![]() Ekta Mourya

Ekta Mourya

FXStreet

Blockchain Association, a crypto proponent and lobbyist group has asked court for permission to support payment giant Ripple in its defense against US regulator Securities and Exchange Commission (SEC).

Also read: NFT traders alert: Post Elon Musk takeover, Twitter quietly rolls out NFT trading feature

The Blockchain Association, a crypto lobbying organization based in Washington, D.C., filed for permission to support Ripple as a friend of the court in the SEC v. Ripple legal battle. The US SEC sued payment giant Ripple on its sale of XRP as an unregistered security. Since December 2020, the case has witnessed several procedural motions and both parties have filed their motions.

1/ Today we announced we filed an amicus brief supporting a correct interpretation of Howey in the SEC’s two-year legal battle against @Ripple.

A judge now has the opportunity to issue a substantive opinion on how Howey applies to digital assets.

Here’s what’s at stake

The Blockchain Association believes that the SEC’s extremely broad interpretation of the securities laws could have devastating effects on the industry and outside. The brief says that the court should look at XRP’s specific purpose, since the SEC has “unlawfully” looked at secondary sales as proof that Ripple violated federal securities laws.

Many tokens that are traded in secondary markets do not meet the different tenets of the Howey test, a Supreme Court case used as precedent in determining whether an asset is a security. The filing said:

The securities laws do not contemplate how an asset that may have been issued as a security can exist when it is no longer attached to any form of investment contract, a crucial consideration when attempting to apply Howey.

The Blockchain Association is not alone in its support for Ripple. Another key group, the Investor Choice Advocates Network and SpendTheBits Inc. filed their own amicus brief on October 28, with the court’s permission. In their brief, these entities argue that the SEC’s definition of “investment contract” is vague and points towards efforts invested towards determination of the SEC’s jurisdiction over crypto.

Ripple, the largest public holder of XRP published a new quarterly report highlighting that it currently holds less than 50% of the altcoin’s supply. What’s more, the payment giant operates just four out of the 130 XRP validator nodes.

Brad Garlinghouse, CEO of Ripple commented on the tweet and said:

Below 50% – a huge milestone! For 10 years, Ripple has focused on using XRP & the XRPL within our products for its speed, security and scalability for movement of value. As more customers use XRP in their payments flows, it’s clear there is real utility here.

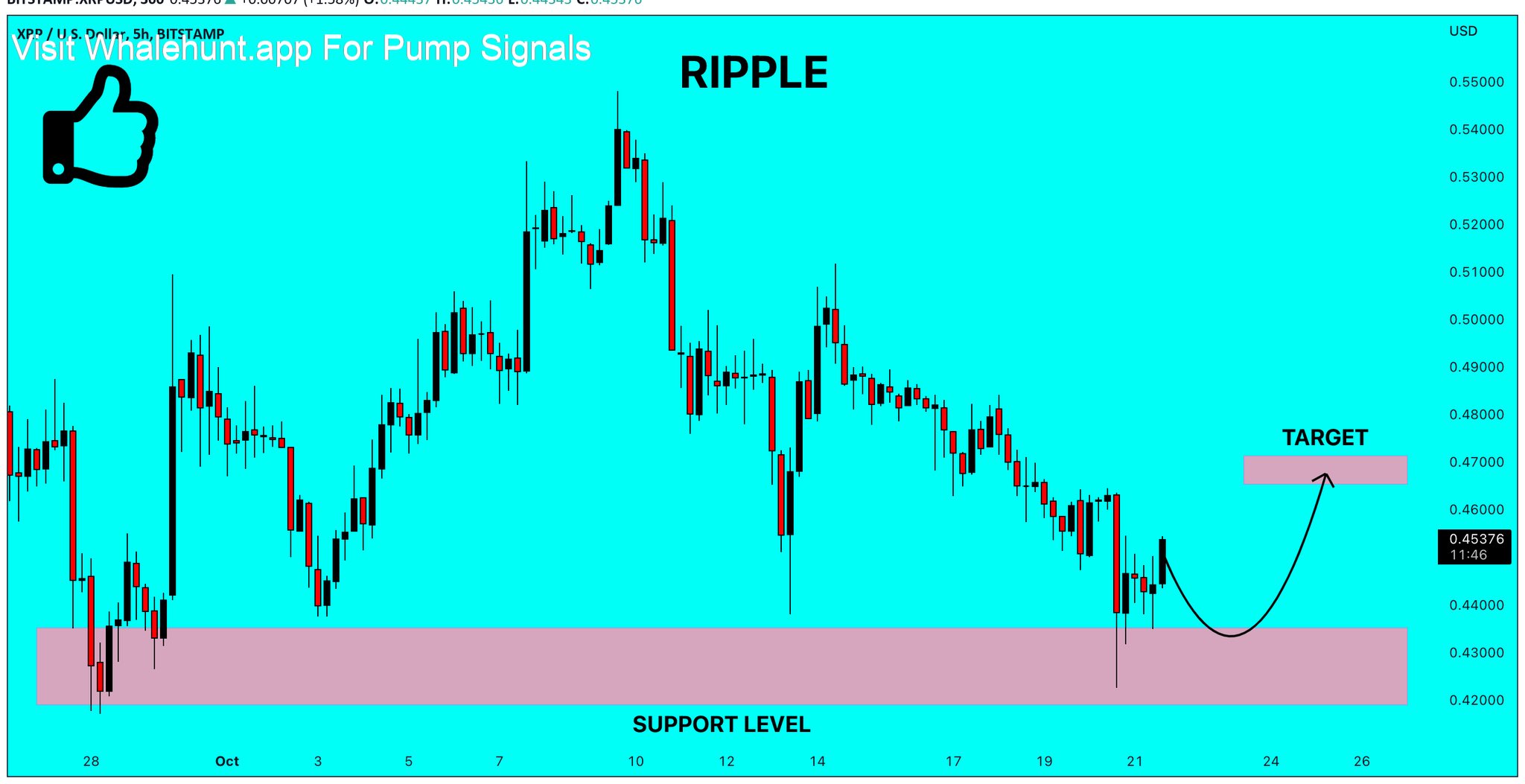

Duncan Baldwin, crypto analyst and certified trader evaluated the XRP/USD price chart and noted that the altcoin recently suffered a decline. XRP has started its recovery and yielded 2.5% gains overnight. Baldwin states that the XRP/USD pair seems locally oversold. As the pair approaches the horizontal support level between $0.42 and $0.43, a rally is expected in XRP price.

XRP/USD price chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Bitcoin price is reacting well to the bullish developments that have been taking place over the last month or so. A recent breakout could be the start of a prolonged move up when looked at via the lens of Bitcoin’s historical performance in Q4s stretching over the last decade.

Algorand (ALGO) price action is taking a beating of almost 5% in just one and a half trading days. Luckily for the cryptocurrencies, it was up 7% before, which still means it is likely to make a marginal profit for the week, making it not a lost cause.

According to data from crypto options and futures exchange Deribit, on October 28, a larger-than-average $2.4 billion worth of Bitcoin and Ethereum options are set to expire.

UK lawmakers agreed on new rules for stablecoins on October 27, as the government promises to consult on crypto regulations soon. Rishi Sunak, the new UK Prime Minister stated that he wants to make the UK a cryptocurrency hub.

Bitcoin price is reacting well to the bullish developments that have been taking place over the last month or so. A recent breakout could be the start of a prolonged move up when looked at via the lens of Bitcoin’s historical performance in Q4s stretching over the last decade.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.