Welcome back to Chain Reaction.

Last week, we talked about privacy in crypto and how it’s sometimes at odds with regulation. This week, we’re covering a larger-than-life founder who is perhaps seeking redemption through web3.

If someone forwarded you this message, you can subscribe on TechCrunch’s newsletter page.

A weekly window into the thoughts of senior crypto reporter Anita Ramaswamy:

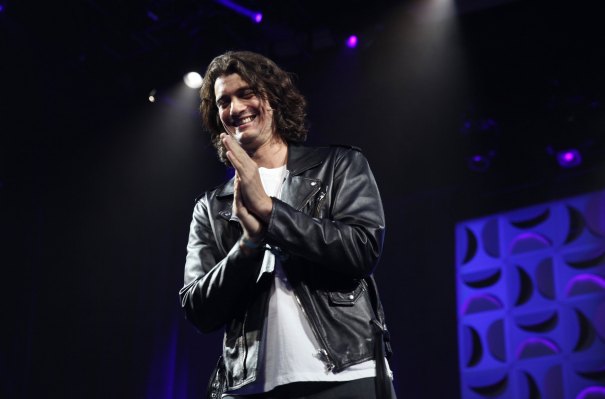

It’s a lesson we all learned over the last crypto bull run — crypto is a well-known refuge for those looking to reinvent themselves. WeWork founder Adam Neumann is no exception. Neumann made waves in the tech world this week when it was revealed that his new startup, focused on residential real estate communities, had just received a $350 million investment from Andreessen Horowitz — the largest check the VC firm has ever written, though it was unclear how much of that was equity versus debt. The company, Flow, earned a $1 billion valuation before, well, actually doing anything (aside from buying up apartment units), according to The New York Times.

In a bit of an ironic twist, the new venture aims to attempt to solve the housing crisis, a plan touted by Marc Andreessen himself in a blog post announcing the deal. Andreessen is the VC who, earlier this month, was found to have fought tooth and nail to prevent affordable housing units from being built in his wealthy hometown of Atherton, California. Initial details, though, were scant as to how exactly Neumann’s company would actually address the crisis, outside of some vague commentary about renters not being able to benefit from owning their home equity.

Tech industry reacts to Adam Neumann’s a16z-backed return to real estate

As if all that wasn’t enough to take in, now, there’s a crypto angle.

Forbes reported this week that Neumann’s startup, called Flow, plans to launch a digital wallet for cryptocurrencies. But there seems to be little to no overlap between the wallet product and the firm’s stated focus in real estate tech, as the wallet won’t allow people to make rental payments on their Flow-owned apartments through crypto.

The company has, according to Forbes, been recruiting candidates by describing its business as a “next generation multi-family property management system” that would include a tokenized rewards program and crypto payment capabilities. A Flow spokesperson later told Forbes that the job description was largely false and blamed the snafu on an external recruiter the company had worked with.

It’s still not clear how big of a role crypto is to play on Flow’s roadmap, but the spokesperson provided Forbes with a new job description that simply focused on “technology” in residential real estate rather than crypto or web3 specifically.

This isn’t Neumann’s first rodeo in the wild west of web3. He raised $70 million, also led by a16z, for Flowcarbon in May, a startup that intended to tokenize carbon credits on the blockchain. Flowcarbon has since halted a planned token sale, citing averse market conditions, and seems to have removed references to Neumann from its team page despite listing him as a co-founder of the venture at the time the a16z investment was announced. Curiously, the Flow announcement this week from a16z cited Flow as Neumann’s first venture since WeWork, as though he was never involved with Flowcarbon at all.

While plenty of founders with substance and potential continue to be overlooked by today’s VC ecosystem, a16z’s choice to make such a big bet on the notorious Neumann is telling of investors’ priorities. Though if one good thing comes out of this venture, perhaps it’ll be a gripping TV series.

How a16z’s investment into Adam Neumann further solidifies the ‘concrete ceiling’

Jacquelyn and Anita took the reins on this week’s news once again while Lucas was out, and the first item on their agenda was pretty juicy.

Do Kwon, the disgraced founder behind the Terra stablecoin collapse, gave his first interview since he went into hiding after losing billions of dollars on behalf of investors. He sat down with Coinage, an NFTV show from startup Trustless Media, to talk about his role in triggering crypto’s biggest crash.

After recapping the highlights reel from the Do Kwon interview, Anita and Jacquelyn talked about Galaxy Digital trying to say “jk lol” after it agreed to acquire crypto custodian BitGo, and ran through both bad and potentially good news for Crypto.com.

Be sure to tune in for our guest interview next Tuesday in which Anita will be chatting with Devin Lewtan, cofounder of web3 media production studio Mad Realities.

Subscribe to Chain Reaction on Apple, Spotify or your alternative podcast platform of choice to keep up with us every week.

Where startup money is moving in the crypto world:

This list was compiled with information from Messari as well as TechCrunch’s own reporting.

Here’s some of this week’s crypto analysis available on our subscription service TC+ from senior reporter Jacquelyn Melinek:

Polygon’s head of investments remains ‘highly bullish on web3’

The crypto market may be in limbo between a deep bear market and recovery, but that hasn’t stopped investors from deploying capital into the space. “In the grand scheme of things, nothing has changed regarding Polygon’s long-term mission, bear markets or not,” Shreyansh Singh, head of investments at Polygon, said to TechCrunch.

Anthony Hopkins sees NFTs as ‘art in a new format’

As celebrities and athletes alike dip into the crypto sphere to endorse tokens or companies, others are looking to NFTs as a way to engage with fans. The newest entrant is two-time Academy Award-winning actor Sir Anthony Hopkins, who partnered with NFT digital collectible company Orange Comet to launch his own series, The Eternal Collection. “NFTs, for me, are a blank canvas to create art in a new format,” Hopkins shared with TechCrunch.

Crypto scams have declined, but hackers remain resilient in bearish markets

When it comes to crime, illicit activity is still abundant regardless of crypto volatility, according to a new Chainalysis report. But there’s nuance in the apparent downturn in illicit activity — some subsectors of crypto-based crime have increased in 2022, while others declined.

Open source software is needed to prevent future crypto hacks, Polygon CISO says

As 2022 continues to rack up expensive exploits, many people in the crypto space are wondering what can be done to prevent these hacks in the future. Sure, they can emphasize the importance of education and protecting your own digital assets — but what else? The answer might be through projects employing open source software, Mudit Gupta, chief information security officer at Polygon, told TechCrunch.

Crypto scams have declined, but hackers remain resilient in bearish markets

Thanks for reading! And — again — to get this in your inbox every Thursday, you can subscribe on TechCrunch’s newsletter page.