See Ad Disclosure

The rise in popularity of the cryptocurrency market has brought with it increased scrutiny, especially regarding the sustainability and environmental impact of these digital assets.

Famously, the energy requirement of the Bitcoin BTC/USD network alone has been compared to that of a small country — say Norway. Many people have come to understand this is because of the mining involved in securing the network. But exactly what is crypto mining, and are there alternative solutions?

Mining is the colloquial name given to the process by which new coins come into circulation. Bitcoin has become synonymous with digital gold, and the mining of both are analogous. There is a scarce asset locked away — gold in the ground and Bitcoin inside incredibly complex math problems — and real labor and energy are required to “extract” it. This system is known as proof of work (PoW).

Computers on the network compete against each other to solve complex mathematical problems. In doing this, they ensure the sequence of transactions that is the blockchain is correct and unimpeachable. For their efforts, they are rewarded new BTC, adding more coins into circulation.

In recent years, an alternative consensus mechanism has become increasingly popular. This mechanism, called proof of stake (PoS), uses a fraction of the energy required by PoW. In this model, mining rewards are doled out not to people doing computational work but rather to people holding a large amount in a single wallet.

Currently, Ethereum ETH/USD is attempting to transition from PoW to PoS.

PoS could be a huge step forward for making crypto more sustainable, but much more work can be done. Cudos CUDOS/USD is an example of a blockchain that is attempting to go the extra mile to create a highly sustainable network. It is a layer 1 blockchain utilizing a PoS consensus mechanism.

With the mainnet live, the team behind Cudos is building a layer 2 distributed cloud computing platform called Cudo Compute. Eventually, it will be bridged to other layer 1 blockchains like Ethereum, Algorand ALGO/USD and Polkadot DOT/USD, bringing its revolutionary power to an even wider audience.

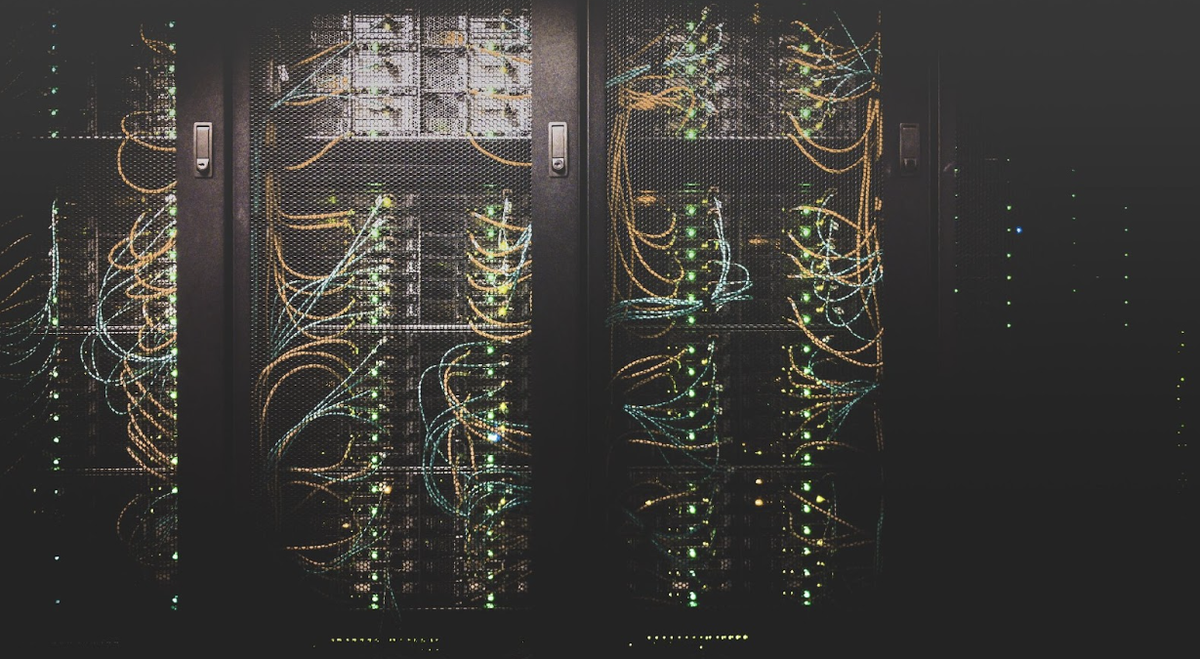

The key to its power lies in its use of a global network of computers and server farms. In contrast to legacy cloud services like Amazon.com Inc.'s AMZN Amazon Web Services (AWS) or Microsoft Corporation’s MSFT Azure, the Cudo Compute network is decentralized without a single point of failure endemic to centralized models.

And critically, the Cudo Compute network utilizes idle computing power. Server farms often have rows of servers that sit idle with nothing to do, wasting electricity. The network allows these idle machines to be put to use, ensuring they are not drawing power for no reason. Compare that to the incredibly inefficient model used by companies like Amazon that ends up having huge swaths of servers sitting idle, wasting precious energy.

And as the global demand for cloud computing grows at a rapid pace, the Cudos model allows for more efficient scaling than legacy providers. By making use of idle power anywhere in the world, the network can grow organically. Legacy providers must build new data centers that are inherently nightmares for the environment with massive land footprints and drawing enormous amounts of electricity.

This makes the Cudos model an important step toward a greener crypto market.

If you are interested in learning more, check out https://www.cudos.org/

This post contains sponsored advertising content. This content is for informational purposes only and is not intended to be investing advice.

Featured photo by Taylor Vick on Unsplash

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ad Disclosure: The rate information is obtained by Bankrate from the listed institutions. Bankrate cannot guaranty the accuracy or availability of any rates shown above. Institutions may have different rates on their own websites than those posted on Bankrate.com. The listings that appear on this page are from companies from which this website receives compensation, which may impact how, where, and in what order products appear. This table does not include all companies or all available products.

All rates are subject to change without notice and may vary depending on location. These quotes are from banks, thrifts, and credit unions, some of whom have paid for a link to their own Web site where you can find additional information. Those with a paid link are our Advertisers. Those without a paid link are listings we obtain to improve the consumer shopping experience and are not Advertisers. To receive the Bankrate.com rate from an Advertiser, please identify yourself as a Bankrate customer. Bank and thrift deposits are insured by the Federal Deposit Insurance Corp. Credit union deposits are insured by the National Credit Union Administration.

Consumer Satisfaction: Bankrate attempts to verify the accuracy and availability of its Advertisers’ terms through its quality assurance process and requires Advertisers to agree to our Terms and Conditions and to adhere to our Quality Control Program. If you believe that you have received an inaccurate quote or are otherwise not satisfied with the services provided to you by the institution you choose, please click here.

Rate collection and criteria: Click here for more information on rate collection and criteria.

Author

Administraroot