Chris Dinga assesses the potential for crypto as more and more financial institutions ramp up their exposure to the sector

Since the pandemic, financial institutions have increased their exposure to the cryptocurrency sector so they can provide crypto investment opportunities to their clients.

The cryptocurrency sector is going through a tumultuous time. Since the crypto crash in May 2022, the value of the crypto market cap has been on a decline. Between November 2021 and the end of July 2022, the cap declined by 65%. Despite this difficult time, there is a growing interest from institutional and retail investors to gain exposure to the market.

GlobalData’s 2022 Financial Services Consumer Survey revealed that consumers around the world are showing interest in the cryptocurrency sector. This interest is primarily driven by the motivation to use cryptocurrency as an investment instrument. 77.4% of global respondents who reported having cryptocurrency said that they were motivated to earn profits from it, while only 18.5% of respondents reported using it as a payment tool.

The crypto sector has gathered a lot of interest from consumers and institutional investors since the pandemic. PWC’s 4th Annual Global Crypto Hedge Fund Report 2022 reported that the assets under management (AUM) of crypto hedge funds surveyed was $4.1bn in 2021, 8% higher than the previous year. Though hedge funds are taking exposure to the crypto market, they are limiting their exposure, as approximately 57% of hedge funds investing in crypto have less than 1% of total AUM invested in the sector. The high volatility of the sector makes cryptocurrency a risky asset in which to invest. One of the main strategies that hedge funds are adopting with cryptocurrencies is a market-neutral strategy, which aims to generate profit no matter the direction of the market by mitigating risk through the use of derivative products.

In addition to the volatility, the crypto sector’s lack of a proper regulatory framework is preventing financial institutions from significantly increasing their position within it. This lack of regulation causes uncertainty in the longer strategies that funds can adopt or the types of cryptocurrencies they can invest in. Regulations in the sector could create stability by reducing speculation, which is partly responsible for the high volatility. Furthermore, regulations can increase investor confidence in the sector, as protection schemes and coverage can be introduced to make trades and investments safer and bring the sector under the oversight of regulatory bodies.

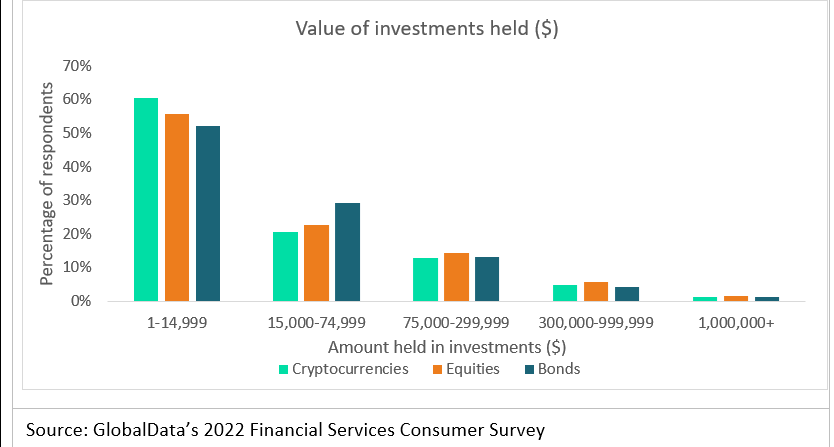

According to GlobalData’s 2022 Financial Services Consumer Survey, approximately 60% of respondents who hold cryptocurrencies hold less than $15,000 of crypto investments, with 41% holding less than $5,000.

This is much higher than the proportion of respondents with holdings of less than $15,000 in both equities (56%) and bonds (52%). Investors who are including cryptocurrencies into their portfolio are doing so by taking small positions in the market. This limits the impact on their investment if the crypto market were to crash.

The cryptocurrency sector is finally getting attention from financial institutions who are looking to capitalise on its growth. Though their investments are currently limited, they are likely to grow their position, especially when governments finally introduce regulatory frameworks.

Figure 1: There is an appetite for crypto investments as 60% of surveyed crypto holders hold less than $15,000 in crypto, higher than bonds and equities

Chris Dinga is payments analyst at GlobalData

Thank you for subscribing to Retail Banker International

Author

Administraroot