D-Keine/iStock via Getty Images

D-Keine/iStock via Getty Images

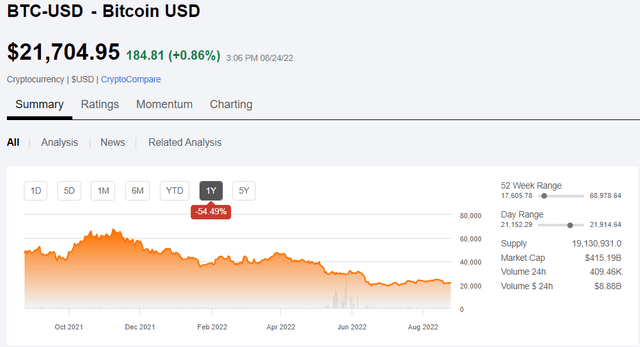

As I’m sure you already know, Bitcoin (BTC-USD) has dropped to less than 1/3 of its peak value.

SA

SA

The relevant question is whether there will be a recovery, or if this is the beginning of the end.

Those of us who work in the broader stock market refer to market drops as cyclical, implying that there is a certain inevitability to an eventual recovery. Crypto purveyors whether that be the currencies or ancillary services have adopted similar language, referring to the unparalleled crash as a downturn, downcycle or the “Crypto Winter”.

After winter inevitably come spring and summer, and they want to convey that sort of inevitability to a crypto recovery.

I posit that Crypto Extinction would be a more accurate term.

In this article, I intend to use reasoning to show 2 things:

I think examining the reasons the broader stock market has always recovered from crashes will help illuminate the flimsiness of the assumption that crypto will have a similar cyclical recovery.

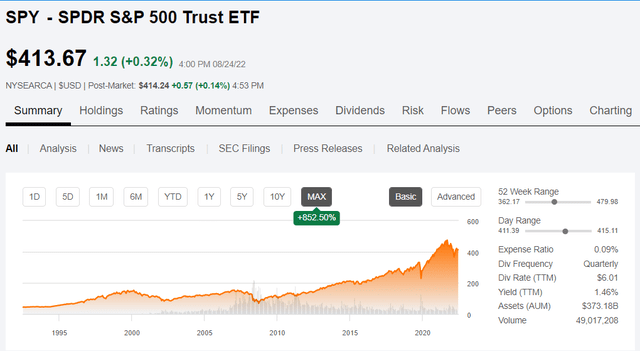

Let us begin with the factual observation. The stock market has crashed dozens of times over its multi century history, but it has always come back to reach new highs.

Every market crash there are doomsayers suggesting this time is different. This will be the end of the up market for reasons XYZ. In every case, these doomsayers have been proven wrong as the stock market proceeds to hit new highs in not too long of a time span.

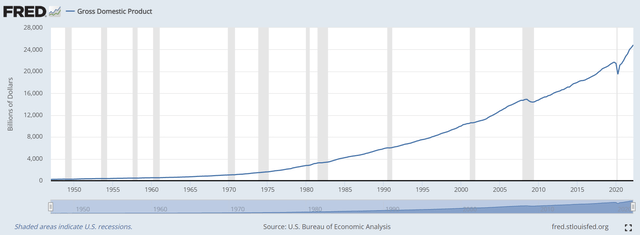

There is an underlying mechanism that makes the recovery so reliable and seemingly inevitable – the steady upward march of U.S. GDP.

FRED

FRED

Individual companies can and do fail. Even entire sectors can become obsolete, but the economy is a big and diverse mechanism. As some companies struggle, others are growing. As overall GDP grows, the market does and should go up.

As the economy grows, the earnings power of the companies comprising the stock market increases, which in turn causes their market prices to go up.

So, when investment professionals speak of market downturns as though they are just cyclical in nature and that a recovery is almost inevitable, that is not hubris. That is not salesmanship. That is a researched understanding of the perdurability of the underlying economic mechanisms.

I, of course, cannot know the intent of others. I can only examine economic incentive. Those who own crypto are economically incented to encourage others the prices will go up because it increases the value of their portfolio.

Those who perform crypto related services are incented to say crypto will recover because when Bitcoin is higher the transaction volume is higher and the fee income is higher.

Coinbase (COIN) is one such purveyor of crypto services. CEO Brian Armstrong said in an interview on CNBC:

“the downturn is not unusual, as Coinbase has been through four down cycles in 10 years”

He also said.

“Hopefully it (the downturn) will be 12-18 months with a nice recovery”

This is roughly par for the course in terms of how crypto insiders describe the “downturn”

Brian Armstrong’s sentiment could be entirely genuine. I can’t know his internal thoughts, but I do think it is worth noting that COIN’s business is reliant upon a crypto rebound, and thus he more or less has no choice but to be bullish publicly.

I disagree with the of language being used to describe the fall of crypto on 2 counts:

The crypto crash is far worse than even the severe crashes of the broader market. The 2000 internet bubble burst, the great financial crisis and COVID were the 3 biggest drops in modern stock market history.

None of them are close to the magnitude of the drop in crypto.

SA

SA

Coinbase is the biggest exchange, and it is down 80%. Bitcoin is the biggest and most stable cryptocurrency, yet it is down over 66% from its highs. Many of the other coins are already extinct. Many of the other exchanges and servicers are declaring bankruptcy.

This is absolute carnage, yet the purveyors are calling it a cyclical downdraft.

A cyclical downdraft is what happened to the broader market in the first half of 2022. The major indices were down 10%, 15% or maybe 20% depending on which index you look at.

That is a cyclical downdraft. Crypto 60%-80% down is a disaster.

As crypto participants are quick to point out, cryptocurrencies have been through downcycles before and recovered. So this time should be no different, right?

