Longer lull expected in PE-backed M&A; cryptocurrency investment stumbles

Perspectives from China: Chinese M&A in 2022

Insight Weekly: CEO pay jumps; yield curve inversion deepens; wind giants lift turbine prices

Headwinds slow global M&A in Q2’22

New Corporate Realities: The Next Generation of Managing Risk and Operations

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Partners Group Holding AG CEO David Layton said back in July that he expected the slowdown in private equity-backed M&A activity to “persist through the end of the summer.” That timeline has been extended.

Layton tacked three to six months onto his prediction when Partners Group reported first-half earnings Aug. 30. Market volatility since the start of the year raised questions about valuations that have yet to be resolved, he said.

“I wouldn’t say that there is a robust market of buyers and sellers that are kind of on the same page,” Layton said. “I think we’re still at the tail end of sellers being able to sell yesterday’s prices because there are still some aggressive buyers. But I don’t think we’re far off either. I think we’re maybe a quarter or two away from having some more reasonable eye-to-eye discussion.”

Layton was responding to an analyst’s question about the timing of new investments, but that disconnect between buyers and sellers has also slowed the pace of exits, with Partners Group delaying portfolio company sales that would otherwise have happened in the first half. That is hitting the listed Swiss asset manager’s bottom line.

Read more about the impact of the M&A slowdown on Partners Group’s performance fees and first-half revenues.

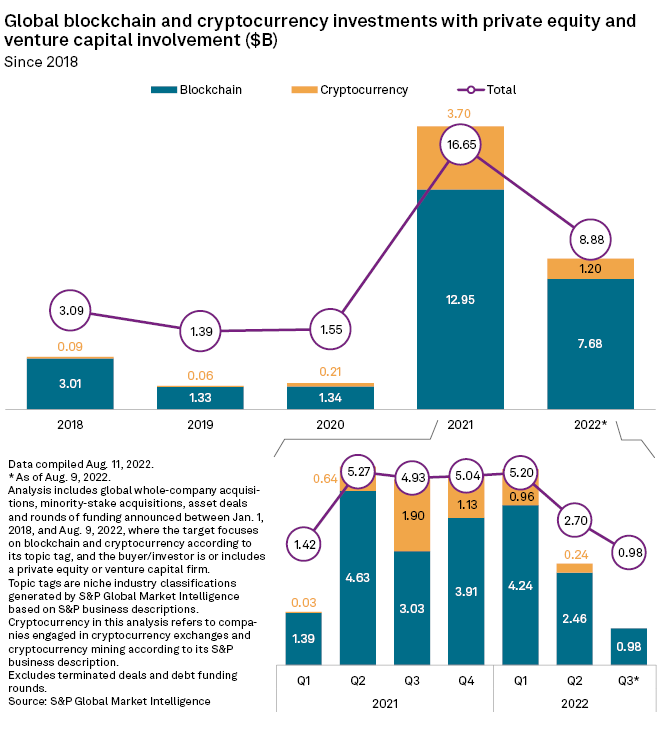

CHART OF THE WEEK: PE investments in blockchain, cryptocurrency slide

⮞ Plunging cryptocurrency prices and looming regulation have dampened private equity activity in the space so far in 2022.

⮞ Global deal value fell by nearly half in the second quarter compared to the same period in 2021, to an aggregate $2.7 billion.

⮞ Private equity and venture capital firms poured $16.65 billion into cryptocurrency and blockchain in 2021, a record for the industry.

FUNDRAISING AND DEALS

* Bain Capital Pvt. Equity LP agreed to buy Evident Corp., the life-sciences and industrial solutions business of Olympus Corp., for approximately $3.11 billion. The deal is expected to close in the first quarter of 2023.

* Funds managed by affiliates of Apollo Global Management Inc. will sell tower platform and build-to-suit provider Parallel Infrastructure LLC to Harmoni Towers LLC, a portfolio company of Palistar Capital LP. The deal is slated to close in the third quarter.

* Genstar Capital LLC closed the acquisition of Numerix LLC, which is a capital markets risk management technology company.

* TPG Capital LP’s The Rise Fund and Norwest Venture Partners led the $110 million series D financing round for India-based consumer lending financial technology group Early Salary Pvt. Ltd. Piramal Capital & Housing Finance Ltd., EarlySalary’s existing investor, also joined the round.

ELSEWHERE IN THE INDUSTRY

* RedBird Capital Partners LLC completed its acquisition of AC Milan for €1.2 billion. As part of the deal, New York Yankees owner Yankee Global Enterprises LLC took a minority stake in the Italian soccer club.

* Levine Leichtman Capital Partners LLC closed the sale of Monte Nido & Affiliates LLC, which provides treatment programs and services for people with eating disorders, to funds managed by Revelstoke Capital Partners LLC.

* Blue Point Capital Partners LLC closed on Water Lilies Food LLC, a frozen food manufacturer and distributor.

* Incline Equity Partners acquired NovaVision Inc., a consumable security and authentication products company.

FOCUS ON: EDUCATION

* Thoma Bravo is selling Frontline Education, a provider of administration software to K-12 educators, to Roper Technologies Inc. The deal, which values the target company at about $3.73 billion, could close in the fourth quarter.

* Discovery Education Inc., a portfolio company of Clearlake Capital Group LP, closed the acquisition of Pivot Interactives SBC, which develops cloud-based activities and laboratories for students.

* Anchorage Capital Partners signed a conditional agreement to buy Lollipops Educare Holdings Ltd. from Evolve Education Group Ltd. at an enterprise value of approximately NZ$46 million. The deal is expected to close by September-end.

Author

Administraroot