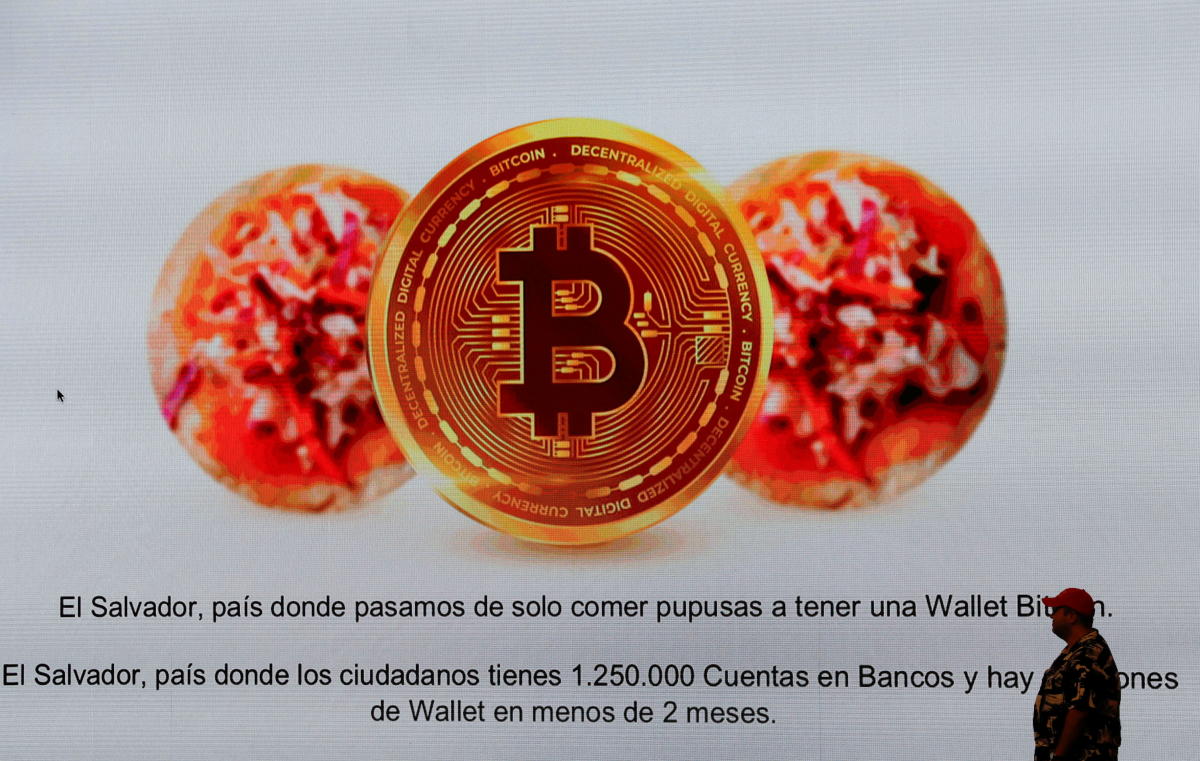

But with last week’s sudden and spectacular implosion of crypto exchange FTX, I thought I’d share some thoughts on cryptocurrencies and blockchain.

Ever since Bitcoin made mainstream news about a decade ago, I’ve done my best to read up on cryptos and blockchain technology. Unfortunately, I’m not sure I totally understand what the big deal is.

I believe blockchain represents a technological breakthrough, and I’m convinced there’s some value in being able to own and exchange digital objects that can’t be copied.

I’m just not convinced there’s an urgent need for any of this. If there were, I’d think there’d be much wider adoption. But the individuals and entities going all-in on cryptos and blockchain are largely detached from anything that matters to me.

That said, I’m also not convinced that cryptos and blockchain will never matter. There may be a day that this technology becomes central to how assets and information are exchanged.

But I also don’t think you need to own a bunch of today’s cryptocurrencies and invest in today’s blockchain companies to benefit. If the technology is indeed all it’s cracked up to be, then everyone should eventually gain from cost savings and reduced frictions across the economy.

As far as the price swings in cryptocurrencies are concerned, here’s an analogy that I think I’m happy with: Blockchain is like the internet and cryptocurrencies are like websites. During the advent of the internet, there were lots of internet companies you could invest in and there were lots of websites you could visit. Today, everybody uses the internet and everybody visits a lot of websites. But a lot of the early internet companies have gone bust and a lot of yesterday’s popular websites aren’t popular today. Maybe some of today’s cryptocurrencies will become tomorrow’s Amazon or Google, but many will also go down like Pets.com or Webvan.

A quick note about fraud: Anything that looks like a financial opportunity is going to come with a lot of crooks who’ll take advantage of those attracted by the prospect of getting rich quick. But the existence of crooks in the crypto world doesn’t necessarily mean that crypto itself is problematic. It just means that there needs to be more education and probably some regulation.

