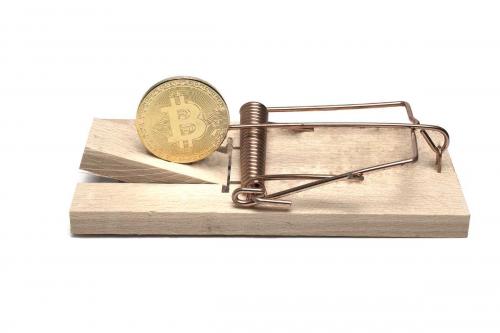

On August 15, 2022, the federal court in the Central District of California authorized the IRS to serve a John Doe summons on SFOX, a cryptocurrency prime dealer headquartered in California. A John Doe summons is a device (e.g., a subpoena) to gather information from a third party, where the IRS does not know the identity of the person about whom they are seeking the information. This is not the first time the IRS has issued a John Doe summons on a crypto-entity, but this is the first time the IRS has specifically investigated and sought out taxpayers with high-value cryptocurrency transactions. This is also marks the first time the IRS has targeted a cryptocurrency trading platform, highlighting the IRS’s interest in underreported cryptocurrency transactions.

Although there is no allegation that SFOX is engaged in any wrongdoing, the John Doe summons requires SFOX to produce records identifying U.S. taxpayers who have used its services and any other documents relating to the taxpayers’ cryptocurrency transactions. The summons allows the IRS to obtain information about U.S. taxpayers who conducted at least $20,000 in any year, in cryptocurrency transactions from 2016 to 2020, using SFOX.

This is not the first time a federal court has used a John Doe summons to extract information from non-parties about U.S. taxpayers involved in cryptocurrency transactions. In 2016, a federal court authorized the IRS to serve a John Doe summons on a U.S.-based cryptocurrency exchange. In 2021, two federal courts in California authorized the IRS to serve two John Doe summons on two cryptocurrency exchanges and one digital wallet institution.

When the IRS investigates potential violations of internal revenue law by unknown persons, groups, or classes of persons, the IRS will seek a John Doe summons, which is authorized under Internal Revenue Code § 7609(f). With a normal summons, the IRS seeks information about a specific taxpayer whose identity is known; in contrast, a John Doe summons allows the IRS to obtain information about any taxpayer within an “ascertainable group or class of persons.” I.R.C. § 7609(f)(1). The IRS also must have a “reasonable basis” for believing such group or class of persons may have violated the internal revenue law. I.R.C. § 7609(f)(2).

John Doe summonses are not limited to cryptocurrency transactions. In 2008 and 2013, the IRS obtained John Doe summonses on Swiss-based banks to obtain information about U.S. taxpayers who used Swiss bank accounts to evade U.S. federal income taxes.

The IRS has made clear its intent on focusing its efforts on obtaining information on those using cryptocurrency to prosecute violations of the internal revenue laws.

About this Author

Thomas F. Carlucci is a partner and litigation attorney at Foley & Lardner LLP where he is managing partner of the San Francisco office. Mr. Carlucci represents corporations, organizations and individuals in white-collar matters and internal investigations with an emphasis on potential health care fraud, tax fraud, off-label marketing, and false claims. He also focuses on civil state and federal tax litigation.

Elizabeth Nevle is an associate for the Litigation Department with Foley & Lardner LLP. She is based in the Houston office where she is a member of the Energy Litigation Practice Group. Elizabeth was also a summer associate at Foley in 2019 and 2020. She has experience researching issues relating to tax, labor and employment, contracts, energy, and bankruptcy matters

You are responsible for reading, understanding and agreeing to the National Law Review’s (NLR’s) and the National Law Forum LLC’s Terms of Use and Privacy Policy before using the National Law Review website. The National Law Review is a free to use, no-log in database of legal and business articles. The content and links on www.NatLawReview.com are intended for general information purposes only. Any legal analysis, legislative updates or other content and links should not be construed as legal or professional advice or a substitute for such advice. No attorney-client or confidential relationship is formed by the transmission of information between you and the National Law Review website or any of the law firms, attorneys or other professionals or organizations who include content on the National Law Review website. If you require legal or professional advice, kindly contact an attorney or other suitable professional advisor.

Some states have laws and ethical rules regarding solicitation and advertisement practices by attorneys and/or other professionals. The National Law Review is not a law firm nor is www.NatLawReview.com intended to be a referral service for attorneys and/or other professionals. The NLR does not wish, nor does it intend, to solicit the business of anyone or to refer anyone to an attorney or other professional. NLR does not answer legal questions nor will we refer you to an attorney or other professional if you request such information from us.

Under certain state laws the following statements may be required on this website and we have included them in order to be in full compliance with these rules. The choice of a lawyer or other professional is an important decision and should not be based solely upon advertisements. Attorney Advertising Notice: Prior results do not guarantee a similar outcome. Statement in compliance with Texas Rules of Professional Conduct. Unless otherwise noted, attorneys are not certified by the Texas Board of Legal Specialization, nor can NLR attest to the accuracy of any notation of Legal Specialization or other Professional Credentials.

The National Law Review – National Law Forum LLC 3 Grant Square #141 Hinsdale, IL 60521 Telephone (708) 357-3317 or toll free (877) 357-3317. If you would ike to contact us via email please click here.

Author

Administraroot