The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First, we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second, we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive payment from the companies that advertise on the Forbes Advisor site. This comes from two main sources.

First, we provide paid placements to advertisers to present their offers. The payments we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market.

Second, we also include links to advertisers’ offers in some of our articles. These “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor.

While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof.

When Collins Dictionary announced that its Word of the Year for 2021 was ‘NFT’, many people began to wonder what NFTs actually were. Here’s everything you need to know about the new phenomenon that shows no sign of abating.

An NFT – non-fungible token – is a digital asset that represents a real-world object like, for example, the Charlie Bit My Finger video that sold for $US760,999 back in May. NFTs are bought and sold online, frequently with cryptocurrency, and are generally encoded with the same underlying software as many cryptocurrencies.

Although they’ve been around since 2014, NFTs are gaining notoriety now because they are becoming an increasingly popular way to buy and sell digital artwork. According to new research from blockchain data platform, Chainalysis, some $US37 billion has already been sent to NFT marketplaces between January and May of 2022.

NFTs are also generally one of a kind, or at least one of a very limited run, and have unique identifying codes. “Essentially, NFTs create digital scarcity,” says Arry Yu, chair of the Washington Technology Industry Association Cascadia Blockchain Council and managing director of Yellow Umbrella Ventures.

This stands in stark contrast to most digital creations, which are almost always infinite in supply. Hypothetically, cutting off the supply should raise the value of a given asset, assuming it’s in demand.

But many NFTs, at least in these early days, have been digital creations that already exist in some form elsewhere – like the viral ‘Charlie Bit My Finger’ clip, or securitised versions of digital art that’s already floating around on Instagram.

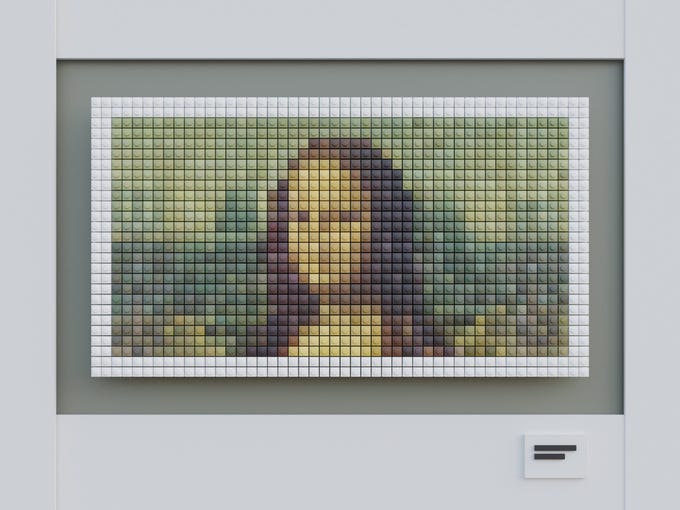

For instance, famous digital artist Mike Winklemann, better known as “Beeple” crafted a composite of 5000 daily drawings to create perhaps the most famous NFT of the moment, “EVERYDAYS: The First 5000 Days,” which sold at Christie’s for $89 million.

Anyone can view the individual images—or even the entire collage of images online for free. So why are people willing to spend millions on something they could easily screenshot or download?

Because an NFT allows the buyer to own the original item. Not only that, it contains built-in authentication, which serves as proof of ownership. Collectors value those “digital bragging rights” almost more than the item itself.

NFT stands for non-fungible token. It’s generally built using the same kind of programming as cryptocurrency, like Bitcoin or Ethereum, but that’s where the similarity ends.

Physical money and cryptocurrencies are “fungible,” meaning they can be traded or exchanged for one another. They’re also equal in value—one dollar is always worth another dollar; one Bitcoin is always equal to another Bitcoin. Crypto’s fungibility makes it a trusted means of conducting transactions on the blockchain.

NFTs are different. Each has a digital signature that makes it impossible for NFTs to be exchanged for or equal to one another (hence, non-fungible). Charlie Bit My Finger, for example, is not equal to EVERYDAYS simply because they’re both NFTs.

Naga

Maker fee: 0,40% Taker fee: 0,40% ; Cryptocurrencies Available for Trade: 30+

NFTs exist on a blockchain, which is a distributed public ledger that records transactions. You’re probably most familiar with blockchain as the underlying process that makes cryptocurrencies possible.

Specifically, NFTs are typically held on the Ethereum blockchain, although other blockchains support them as well.

An NFT is created, or “minted” from digital objects that represent both tangible and intangible items, including:

• Art

• GIFs

• Videos and sports highlights

• Collectibles

• Virtual avatars and video game skins

• Designer sneakers

• Music

Even tweets count. Twitter co-founder Jack Dorsey sold his first ever tweet as an NFT for $US2.9 million.

