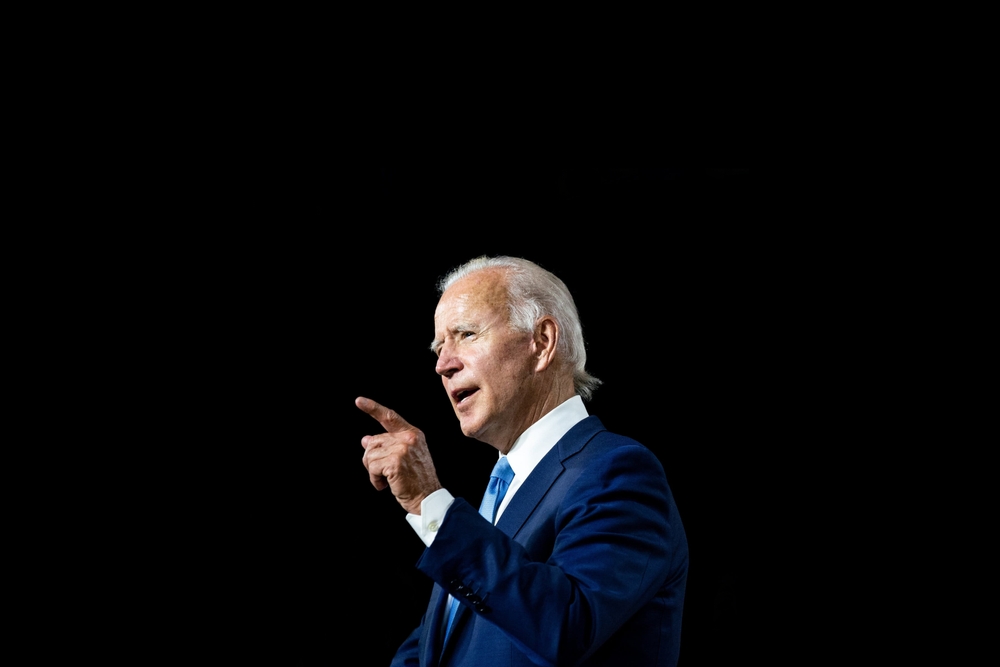

Joe Biden’s White House has presented the framework for new cryptocurrency rules.

By Eric Johansson

The White House isn’t playing around with cryptocurrency companies. The Biden Administration has not only presented a framework for new rules to rein in the Wild West of the nascent market, but it’s also actively encouraging regulators to “aggressively pursue” those that break the law.

“Digital assets present potential opportunities to reinforce US leadership in the global financial system and remain at the technological frontier,” the White House said in a statement on Friday.

“But they also pose real risks as evidenced by recent events in crypto markets. The May crash of a so-called stablecoin and the subsequent wave of insolvencies wiped out over $600bn of investor and consumer funds.”

Unsurprisingly, bitcoin and ether fell on the back on the news, suggesting that the crypto crash is far from over. Bitcoin fell below $19,000 on Monday, a far cry from its $69,000 all-time high in November. The drop was also fuelled by expectations that the Federal Reserve will announce a third interest rate hike this week.

!function(){“use strict”;window.addEventListener(“message”,(function(e){if(void 0!==e.data[“datawrapper-height”]){var t=document.querySelectorAll(“iframe”);for(var a in e.data[“datawrapper-height”])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

The White House announced its new cryptocurrency roadmap on Friday, explaining the goals that new rules would attempt to achieve.

The new rules aim to achieve six different goals: to boost consumer and investor protection, promote financial stability, counter illicit finance, strengthen US leadership in the global financial system and economic competitiveness, increase financial inclusion, and safeguard responsible innovation.

The White House said the new cryptocurrency rules would protect consumers and investors by preventing sellers from misleading buyers about the risks of trading with digital assets and from failing to comply with existing regulation.

“Outright fraud, scams, and theft in digital asset markets are on the rise: according to FBI statistics, reported monetary losses from digital asset scams were nearly 600% higher in 2021 than the year before,” the White House said.

On the back of that, the administration urged the Securities and Exchange Commission (SEC), and the Commodity Future Trading Commission (CFTC) to “aggressively pursue investigations and enforcement actions against unlawful practices in the digital assets space.”

The two agencies have reportedly been locked into a power struggle over which regulator should police cryptocurrencies. Although, when Verdict confronted the CFTC with the reports of a brewing turf war, the market watchdog rejected them as a tiresome “media trope”.

The White House made similar edicts for the Consumer Financial Protection Bureau and the Federal Trade Commission.

That being said, the White House has also encouraged agencies to issue guidance and rules to address current and emergent risks in the digital asset ecosystem.

Cryptocurrencies and other digital assets like non-fungible tokens, so-called NFTs, have struggled this year. The collapse of the sector is intimately linked to the overall market volatility seen around the world as a result of the pandemic and Russia’s invasion of Ukraine.

The market slowdown as well as the looming threat of tougher policing have contributed to the cryptocurrency winter has shaved off about $2tn of the industry’s value since November. It is now worth roughly $1tn.

The crash has also given the bottom lines of established businesses a beating. Cryptocurrency exchange Coinbase’s revenue has dropped by 63% and its South Korean rival Upbit has reported a 61.3% drop in sales since last year.

The crash has also resulted in the very public collapses of stablecoin TerraUSD which collapsed after a large amount of the digital asset was dumped, which led to it becoming unpegged.

Following the crash, South Korean police raided offices associated with the company after investors had levied fraud accusations against the firm. South Korea issued an arrest warrant for Do Kwon, the founder and CEO of Terraform Labs, last week.

Similarly, crypto lender Celsius filed for bankruptcy in July. The company is now undergoing a restructuring and has been accused by regulators of looking like a Ponzi scheme.

Despite these setbacks for the industry, some, like exchange Bitstamp’s new CEO Jean-Baptiste Graftieaux, have seemed reasonably optimistic about the future of the industry.

However, there may be reason for this bullishness. While cryptocurrencies have fallen in value, venture capitalists (VC) have seemingly not lost faith in the industry, according to new data from research firm GlobalData.

!function(){“use strict”;window.addEventListener(“message”,(function(e){if(void 0!==e.data[“datawrapper-height”]){var t=document.querySelectorAll(“iframe”);for(var a in e.data[“datawrapper-height”])for(var r=0;r<t.length;r++){if(t[r].contentWindow===e.source)t[r].style.height=e.data["datawrapper-height"][a]+"px"}}}))}();

In 2020, the industry enjoyed VC-backing to the tune of $3.3bn across 533 deals. Those figures surged to $26.4bn across 1,013 deals in 2021.

As of Tuesday September 20, GlobalData estimates that the industry has raised $15.7bn across 972 VC deals in 2022.

GlobalData is the parent company of Verdict and its sister publications.

Thank you for subscribing to Private Banker International

Author

Administraroot