In summary, I think blockchain technology is interesting, but I don’t think the need is urgent. And just because you don’t own a bunch of cryptocurrencies and you don’t invest in a bunch of blockchain companies doesn’t mean you won’t benefit should the technology become widely adopted.

There were a few notable data points from last week to consider:

🚨 Inflation cools a bit. The consumer price index (CPI) in October was up 7.7% from a year ago. Adjusted for food and energy prices, core CPI was up 6.3%. Both measures were down from September levels and both were cooler than economists’ expectations.

On a month-over-month basis, CPI was up 0.4% and core CPI was up 0.3%. Again, both measures were cooler than expected.

Core services prices cooled and core goods prices fell.

Rent of primary residence (a.k.a., tenants’ rent) and owners’ equivalent rent (i.e., how much a homeowner would have to pay to rent their currently owned home) cooled a bit as they catch up with the decline in market rents.

😞 Consumer sentiment is deteriorating again. From the University of Michigan’s November Survey of Consumers: “Consumer sentiment fell about 9% below October, erasing about half of the gains that had been recorded since the historic low in June. All components of the index declined from last month, but buying conditions for durables, which had markedly improved last month, decreased most sharply in November, falling back 21% on the basis of high interest rates as well as continued high prices. Overall, declines in sentiment were observed across the distribution of age, education, income, geography, and political affiliation, showing that the recent improvements in sentiment were tentative. Instability in sentiment is likely to continue, a reflection of uncertainty over both global factors and the eventual outcomes of the election.“

💳 Consumers are taking on more debt. According to Federal Reserve data, total revolving consumer credit outstanding increased to $1.16 trillion in September. Revolving credit consists mostly of credit card loans.

📈 Credit card rates are rising. From CNN Business: “The Federal Reserve’s war on inflation has driven up the average credit card APR (annual percentage rate) to 19.04% as of November 9, according to Bankrate.com. That’s the highest rate since Bankrate.com’s database began in 1985, beating the prior record of 19% set in July 1991.“

😞 It’s getting harder to borrow: According to Federal Reserve’s Senior Loan Officer Opinion Survey, bank lending standards got significantly tighter during Q3.

👎 Personal bankruptcies are ticking up. From Axios: “ In October, there were 14,161 new cases, a 27% increase from the same month a year ago, according to Epiq Bankruptcy Analytics. Yes, but: Don't fret about the state of the American consumer just yet — bankruptcy filings remain far below pre-pandemic norms. Back in 2019, the monthly average was 23,570, or about 66% higher than last month's tally.“

🛍 Consumers still expect to shop this holiday season. From the National Retail Federation: “Holiday spending is expected to be healthy even with recent inflationary challenges, as the National Retail Federation today forecast that holiday retail sales during November and December will grow between 6% and 8% over 2021 to between $942.6 billion and $960.4 billion. Last year’s holiday sales grew 13.5% over 2020 and totaled $889.3 billion, shattering previous records. Holiday retail sales have averaged an increase of 4.9% over the past 10 years, with pandemic spending in recent years accounting for considerable gains.“ From NRF CEO Matthew Shay: “In the face of these challenges, many households will supplement spending with savings and credit to provide a cushion and result in a positive holiday season.“

⏳ But they’re waiting for a deal. From Morgan Stanley: “Consumers are waiting for a deal; 70% of shoppers said they are waiting for stores to offer discounts before they begin their holiday shopping (Exhibit 7). Shoppers are looking to see substantial discounts before they begin spending; 30% of shoppers are waiting for 10% – 20% discounts while 27% are looking for 21% – 30% discounts. In the absence of last year’s supply issues consumers will have plenty of choices this year and will feel free to shop around for the best prices. Stores offering the best deals will be able to grab the largest wallet share but at a hit to margins.“

🛍Holiday sales are off to a slow start. From BofA: “In fact, holiday sales, which include categories that usually receive a big boost in sales during the winter holidays such as clothing and electronics, continue to show some weakness in goods spending for the winter holiday season relative to last year (Exhibit 3).“

💼 Unemployment claims remain low. Initial claims for unemployment benefits rose to 225,000 during the week ending Nov. 5, up from 218,000 the week prior. While the number is up from its six-decade low of 166,000 in March, it remains near levels seen during periods of economic expansion.

📋 Small businesses say labor shortages continue. From the NFIB’s Bill Dunkelberg: “Inflation, supply chain disruptions, and labor shortages continue to limit the ability of many small businesses to meet the demand for their products and services.“

While inflation appears to be cooling, it continues to be very hot. So we should expect the Federal Reserve to continue to tighten monetary policy, which means tighter financial conditions (e.g. higher interest rates and tighter lending standards). All of this means the market beatings will continue and the risk the economy sinks into a recession will intensify.