Essentially, NFTs are like physical collector’s items, only digital. So instead of getting an actual oil painting to hang on the wall, the buyer gets a digital file instead.

They also get exclusive ownership rights. NFTs can have only one owner at a time. NFTs’ unique data makes it easy to verify their ownership and transfer tokens between owners. The owner or creator can also store specific information inside them. For instance, artists can sign their artwork by including their signature in an NFT’s metadata.

Blockchain technology and NFTs give artists and content creators a unique opportunity to monetise their work.

For example, artists no longer have to rely on galleries or auction houses to sell their art. Instead, the artist can sell it directly to the consumer as an NFT, which also lets them keep more of the profits.

In addition, artists can program in royalties so they’ll receive a percentage of sales whenever their art is sold to a new owner. This is an attractive feature as artists generally do not receive future proceeds after their art is first sold.

Art isn’t the only way to make money with NFTs. Toilet paper manufacturer Charmin auctioned off themed NFT art to raise funds for charity. Charmin dubbed its offering “NFTP” (non-fungible toilet paper).

Even celebrities like Snoop Dogg and Lindsay Lohan are jumping on the NFT bandwagon, releasing unique memories, artwork and moments as securitised NFTs.

If you’re keen to start your own NFT collection, you’ll need to acquire some key items:

First, you’ll need to get a digital wallet that allows you to store NFTs and cryptocurrencies. You’ll likely need to purchase some cryptocurrency, like Ether, depending on what currencies your NFT provider accepts. You’ll then be able to move it from the exchange to your wallet of choice.

You’ll want to keep fees in mind as you research options. Most exchanges charge at least a percentage of your transaction when you buy cryptocurrency.

eToro

Invest with a crypto brand trusted by millions ; Buy and sell 70+ cryptoassets on a secure, easy-to-use platform

*Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

Once you’ve got your wallet set up and funded, there’s no shortage of NFT sites to shop. Currently, the largest NFT marketplaces are:

• OpenSea.io: This peer-to-peer platform bills itself a purveyor of “rare digital items and collectibles.” To get started, all you need to do is create an account to browse NFT collections. You can also sort pieces by sales volume to discover new artists.

• Rarible.com: Similar to OpenSea, Rarible is a democratic, open marketplace that allows artists and creators to issue and sell NFTs. RARI tokens issued on the platform enable holders to weigh in on features like fees and community rules.

• Foundation.app: Here, artists must receive “upvotes” or an invitation from fellow creators to post their art. The community’s exclusivity and cost of entry—artists must also purchase “gas” to mint NFTs—means it may boast higher-calibre artwork. For instance, Nyan Cat creator Chris Torres sold the NFT on the Foundation platform.

It may also mean higher prices — not necessarily a bad thing for artists and collectors seeking to capitalise, assuming the demand for NFTs remains at current levels, or even increases over time.

Although these platforms and others are host to thousands of NFT creators and collectors, be sure you do your research carefully before buying. Some artists have fallen victim to impersonators who have listed and sold their work without their permission.

In addition, the verification processes for creators and NFT listings aren’t consistent across platforms — some are more stringent than others. OpenSea and Rarible, for example, do not require owner verification for NFT listings. Buyer protections appear to be sparse at best, so when shopping for NFTs, it may be best to keep the old adage “caveat emptor” (let the buyer beware) in mind.

Just because you can buy NFTs, does that mean you should? It depends, Yu says.

“NFTs are risky because their future is uncertain, and we don’t yet have a lot of history to judge their performance,” she notes. “Since NFTs are so new, it may be worth investing small amounts to try it out for now.”

In other words, investing in NFTs is a largely personal decision. If you have money to spare, it may be worth considering, especially if a piece holds meaning for you.

But keep in mind, an NFT’s value is based entirely on what someone else is willing to pay for it. Therefore, demand will drive the price rather than fundamental, technical or economic indicators, which typically influence stock prices and at least generally form the basis for investor demand.

All this means, an NFT may resale for less than you paid for it. Or you may not be able to resell it at all if no one wants it. Do your research, understand the risks—including that you might lose all of your investment—and if you decide to take the plunge, proceed with a healthy dose of caution.

Robyn Conti is a freelance financial writer based in Los Angeles, CA. She has been writing about workplace retirement plans, investing, and personal finance for the past 20+ years. When she isn't feverishly working to meet a deadline, Robyn enjoys hanging out with her kids, drinking coffee, reading, and hiking.

Johanna Leggatt is the Lead Editor for Forbes Advisor, Australia. She has more than 20 years' experience as a print and digital journalist, including with Australian Associated Press (AAP) and The Sun-Herald in Sydney. She is a former digital sub-editor on The Guardian and The Telegraph in the UK, and lives in Melbourne.

Author

Administraroot