Free Webinar: Building the Financial Backbone of GameFi. Register

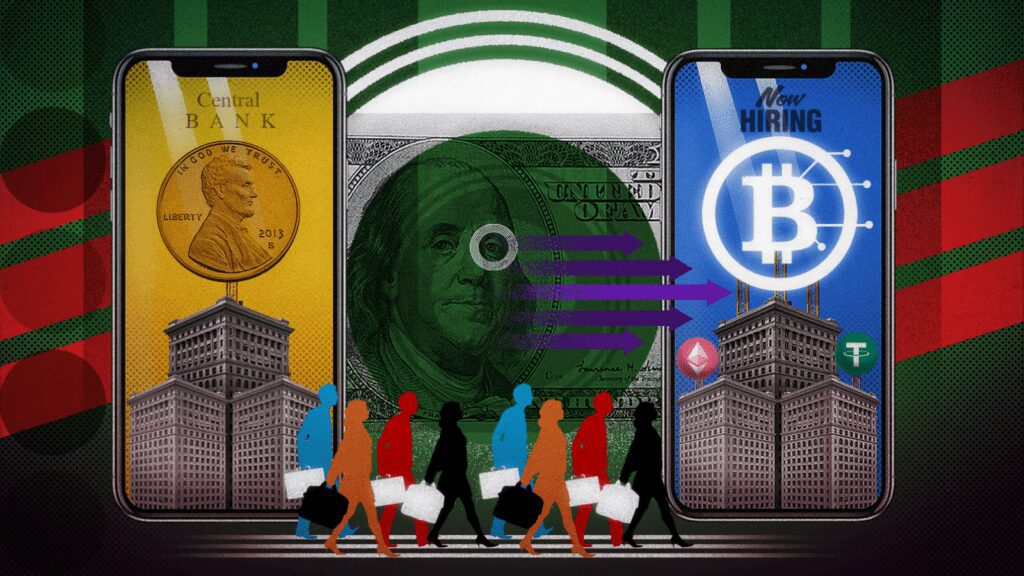

Former WisdomTree director of digital assets and commodity operations joins largest crypto exchange

Hedge fund figure Blue Macellari joined T. Rowe Price as its head of digital assets strategy, she revealed on LinkedIn Thursday.

“This is what adoption looks like,” Macellari wrote in the post.

Macellari spent the last four-plus years as a managing partner at crypto hedge fund firm Dunamis Trading, according to her profile. There, she launched and co-managed Dunamis’ crypto market-neutral vehicle and formulated company strategy.

T. Rowe Price managed $1.3 trillion in assets, as of June 30. A company survey published in April found that 40% of children believe crypto is the future of investing. A T. Rowe Price spokesperson told Blockworks at the time that given the size of digital asset markets, their impact on capital markets cannot be ignored.

Crypto exchange OKX appointed Frederica Tompkins as director of brand marketing and Kim Murphy as director of events.

Tompkins joins OKX from the luxury and fast-moving consumer goods sectors, having worked with brands such as Chanel and Ralph Lauren. Murphy comes from the worlds of event production and philanthropy, where she helped organize concerts, conferences and boutique celebrations.

Tompkins and Murphy join during a year that has seen OKX strike partnerships with Manchester City Football Club, the McLaren Racing Formula One team and the Tribeca Festival. The exchange appointed Rachel Conlan as its global head of brand marketing and partnerships earlier this year.

OKX’s hiring of female leaders coincides with its joint report with LinkedIn showing a shortage of tech talent, as well as female professionals, in the blockchain industry. The analysis found the sector had about four times more men than women, as of June.

Leading exchange Binance hired Karl Long, WisdomTree Asset Management’s former director of digital assets and commodity operations, to spearhead its operations in Ireland, Irish Independent reported Monday.

A Binance spokesperson declined to comment.

Long joined WisdomTree in February after working as a managing director of operations at State Street for nearly a decade, according to his LinkedIn profile.

The executive is based in Dublin, Ireland, his profile indicates. Binance CEO Changpeng Zhao told Reuters last year that the exchange was considering Ireland and France as potential headquarters and had registered a new entity in Ireland the following month.

