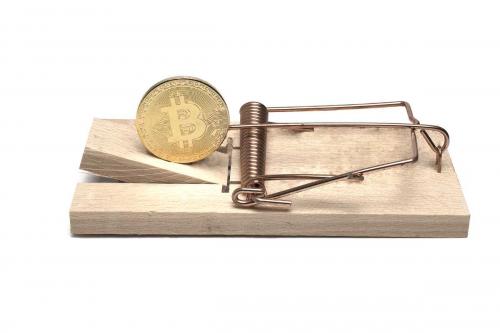

The Federal Deposit Insurance Corporation (FDIC) recently issued letters demanding that five crypto companies cease and desist from making false and misleading statements about FDIC insurance and take immediate corrective action to address false and misleading statements.

The letters follow an enforcement memorandum and new rule published by the Consumer Financial Protection Bureau (CFPB) earlier this year threatening enforcement for deceptive acts and practices relating to the use of the FDIC logo and statements concerning insurance coverage.

The crypto companies were cited by the FDIC for making false representations stating or suggesting that certain crypto-related products were FDIC-insured. Each of these digital asset providers made statements, including in marketing and product information published on websites and social media accounts and, in one case, registered domain names indicating certain crypto products or accounts were insured or endorsed by the FDIC.

Digital assets, virtual currency, tokens, and cryptocurrency are receiving heightened regulatory oversight, scrutiny, and review as new and traditional laws and regulations gain traction in application to digital asset markets, participants, and products. Providers must take care to remain abreast of regulatory notices, updates, and informational releases published by regulatory bodies like the CFPB and FDIC, along with other state and federal regulators.

The Federal Deposit Insurance Act (FDIA), which can be enforced by both the FDIC and CFPB, prohibits any person from representing or implying that an uninsured product is FDIC-insured or from knowingly misrepresenting the extent of deposit insurance applicable to a product. Companies, including digital asset and crypto providers, are prohibited from implying their products are FDIC-insured by using “FDIC” in the company’s name, advertisements, or other documents and websites.

In short, a company may not indicate that customer accounts are insured, nor that pass-through insurance applicable to company accounts may provide coverage to customer accounts. These prohibitions include statements that imply deposits to certain crypto providers are insured and or are stored in insured deposits accounts with participating financial institutions.

The FDIA often requires that non-bank institutions identify the ultimate institution at which deposits are actually insured by name. Such that, when pass-through or deposit accounts are advertised as insured, the actual FDIC-insured institution is identified as providing the insured accounts.

The FDIC issued letters to one crypto commodities exchange, three crypto product news providers, and one crypto-related domain holder relating to their statements, claims and indications that certain accounts, products, exchanges, and providers were FDIC insured or FDIC endorsed. Three providers that listed information concerning FDIC coverage for certain other digital asset businesses as an information or news service were ordered to cease and desist from including false insurance coverage information in their news and informational webpages.

The FDIC letters reflect an increase, across government agencies, regulators, and regimes, in the oversight and scrutiny applicable to digital asset platforms, products, and service providers. Digital asset platforms, cryptocurrency offerors, and virtual asset businesses may be subject to oversight when making statements concerning the coverage, status, and insurance applicable to their accounts and customer deposits.

About this Author

Michael Cavallaro advises banking and financial services companies on national and regional regulatory and legal compliance issues related to consumer and commercial bankruptcy and restructuring, collections, vendor management, foreclosure, loss mitigation and default servicing. Mike is a client-centered, creative problem-solver who focuses on providing efficient and effective representation.

A consummate team player, Mike is personally dedicated to navigating his clients through the challenges associated with an industry where laws and regulations are constantly evolving. Mike’s…

Katerina (Katie) Mills assists with a range of financial services and digital asset regulatory matters, transactions, compliance, and licensure. Knowledgeable and driven, Katie works collaboratively with her colleagues and clients to find flexible and comprehensive solutions to meet clients’ needs.

She advises on day-to-day compliance issues, anti-money laundering and financial institution regulatory matters, payment products and cryptocurrency regulations, and issues involving financial technology products. She also as a deep understanding of…

You are responsible for reading, understanding and agreeing to the National Law Review’s (NLR’s) and the National Law Forum LLC’s Terms of Use and Privacy Policy before using the National Law Review website. The National Law Review is a free to use, no-log in database of legal and business articles. The content and links on www.NatLawReview.com are intended for general information purposes only. Any legal analysis, legislative updates or other content and links should not be construed as legal or professional advice or a substitute for such advice. No attorney-client or confidential relationship is formed by the transmission of information between you and the National Law Review website or any of the law firms, attorneys or other professionals or organizations who include content on the National Law Review website. If you require legal or professional advice, kindly contact an attorney or other suitable professional advisor.

Some states have laws and ethical rules regarding solicitation and advertisement practices by attorneys and/or other professionals. The National Law Review is not a law firm nor is www.NatLawReview.com intended to be a referral service for attorneys and/or other professionals. The NLR does not wish, nor does it intend, to solicit the business of anyone or to refer anyone to an attorney or other professional. NLR does not answer legal questions nor will we refer you to an attorney or other professional if you request such information from us.

Under certain state laws the following statements may be required on this website and we have included them in order to be in full compliance with these rules. The choice of a lawyer or other professional is an important decision and should not be based solely upon advertisements. Attorney Advertising Notice: Prior results do not guarantee a similar outcome. Statement in compliance with Texas Rules of Professional Conduct. Unless otherwise noted, attorneys are not certified by the Texas Board of Legal Specialization, nor can NLR attest to the accuracy of any notation of Legal Specialization or other Professional Credentials.

The National Law Review – National Law Forum LLC 3 Grant Square #141 Hinsdale, IL 60521 Telephone (708) 357-3317 or toll free (877) 357-3317. If you would ike to contact us via email please click here.

Author

Administraroot