Global Cryptocurrency Market

Dublin, Oct. 25, 2022 (GLOBE NEWSWIRE) — The “Cryptocurrency Market Size, Share & Trend Analysis Report by Component, by Hardware, by Software, by Process (Mining, Transaction), by Type, by End-use, by Region, and Segment Forecasts, 2022-2030” report has been added to ResearchAndMarkets.com’s offering.

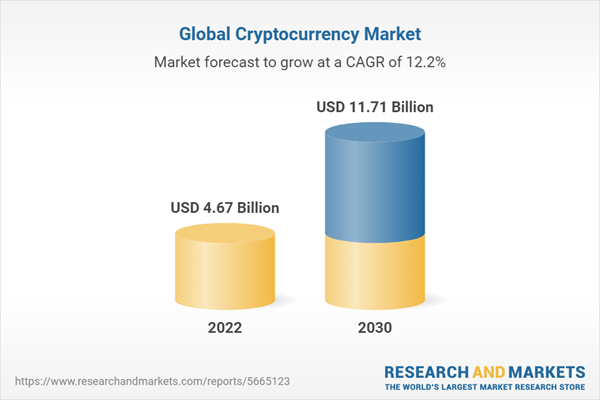

The global cryptocurrency market size is expected to reach USD 11.71 billion by 2030, registering a CAGR of 12.2% from 2022 to 2030. The market growth is anticipated to be fueled by the increasing demand for better data security, operational transparency, and the incorporation of blockchain technology in digital payment systems. Additionally, the legalization of the purchase, sale, and trading of digital currencies in several developed countries, such as the U.S., is fostering industry expansion.

The cryptocurrency industry is anticipated to grow owing to the rising global popularity of digital currencies such as bitcoin, Ethereum, and Litecoin. This growing popularity can be credited to the capacity of cryptocurrencies to provide quick, transparent, safe, and effective payment to users. As stated by Crypto.com, there were 295 million crypto owners in December 2021 as compared to 228 million in July 2021.

The market for cryptocurrencies is anticipated to be positively impacted by the recent advancements in artificial intelligence. Numerous businesses have been motivated to concentrate on their development as a result of the increased popularity of AI-based cryptocurrency platforms. For instance, in August 2021, Los Alamos National Laboratory researchers reported that they had created an artificial intelligence algorithm to recognize unauthorized cryptocurrency miners who utilize research computers for cryptocurrency mining.

The COVID-19 pandemic adversely impacted market growth in 2020, while 2021 saw a steady uptick. The sales of cryptocurrency mining hardware were slowed down by the global supply chain slowness caused by the border closures in 2020, which restrained the market’s expansion. Moreover, owing to the COVID-19 consequences blockchain companies were compelled to reduce their staffing levels and budgets in 2020. For instance, Cipher Trace decreased its advertising and market department jobs, and Elliptic lay off employees in the U.S. as well as the U.K.

Cryptocurrency Market Report Highlights

The hardware segment is estimated to dominate the market in 2021. The dominance can be attributed to the increasing demand for cryptocurrency mining devices to mine new coins and include them in the supply chain

The graphics processing unit (GPU) segment is expected to witness the fastest growth during the forecast period. The growth can be attributed to the rising demand for GPU in crypto mining as it consumes less energy and offers high-speed processing

The wallet segment is anticipated to witness the fastest growth during the forecast period. The growing demand for cryptocurrency wallets for trading, sending, and receiving cryptocurrencies is anticipated to fuel the segment’s growth

The mining segment is estimated to dominate the market in 2021. The dominance can be attributed to the growing investment by several companies to build crypto mining farms

The bitcoin segment has dominated the market in 2021 and is anticipated to grow at the fastest CAGR through the projection period. The growth can be attributed to the increasing popularity of Bitcoin. Moreover, acceptance of Bitcoin by several emerging countries, such as El Salvador, is anticipated to spur the growth of the segment

The retail & e-commerce segment is anticipated to grow at the fastest CAGR through the projection period. The growing acceptance of cryptocurrencies by several retail &e-commerce stores is anticipated to aid the growth of the segment

The Asia Pacific is expected to register rapid growth during the forecast period. The presence of crypto mining companies in the region is predicted to propel regional market growth

Market Dynamics

Market Drivers

High Charges of Cross-Border Remittance

Transparency of Distributed Ledger Technology

Market Challenges

Concerns Regarding Security, Privacy, and Control

Market Opportunities

Growing Acceptance of Cryptocurrency Across Various Industries

Key Topics Covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

Chapter 3 Cryptocurrency Industry Outlook

Chapter 4 Cryptocurrency Component Outlook

Chapter 5 Cryptocurrency Process Outlook

Chapter 6 Cryptocurrency Type Outlook

Chapter 7 Cryptocurrency End-use Outlook

Chapter 8 Cryptocurrency Regional Outlook

Chapter 9 Competitive Analysis

Chapter 10 Competitive Landscape

Companies Mentioned

Advanced Micro Devices, Inc.

