I`m a content marketer from Ukraine, specializing in blogs. I work in IT, crypto, and marketing niches. You can DM me.

In the spring of 2022, the cryptocurrency market decided to move against the laws of nature. The red charts forced the investor through all phases of accepting the inevitable. The value of Bitcoin rolled back 80% from its high, and the total capitalization fell below the psychological mark of $1 trillion.

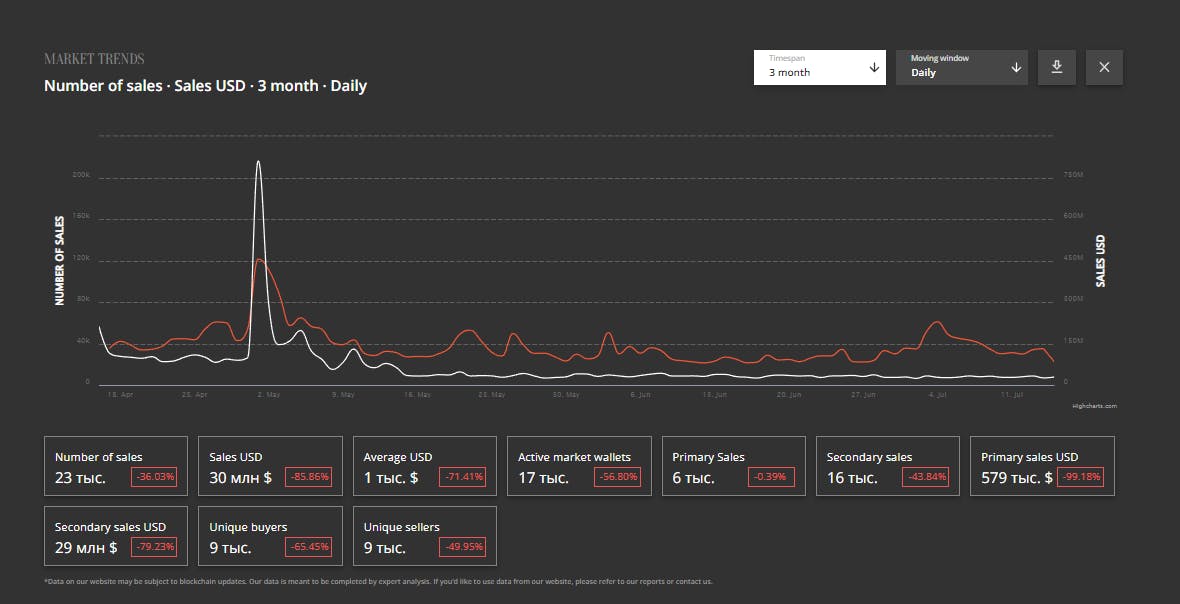

Against this backdrop, the NFT sector took a hit. Trading volumes of non-fungible tokens are moving steadily toward a yearly low. NonFungible statistics show that on July 15, the daily sales volume was 28 920 transactions, while trading volume in the NFT market collapsed to the $35 788 508, 28 mark.

NFT investors are divided into two opposing camps. Some are buying up non-fungible tokens "at discounts" while others are selling their assets in a panic with cries of, "Chief, it's all gone!"

So, what behavior model suits NFT investors during crypto winter 2022?

In 2021, the NFT market peaked, with everyone talking about non-fungible tokens. Stories about a British schoolboy and an American teenage girl who made a fortune creating NFT collections inspired thousands of new "romantics" who came to the ecosystem on a hype.

Experts see the drop in trading volumes as some industry filtering. NFT-tokens will not be issued by anyone lazy, hoping to earn at least some money on them.

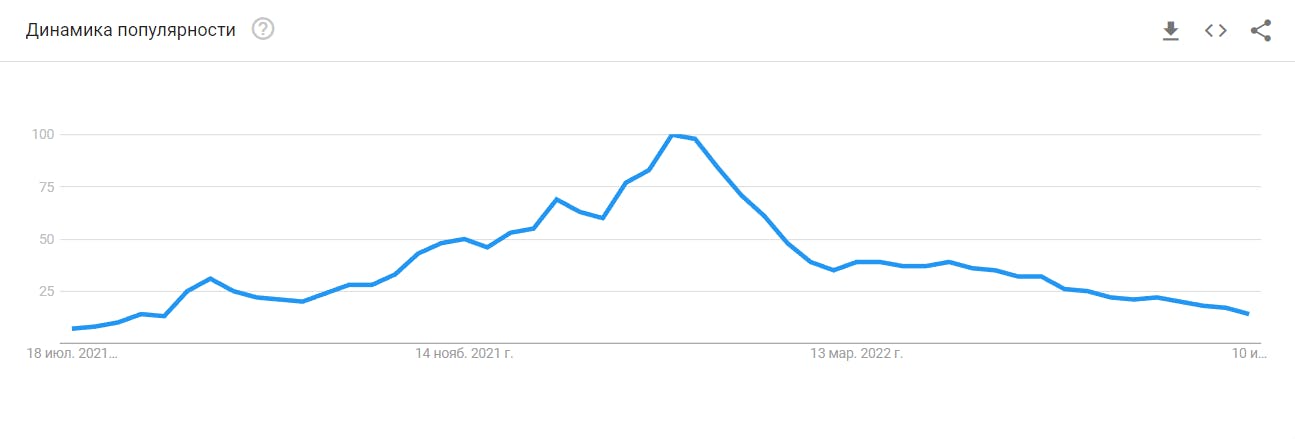

The Google Trends analysis of the NFT request shows that the peak interest (100) for non-fungible tokens was in January 2022, after which the hype passed. As of June 15, the popularity of the NFT query is 14 – the number of searches has decreased by more than 85%. This trend suggests that scam projects will leave the market – the industry will be cleared of "passengers" opening up new prospects.