Yuga Labs, the firm behind Bored Ape Yacht Club, named Danny Greene to fill its newly created role of brand lead for Meebits after Greene spent the last eight months as general manager of the MeebitsDAO.

Meebits is an NFT collection with 20,000 characters and a trading marketplace. Yuga Labs acquired the commercial rights to Meebits and CryptoPunks from Larva Labs in March.

“The Meebits collection stands out not only for the artistic achievement but also because it was the first 3D avatar designed for the interoperable metaverse and has always been a pillar of diversity and inclusion in web3,” Greene said in a statement. “Already you can play with your Meebit in over 20 virtual worlds, apps, and games — and this is just the beginning.”

Sports NFT (non-fungible token) platform Dibbs has added leaders as it seeks to grow beyond a collectibles marketplace to a tokenization and custody platform for intellectual property owners and collectors.

Dibbs hired Ben Plomion as its chief marketing officer and Bill Plumeri as its chief compliance officer.

Plomion spent seven years at contextual intelligence company GumGum, where he served as chief growth officer. Plumeri most recently led the global institutional compliance program at crypto lender BlockFi.

Prior to BlockFi, Plumeri was the director of compliance at digital asset securities unit Securitize, where he designed and implemented a compliance program focused on tokenizing traditional securities on the blockchain. He has held other leadership roles at crypto exchange Gemini, as well as JPMorgan and BNP Paribas.

Institutional crypto trading tech provider Talos hired Neal Pawar as a strategic adviser.

Pawar is the chief operating officer of Qontigo, an affiliate of Deutsche Börse Group that offers index analytics and risk solutions. He was formerly chief investment officer of UBS’ wealth management group and a group CIO at Deutsche Bank.

Pawar joins Jennifer Hill, ex-chief financial officer of Merrill Lynch; David Cushing, former director of global trading at Wellington; and Tim Grant, Galaxy Digital’s head of Europe, on the company’s advisory board.

London-headquartered Luno hired Thomas Tudehope as its global head of public policy to deepen its crypto investment app’s relationships with industry regulators, at a time when governments are looking to fix their eyes on the sector.

Founded in 2013, Luno was acquired by Digital Currency Group in 2020. Luno’s flagship app of the same name, has more than 10 million customers across roughly 40 countries, according to company figures.

Tudehope was most recently head of public affairs at Revolut, where he expanded the company’s public policy team and led political engagement. He was also formerly a senior adviser to former Australian Prime Minister Malcolm Turnbull.

Decentralized finance-focused UK firm AQRU appointed Digby Try, the company’s co-founder, as its chief commercial officer.

Before becoming co-founder and chief operating officer of AQRU last October, Try previously worked as head of global sales at banking and payments platform OpenPayd and as a vice president of sales for EMEA at Currencycloud, which Visa acquired last year.

Kamelia Gankova, formerly managing director at Crypto.com’s Bulgarian outpost, is now the COO of AQRU subsidiary Accru Finance.

Gankova has also served as director of customer service at online payments company Paysafe.

Core Scientific reduced its headcount by 10% in the second quarter as part of cost-cutting measures to deal with market turmoil, the top crypto miner revealed Thursday.

Galaxy Digital CEO Mike Novogratz said on an earnings call earlier in the week that it did some “selective shrinking” of its team in the second quarter. Galaxy, a digital asset management firm, posted a $555 million net loss during the three-month period.

Novogratz said the company is seeking to boost its headcount from 375 people to more than 400 by the end of the year. A Galaxy spokesperson declined to comment.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.

DATE

Tuesday & Wednesday, September 13 & 14, 2022

LOCATION

The Glasshouse, 660 12th Avenue, NY, NY 10019

The ‘NFTiff’ campaign sold out a collection of 250 NFTs in 22 minutes, each redeemable for a precious pendant

OFAC’s decision suggests that all protocols are subject to the same compliance obligations

Beneficiary options would make the transfer process faster, easier and cheaper for loved ones after a user’s death

Tornado Cash’s native token TORN lost 96.9% of its value since its all-time high in February 2021, and at least one developer is now in legal jeopardy

Controversial Tron founder Justin Sun has so far struggled to garner significant interest in his set of forked ether tokens

Author

Administraroot