On the matter of recession risks, consumers are increasingly stretching their finances to maintain their spending. They’re accumulating more debt and a growing number of these folks are entering bankruptcy.

But it’s important to remember that while consumer finances may be deteriorating, they are coming from a very strong position. Many still have excess savings to tap into and the labor market continues to be very favorable for workers. So it’s too early to sound the alarm on the consumer.

Overall, any downturn won’t turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a terrible year so far, the long-run outlook for stocks remains positive.

This post was originally published on TKer.co

Sam Ro is the founder of TKer.co. Follow him on Twitter at @SamRo

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for Apple or Android

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and YouTube

Chief Medical Officers have largely been relegated to executive roles in health care companies, but the pandemic has given corporate America a reason to hire more.

FTX, which filed for bankruptcy on Friday, was engulfed in more chaos on Saturday when the crypto exchange said it had detected unauthorized access and analysts said hundreds of millions of dollars of assets had been moved from the platform in "suspicious circumstances". "(Binance) has stopped FTT deposit, to prevent potential of questionable additional supplies affecting the market.

Markets also saw a “big lie” finally appear to fall apart—that speculative assets benefiting from ultralow interest rates were worth the ridiculous sums people have paid for them.

The entire market crashed this week as one of the industry’s biggest players watched their empire totally evaporate in five days flat.

The general counsel for cryptocurrency trading company FTX announced on Saturday that the exchange is investigating unauthorized transactions. “Following the Chapter 11 bankruptcy filings – FTX US and FTX [dot] com initiated precautionary steps to move all digital assets to cold storage,” lawyer Ryne Miller wrote on Twitter. “Process was expedited this evening – to…

Ukrainian President Volodymyr Zelensky on Sunday said 400 Russian war crimes have already been documented in Kherson just days after Moscow’s troops retreated from the region. “Investigators have already documented more than 400 Russian war crimes, the bodies of both civilians and military personnel are being found. In the Kherson region, the Russian army left…

Since the filing that included 135 affiliated companies, millions of dollars in crypto have been stolen from the company.

It is tough for any market to withstand a 56% cost increase in a single year. That’s not a 56% jump in prices. It is a 56% pop in the cost to the buyer.

Billionaire Dallas Maverick's owner Mark Cuban recently offered his perspective on the recent implosion of crypto platform FTX.

The Census Bureau releases its October retail sales report on Wednesday, and the Conference Board releases its October Leading Economic Index on Friday.

As the fallout from the collapse of Sam Bankman-Fried's blockchain empire FTX continues, investors are wary about the battered cryptocurrency market. The crypto industry has already seen the closure of major players, along with the Bitcoin (CRYPTO: BTC) bubble bursting. "Rich Dad, Poor Dad" author Robert Kiyosaki has dropped words of caution about Bitcoin's performance in the present market scenario. In a recent tweet, Kiyosaki says he is not looking at flipping Bitcoin by market cap as he is a

Bankrupt crypto exchange FTX’s founder Sam Bankman-Fried has been interviewed by police and regulators in the Bahamas. According to a Bloomberg report, FTX’s move to allow withdrawals for residents in the Bahamas was questioned by the Securities Commission of the Bahamas (SCB). However, the commission said in a statement that it hadn’t “directed, authorized or suggested” the prioritization of local withdrawals by FTX Digital Markets Ltd. The SCB added that it "does not condone the preferential t

The token is the first big victim of the abrupt implosion of Sam Bankman-Fried's FTX cryptocurrency exchange.

Since hitting an all-time high roughly one year ago, the Nasdaq has plunged as much as 38%. This entrenches the index that was largely responsible for pushing the broader market to new heights in a bear market. Although bear markets can, at times, be scary for new and tenured investors alike, the rewards of patience can easily outweigh those fears.

Calpers, the California Public Employees' Retirement System, disclosed the third-quarter moves in a filing with the SEC.

A roundup of commentary on how digital-asset market analysts see the next few months unfolding.

The demise and bankruptcy of crypto brokerage FTX will not be the last downfall in the industry, Binance's CEO predicts.

The founder of hedge fund giant Bridgewater Associates sees more financial and economic challenges ahead as the era of free money ends.

Answer: It sounds like you’re feeling stressed about money and questioning your decisions, so we asked financial advisers and money pros what you’re doing right and what you might want to change. “I would base your savings rate towards a home, and how much you can temporarily divert from the student loan debt towards a home, on how much you think the home will cost,” says Joe Favorito, certified financial planner at Landmark Wealth Management.

The ageless Dow Jones Industrial Average, broad-based S&P 500, and tech-dependent Nasdaq Composite have all plunged into bear market territory. Historically, stock market crashes, corrections, and bear markets have represented the ideal time for long-term investors to put their money to work. Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), the parent company of internet search engine Google and streaming platform YouTube, is a new addition to my portfolio in 2022 (I specifically bought GOOGL).

Author

Administraroot