The bitcoin and crypto market has crashed this year, falling sharply after rocketing to around $3 trillion late last year (with some yet to call the bitcoin price bottom).

Subscribe now to Forbes’ CryptoAsset & Blockchain Advisor and successfully navigate the volatile bitcoin and crypto market

The bitcoin price has crashed under $20,000 per bitcoin, dropping from almost $70,000, as the market wrestles with the Federal Reserve’s string of interest rate hikes that could mean more volatility for bitcoin.

Now, the Biden administration has instructed U.S. government agencies to double down on bitcoin and crypto enforcement—potentially putting the $1 trillion market on a collision course with regulators after the White House Office of Science and Technology suggested bitcoin could be banned.

Want to stay ahead of the market and understand the latest crypto news? Sign up now for the free CryptoCodex—A daily newsletter for traders, investors and the crypto-curious

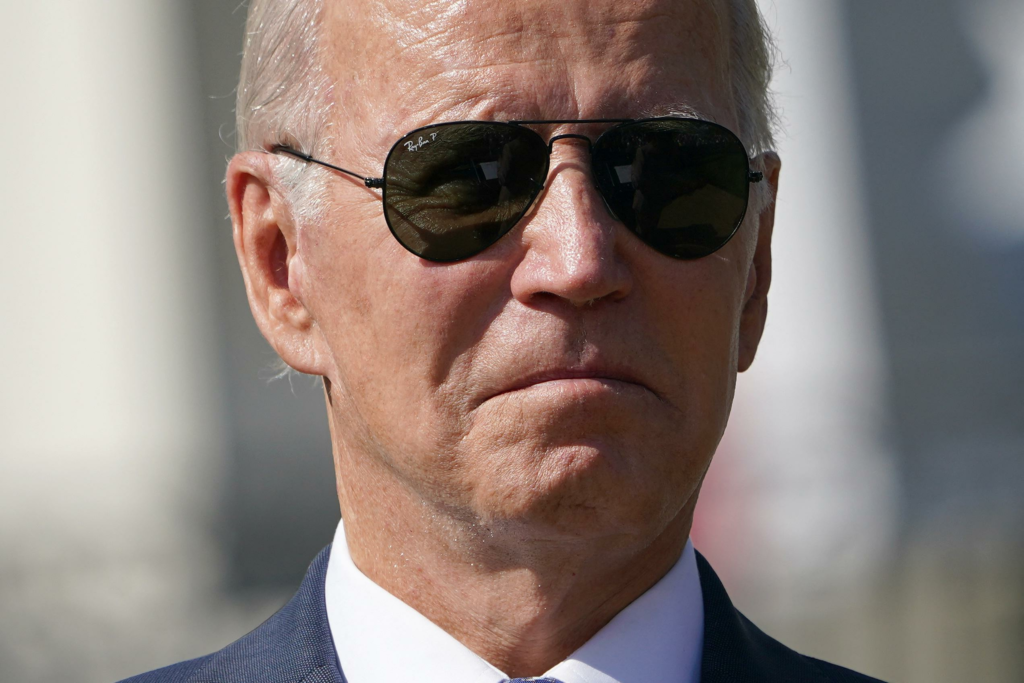

U.S. President Joe Biden issued an executive order in March, calling on government departments and … [+]

A series of White House reports urged regulators including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to issue rules for cryptocurrencies.

“Digital assets pose meaningful risks for consumers, investors, and businesses,” the Biden administration said, adding there are “frequent instances of operational failures, market manipulation, frauds, thefts, and scams.”

Research suggests at least $1 billion has been lost to crypto fraud since the beginning of 2021, according to the Federal Trade Commission, with the collapse of major cryptocurrency luna and its linked stablecoin terraUSD adding to fears people could lose their investments.

“The reports clearly identify the real challenges and risks from digital assets used for financial services,” Treasury secretary Janet Yellen said during a press briefing, it was reported by Coindesk. “If these risks are mitigated, digital assets and other emerging technologies could offer significant opportunities.”

However, Yellen went on to warn a lack of regulation risks repeating “painful” lessons.

“Innovation is one of the hallmarks of a vibrant financial system and economy, but as we’ve painfully learned from history, innovation without adequate regulation can result in significant disruptions and harm to the financial system and individuals,” Reuters quoted Yellen as saying.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has swung wildly over the last month.

Regulators have recently stepped up their scrutiny of the bitcoin and crypto market, with the SEC branding a number of cryptocurrencies securities and fighting a long-running battle with the developer of the XRP cryptocurrency Ripple.

“The reports encourage regulators, as they deem appropriate, to scale up investigations into digital asset market misconduct, redouble their enforcement efforts, and strengthen interagency coordination,” said national security adviser Jake Sullivan and Brian Deese, director of the National Economic Council, in a statement.

Author

Administraroot