Bloomberg Markets: China Open is the definitive guide to the markets in Hong Kong and on the mainland. David Ingles and Yvonne Man bring you the latest news and analysis to get you ready for the trading day.

Live market coverage co-anchored from Hong Kong and New York. Overnight on Wall Street is daytime in Asia. Markets never sleep, and neither does Bloomberg. Track your investments 24 hours a day, around the clock from around the world.

Follow Bloomberg reporters as they uncover some of the biggest financial crimes of the modern era. This documentary-style series follows investigative journalists as they uncover the truth

Musk Tweets He’s Buying ManU in Thread Joking About Politics

Berkshire Unit Sued Over California’s Largest Fire of Season

Toyota and CATL Shut Plants in Sichuan as Power Crisis Worsens

SoftBank-Backed Socar Sticks With Sales Goals After Slashing IPO

China’s Reliance on Taiwan Would Make Trade Retaliation Costly

Sunak Rules Out Freezing UK Energy Price Cap as Truss Holds Back

Argentina Plows Ahead With Utility-Subsidy Cuts Key to IMF Deal

Fleming’s Rockefeller Aims to Double Number of Adviser Teams

Billionaire Larry Ellison Lists $145 Million Estate in North Palm Beach

Pirates’ Castro Suspended 1 Game for Phone Flap, He Appeals

AP Sources: Tiger Meets With Top Players Against LIV Golf

A New Normal Is Dividing the Global Chip Industry

Walmart Says We’re Gonna Be Okay

Can Xi’s China Correct Course on Covid — Like Vietnam?

Women Are Smashing the Construction Industry’s Concrete Ceiling as Labor Shortages Leave a Void

Andreessen Horowitz Thinks It’s Time for Adam Neumann to Build

Texas Businesses Have an Incentive to Save Power—and Aid the State’s Electricity Grid

NBA Won’t Show Games on Election Night to Encourage Voter Participation

Amazon Labor Union Is Set to File for Election Near Albany

UK’s Iceland Lets Shoppers Pay for Food in Installments

California Seeks Power Conservation to Avoid Blackouts Amid Heat

Australia’s Climate Risks Are Driving Up Home Insurance Costs

Beleaguered Brooklyn Jail Blasted By Candidates in Crowded N.Y. Congressional Race

Car Owners Say It’s ‘Virtually Impossible’ to Find Street Parking in New York City

Chicago Music Festivals Bring Revenue — and Tension — to City

Bitcoin Miner Stronghold Gives Back 26,200 Rigs to Reduce Debt

Bankrupt Crypto Lender Celsius Considers Financing Proposals

Fed Says Banks That Jump Into Crypto Must Do Legal Homework

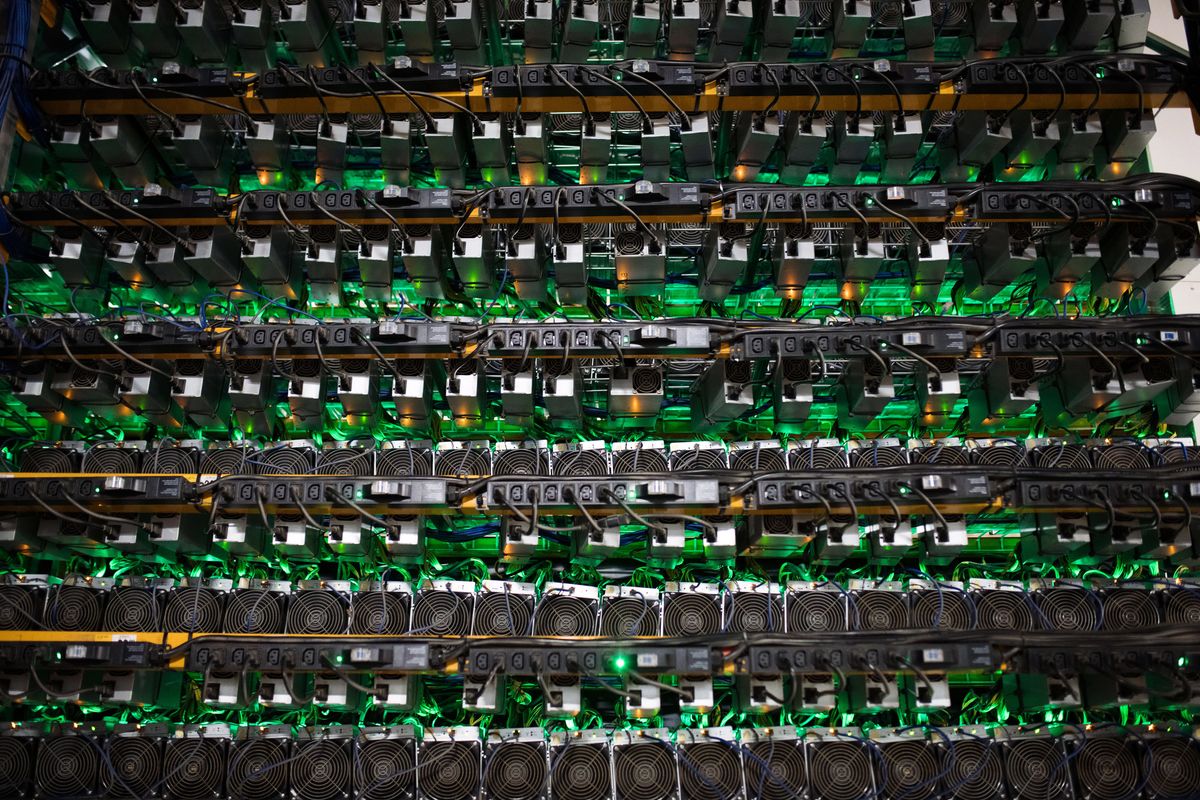

Mining rigs at a Bitfarms facility in Saint-Hyacinthe, Quebec, Canada.

David Pan

The three-largest US publicly traded Bitcoin mining companies lost more than $1 billion in the second quarter after taking a series of impairment charges spurred by the collapse of cryptocurrency prices.

Core Scientific Inc., Marathon Digital Holdings Inc. and Riot Blockchain Inc. posted net losses of $862 million, $192 million and $366 million, respectively, in the three months ended June 30, recent quarterly earnings reports show. Other significant miners such as Bitfarms Ltd. and Greenidge Generation Holdings Inc., which reported results Monday, were also forced to write down the value of their holdings in the wake of the almost 60% drop in the price of Bitcoin during the quarter.

Author

Administraroot