While almost any NFT token was resold a couple of times last year, that strategy won't work now. Investors are more careful to analyze prospects and choose NFTs with growth prospects. Anything else risks staying in their crypto wallet for a long time.

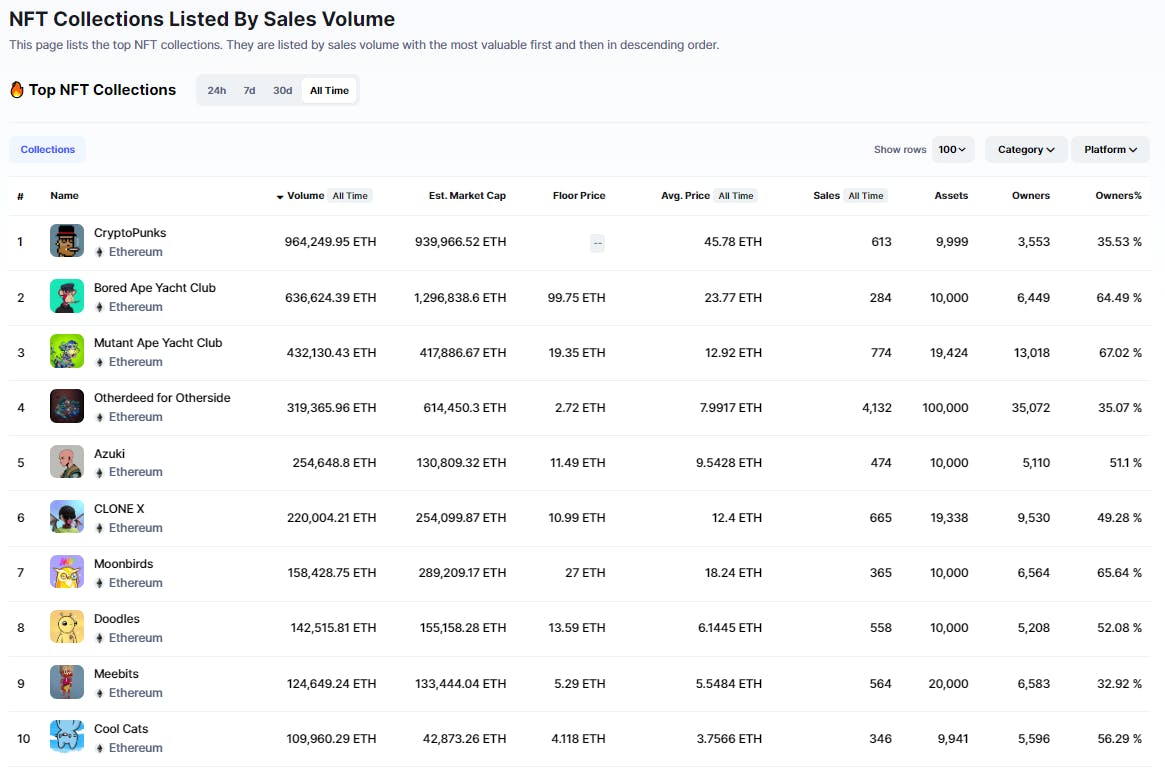

The representatives of the top NFT collections always provided the basic mass of the trading volumes of the market. Their value varies from a few tens to several hundreds of ETH. In the Coinmarketcap ranking, the top 5 NFT collections by capitalization look like this:

Crypto Punks

Bored Ape Yacht Club

Mutant Ape Yacht Club

Otherdeed for Otherside

Azuki

All of the above NFT collections are running on the Ethereum blockchain. The value of NFT tokens has fallen, and the price of Ethereum has also rolled back noticeably. Adding a few top NFTs to your portfolio is a good idea, especially if the ecosystem has prospects.

For example, the Mutant Ape Yacht Club collection has become mainstream in the meta-universe ecosystem. Also, this collection has a lot of sympathy for Elon Musk, who recently put a collage of Bored Ape Yacht Club monkeys on his Twitter avatar.

Experts from Markets and Markets say that by 2027 the NFT market will grow to $13.6 billion, and the top NFT collections will not play a minor role in this growth.

Speaking of the NFT market, there are two new industries directly related to non-fungible tokens – GameFi and Move-to-Earn.

Crypto.com claims that the blockchain gaming industry will reach the $50 billion mark by 2025. The assumption is indeed right – the GameFi sector is essentially nascent, but it is already attracting significant investments.

It makes sense to buy NFT tokens of top games and meta worlds with an eye on the future. For example, the Sandbox project lands have even interested Dubai's Virtual Asset Regulatory Authority.

It is more complicated with move-to-earn, and it is not worth rushing to buy sneakers from STEPN and other projects. You can become a virtual shoe baron, but whether you get a profit… With minimal risk, you can enter promising projects where the cost of sneakers is no more than $100.

If you enjoyed this piece, I also recommend that you read:

Automatically Support Sites You Love in Real Time

Quality Weekly Reads About Technology Infiltrating Everything