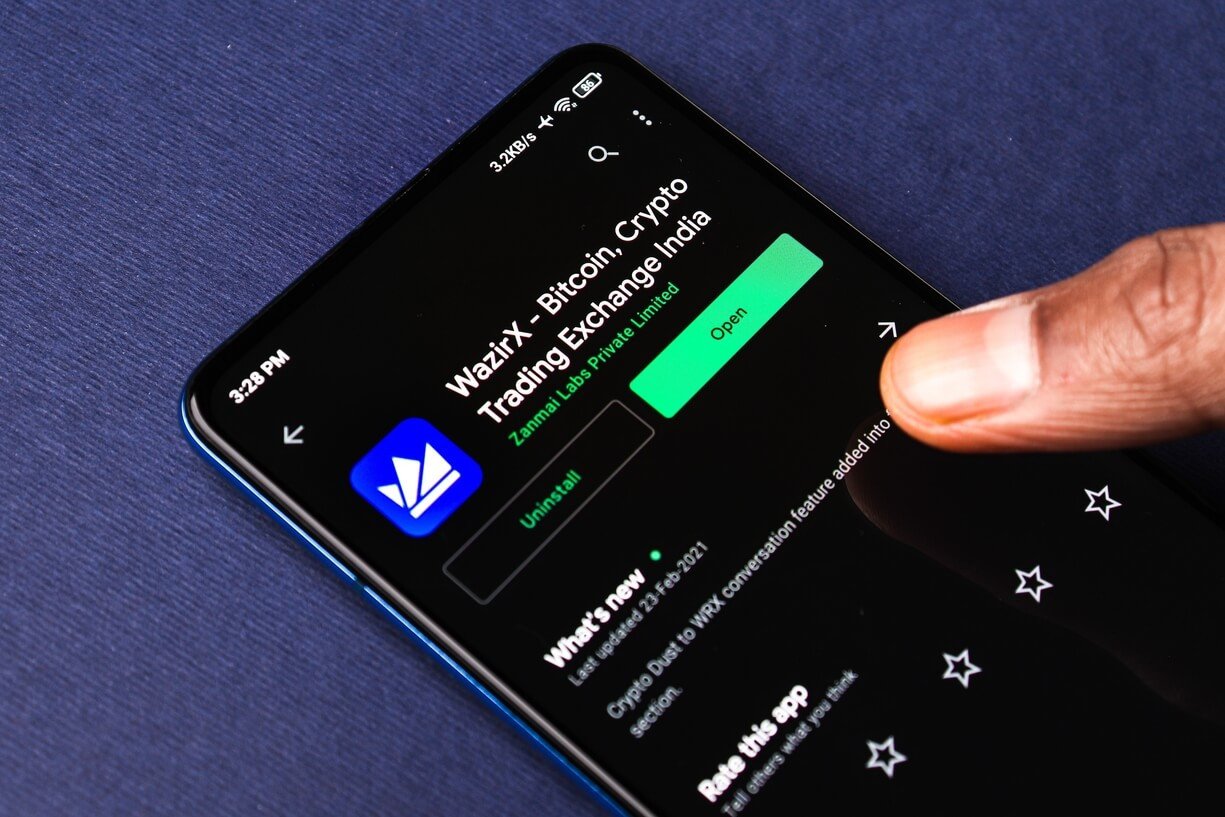

Major Indian crypto exchange WazirX has laid off about 40% of its employees, citing a fall in trading volumes due to the bear market and the regulatory climate in India.

Local news outlet the Economic Times reports that the figure equates to around 50 to 70 employees of the exchange’s around 150 employees. WazirX said in a statement that the move would help it maintain financial stability and continue to serve its customers.

“The Indian crypto industry has had its unique problems with respect to taxes, regulations, and banking access. This has led to a dramatic fall in volumes in all Indian crypto exchanges… As India’s No 1. exchange, our priority is to be financially stable and to continue serving our customers. To achieve this, we’ve had to reduce our staff to weather the crypto winter,” the statement read.

WazirX further noted that it is not new to crypto bear markets as it lived through the 2018 cycle. At the time, it doubled down and built its innovative peer-to-peer engine. This is one reason it is confident that it will come out stronger when the market turns bullish again.

The affected employees have already been contacted and will be compensated with about 45 days’ pay as well as other support, the report notes. The company cut across several departments, including customer support and HR, where managers, analysts, and associate managers/team leaders were among the axed personnel.

Adding to the global crypto market downturn and India’s tax laws which have caused turmoil for crypto projects, the company is also involved in other controversies. The exchange’s co-Founder Nischal Shetty has been embroiled in an online battle with Binance CEO Changpeng Zhou (also CZ).

CZ took to Twitter to state that Binance is not linked to WazirX as is commonly believed as a purchase transaction was never completed. Nischal has debunked the claim, pointing to WazirX’s terms of service. He also stated that Binance owns the exchanges domain name, has root access to its AWS servers, and owns all its crypto assets and crypto profits as well.

Meanwhile, the exchange also just emerged successful from a dispute with the Enforcement Department (ED), India’s financial crime-fighting agency, which froze its accounts for more than a month. Reuters reports that following an investigation, the ED has unfrozen assets worth up $8.16 million, which it previously linked to suspicious transactions.

A quick 3min read about today's crypto news!

Author

Administraroot