by Terence Zimwara

According to a recent Chainalysis report, although Sub-Saharan Africa is believed to account for as little as 2% of global transaction activity, the area “contains some of the most well-developed cryptocurrency markets of any region.” Additionally, Sub-Saharan Africa’s “retail market and outsized usage of P2P platforms make it unique compared to other regions.”

According to a new report by blockchain intelligence firm Chainalysis, Sub-Saharan Africa’s total crypto transaction volumes of $100.6 billion seen between July 2021 and June 2022 are the least of any region that has been surveyed. While the on-chain volumes during this period are 16% higher than the preceding period, the report nevertheless states that Sub-Saharan Africa only accounts for 2% of the global crypto activity.

Still, according to the blockchain analysis firm’s findings, Sub-Saharan Africa likely has some of the most developed cryptocurrency markets globally. The Chainalysis report said:

[A] deeper analysis reveals that Africa contains some of the most well-developed cryptocurrency markets of any region, with deep penetration and integration of cryptocurrency into everyday financial activity for many users.

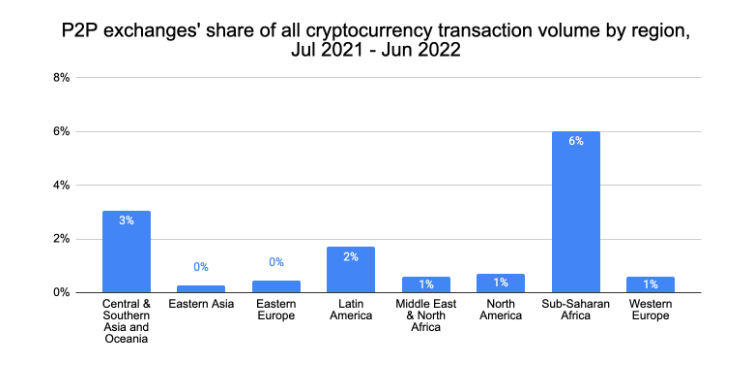

To help buttress these assertions about the region, the report points to the structure of the region’s crypto market and how this distinguishes Sub-Saharan Africa from other regions. As explained in the report, the retail market as well as an “outsized usage of P2P platforms” is what separates this region from the rest of the global crypto market.

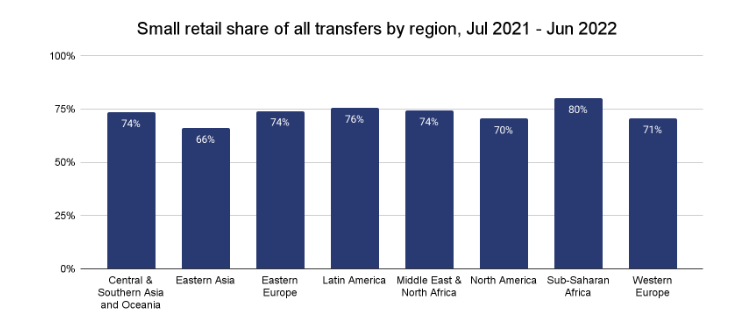

“Retail-sized transfers below $10,000 make up 6.4% of its transaction volume, more than any other region. The role of retail becomes even more apparent when we look at the number of individual transfers. Retail transfers make up 95% of all transfers, and if we drill down to just small retail transfers under $1,000, the share becomes 80%, more than any other region,” the report stated.

Meanwhile, the region has seen an increase in the number of users that prefer to use peer-to-peer (P2P) exchanges. As stated in the report, the region’s P2P volumes alone are thought to “account for 6% of all cryptocurrency transaction volume in Africa.”

Concerning Sub-Saharan Africa’s projected future use of crypto, the report said:

“Overall, we expect cryptocurrency usage in Sub-Saharan Africa to continue growing as long as residents face issues crypto has proven it can solve for them, such as preserving savings through economic volatility and enabling cross-border transactions in places with strict capital controls.”

Register your email here to get a weekly update on African news sent to your inbox:

What are your thoughts on this story? Let us know what you think in the comments section below.

Terence Zimwara is a Zimbabwe award-winning journalist, author and writer. He has written extensively about the economic troubles of some African countries as well as how digital currencies can provide Africans with an escape route.

Image Credits: Shutterstock, Pixabay, Wiki Commons, makasana photo / Shutterstock.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Fidelity Investments Launches Crypto, Metaverse ETFs — Says ‘We Continue to See Demand’

Fidelity Investments, one of the largest financial services firms with more than $11 trillion under administration, is launching exchange-traded funds (ETFs) focusing on the crypto ecosystem and the metaverse. “We continue to see demand, particularly from young investors, for access … read more.

Oman to Incorporate Real Estate Tokenization in Virtual Assets Regulatory Framework

Real estate tokenization is set to be incorporated into Oman Capital Markets Authority (OCMA)’s virtual asset regulatory framework. According to an advisor with the authority, the tokenizing of real estate will open investment opportunities for local and foreign investors. Real … read more.

Check all the news here