Well, as it turns out, the previous recoveries were the result of expansion of potential investor base via accessibility.

Cryptocurrencies themselves do not have fundamentals because they don’t produce earnings or even have a pathway to producing earnings, but the securities by which people own them do have fundamentals in the form of the supply and demand of the securities/coins.

Any time one increases the buyer pool for a security, even if just a small percentage of the new potential investors end up buying, it has a positive impact on the price of the stock or in this case, coin. Bitcoin and other cryptos simultaneously hit peak buyer pool and peak adoption as a percentage of said buyer pool. That, I believe, made the highs seen last year the all-time peak and I don’t think it is plausible to return there because that level of hype cannot be replicated.

When bitcoin first started out, it was only accessible to the most tech-savvy people and was largely just held by the miners. Its meteoric price rise was the result of continual expansion to the pool of investors via accessibility.

Crypto is now held by people who until very recently didn’t even have investment accounts. One can trade crypto on their phone with just a few clicks. Accessibility has reached a point of ubiquity such that I don’t see a way for there to be no more gains via increased investor pool. Hype hit a high when billions of dollars were being spent by crypto purveyors, filling up a massive percentage of ad space across the internet, TV and even billboards. I don’t think one can throw more ad dollars at the space than LeBron James advertising crypto in a Superbowl ad.

The hype was not just a product of advertising, but also a momentum driven phenomenon. People love bragging, and the huge crypto gains provided an opportunity to brag. I had a strong feeling crypto was nearing its peak when I started to overhear gym bros telling each other about their sick Ethereum gains (ETH-USD).

Bragging is just a part of human nature. It is evolutionarily bred into us as a way of increasing social standing. I like bragging too, which is why I’m going to tell you I wrote a short thesis on Shiba Inu when it was at more than double today’s price and a short thesis on Coinbase when it was nearly triple today’s price.

After the crypto collapse, however, I believe that hype train is dead. Bragging about crypto gains has been replaced by reluctant admissions of former ownership, akin to the way that one would admit to having done some stupid things back in college.

Perhaps one area of remaining expansion to the investor pool is bigger institutions such as BlackRock getting involved. That could indeed be a source of incremental demand, but I don’t see it as likely to outweigh all the headwinds from reduced hype.

As such, the investor pool expansion mechanism that caused previous crypto rebounds off lows appears weak.

I don’t see any replacement mechanisms that would lead to a recovery. Unlike the S&P, crypto does not have earnings to pull it back up. See, when the S&P gets cheap, the earnings yield gets higher, leading to bigger dividends and more retained capital to further grow those earnings and dividends.

Thus, the cheapness of the S&P causes the investments to get increasingly attractive, thereby pulling prices back up.

Crypto does not get cheap on valuation as it drops. It does not have earnings to pull it back up. I see no reason that it will not simply go to zero. While I am confident the crypto extinction has begun, I am also fallible, so let’s look at the risks to shorting Bitcoin.

One of the challenges of shorting in general is that to make it work you not only have to be right, but the pathway matters. For example, even if I am correct about BTC eventually going to zero, if it were to rebound to say $100K per coin before then it might cause significant financial stress and force short sellers to cover.

Thus, to profit on a short, one needs to not only be right about the destination, but also be able to handle the vicissitudes of the pathway. As such, it may be wise to keep short positions rather small.

This pathway risk is perhaps greater with Bitcoin than it would be with a normal stock because it is a momentum driven story, which means it can have huge moves over short periods of time.

Make your money work for you

At Portfolio Income Solutions we do the rigorous analysis to determine which stocks will work and which won’t. We then curate a portfolio of the most opportunistic individual stocks and provide members with continuous analysis to help keep their investments in shape. We constantly watch the market in order to buy and sell the right stocks at the right times.

Start investing with the aid of professional research by joining Portfolio Income Solutions.

Not sure yet? Grab a free trial. Canceling is easy and there are no obligations.

This article was written by

2nd Market Capital Advisory specializes in the analysis and trading of real estate securities. Through a selective process and consideration of market dynamics, we aim to construct portfolios for rising streams of dividend income and capital appreciation.

Our Portfolio Income Solutions Marketplace service provides stock picks, extensive analysis and data sheets to help enhance the returns of do-it-yourself investors.

Investment Advisory Services

We now offer a way to directly invest in our Proprietary Investment Portfolio Strategy via REIT Total Return, which replicates our activity in client accounts. Total Return client’s brokerage accounts are automatically invested simultaneously and at the same price when we make a trade in the REIT Total Return Portfolio (also known as 2CHYP).

Learn more about our REIT Total Return Portfolio.

Dane Bowler, along with fellow SA contributors Simon Bowler and Ross Bowler, is an investment advisory representative of 2nd Market Capital Advisory Corporation (2MCAC). As a state registered investment advisor, 2MCAC is a fiduciary to our advisory clients.

Full Disclosure. All content is published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of the specific person. Please see our SA Disclosure Statement for our Full Disclaimer.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in COIN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Important Notes and Disclosure

All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person.

The information offered is impersonal and not tailored to the investment needs of any specific person. Readers should verify all claims and do their own due diligence before investing in any securities, including those mentioned in the article. NEVER make an investment decision based solely on the information provided in our articles.

It should not be assumed that any of the securities transactions or holdings discussed were profitable or will prove to be profitable. Past Performance does not guarantee future results. Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions.

Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts, and findings in this article.

S&P Global Market Intelligence LLC. Contains copyrighted material distributed under license from S&P

2nd Market Capital Advisory Corporation (2MCAC) is a Wisconsin registered investment advisor. Dane Bowler is an investment advisor representative of 2nd Market Capital Advisory Corporation.