Intel Corporation

Nvidia Corporation

Ripple

Bitmain Technologies Holding Company

Xilinx, Inc. (Amd)

Binance

Bitfury Group Ltd.

Bitgo

Xapo Holdings Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/29dart

Attachment

Global Cryptocurrency Market

In the cryptocurrency market, every bull run is invariably followed by a bear run. In a market that takes pride in its ability to withstand volatility, the price fluctuations are little more than a cyclical blip.

Intel (INTC) is expected to have recorded year-over-year lower revenues due to a fall in sales in the Client Computing Group and Datacenter and AI Group.

Meta Platforms (META) third-quarter 2022 earnings are expected to have been affected by ad revenue business slowdown and global macro-economic condition.

Wall Street closed higher on Monday, buoyed by the prevailing sentiment that the Fed is looking to slow down its policy tightening.

Boeing is having its worst day since May as shares plunge following its earnings miss.

Jefferies Senior Analyst Brent Thill assesses the state of tech sector, looking at industry leaders like Meta, Google, and Microsoft amid corporate earnings season.

Meta, Ford, and ServiceNow are among the top trending stocks in extended trading Wednesday, October 26, 2022.

Shopify's (SHOP) third-quarter performance is expected to have benefited from the growing adoption of merchant-friendly solutions, despite the challenging macro environment and higher inflation.

Markets are rewriting the same story we’ve been looking at all summer – investors are skittish, and wary of the headwinds. Those headwinds are enough to spook even the most experienced traders. High inflation is making everyone nervous, the Fed’s turn to higher interest rates – to combat inflation – brings with it the risk of recession, and macro data on the economy is starting to show declines in the housing markets and consumer confidence and spending. As if all that wasn’t enough, now add in

Healthcare-connected real estate investment trusts (REITs) combine the recession-resistant medical sector with the high-yield dividends that REITs are known for. Rising borrowing costs cut into the float between what the REITs pay in financing for their investment properties and what they earn from tenant leases, at least in the short term. Global Medical REIT (NYSE: GMRE), Omega Healthcare Investors (NYSE: OHI), and Medical Properties Trust (NYSE: MPW) all offer dividends with yields of 8% or more, but only two of these companies are worth the risk.

Cannabis investors were encouraged by President Biden's announcement on October 6 that he would pardon federal marijuana possession convictions. Aside from state legalization, the marijuana sector hasn't made much progress toward federal legalization. Cannabis legalization in the U.S. could be inevitable, maybe in a decade or so.

Shares of Microsoft (NASDAQ: MSFT) fell 7.7% on Wednesday after the tech giant told investors to brace for a steep downturn in the personal computer (PC) market and a decelerating pace of expansion in the cloud. Microsoft's revenue grew by 11% year over year to $50.1 billion in its fiscal 2023 first quarter, which ended on Sept. 30. Excluding foreign exchange fluctuations, the software maker's sales rose by 16%.

Teladoc (TDOC) delivered earnings and revenue surprises of 23.73% and 0.32%, respectively, for the quarter ended September 2022. Do the numbers hold clues to what lies ahead for the stock?

Shares in General Electric (NYSE: GE) were up by almost 5% by midday. The move comes as the market digests the company's earnings report the day before. Management maintained its expectation for full-year revenue growth toward the low end of its guidance range of high single-digit growth and lowered its full-year adjusted earnings-per-share (EPS) guidance to $2.40 to $2.80 from its previous range of $2.80 to $3.50.

Yahoo Finance Live anchors discuss Boeing CEO David Calhoun’s take on the company’s disappointing third-quarter earnings.

Independent Wealth Solutions Management Paul Meeks joins Yahoo Finance Live to discuss tech earnings and how they are weighing on markets, macro headwinds, investing in the tech space, post-COVID PC demand, and the outlook for Meta.

Canopy Growth Corporation ("Canopy" or the "Company") (TSX: WEED) (NASDAQ: CGC) and Canopy USA, LLC ("Canopy USA") today announced that each of the Company and Canopy USA has filed an early warning report under National Instrument 62-103 – The Early Warning System and Related Take-Over Bid and Insider Reporting Issues in connection with the Company's direct and indirect disposition of, and Canopy USA's direct and indirect acquisition of beneficial ownership of: (i) 38,890,570 exchangeable shares

The stock market had a good day today. The S&P has gained 1.63% and moderated its year-to-date losses to 19%. That rally has pushed the index up just out of bear territory. Despite these gains, at least one major bear believes that the index hasn’t bottomed out yet. Mike Wilson, Morgan Stanley’s chief US equity strategist, sees more room for the index to fall, and predicts that the S&P will hit its low point somewhere between 3,000 and 3,200 – a drop that would mean another 20% loss for stocks.

AT&T Inc. no longer seems the most unloved name in wireless, and that manifested in one milestone that occurred last week.

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) owns about 50 stocks in its portfolio, with a combined market value of around $338 billion as of this writing. Many of them — especially the larger positions — were hand-picked by CEO Warren Buffett himself. Just to name a few, Amazon (NASDAQ: AMZN) has been beaten down significantly despite recent data showing that consumer spending remains strong.