We are now firmly in a crypto winter – meaning that digital asset prices have taken a significant hit in recent months. On the other hand, this allows investors to buy a range of crypto tokens at a discounted price.

In this guide, we rank the best crypto winter tokens to consider buying today to take full advantage of the current bear market.

The best crypto winter tokens are those that stand a solid chance of recovering from the current bear market.

Overall, we found that the following 10 projects represent the best coins to invest in during the crypto winter:

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

Being able to separate the good winter crypto tokens from the bad is a very difficult task.

After all, nobody could have forecast that a top-10 project like Terra Luna would have capitulated in a matter of days to become virtually worthless.

As a result, plenty of in-depth research is required before parting with any investment capital.

Below, we analyze the best coins to invest in during the crypto winter: Look no further than Battle Infinity (IBAT) when searching for the best crypto winter tokens to buy. This innovative project is building an entire blockchain ecosystem that covers a variety of products and services.

Look no further than Battle Infinity (IBAT) when searching for the best crypto winter tokens to buy. This innovative project is building an entire blockchain ecosystem that covers a variety of products and services.

At the forefront of this is the IBAT Premier League. Put simply, this takes fantasy sports and crypto games to a whole new level, insofar that Battle Infinity incorporates the game into an ever-expanding metaverse. Moreover, those that progress through the game and perform well can earn rewards on two different fronts.

First, all in-game digital items and assets are owned 100% by the respective player. The reason for this is that each asset is represented by a unique NFT. This means that users can trade or sell any NFTs that are earned.

Second, rewards can also be earned in the form of the project’s native token – IBAT. Like any other digital currency, IBAT will trade on public exchanges. Moreover, Battle Infinity will also be launching a decentralized exchange. This will enable players to buy and sell IBAT both anonymously and without needing to go through a centralized operator.

Crucially, IBAT is yet to launch to the public. On the contrary, the IBAT token is currently in the midst of its presale campaign. And therefore, those looking to buy IBAT tokens right now can do so at a favorable cost price.

After the presale has concluded – IBAT will then be launched to the public at a higher price. Before investing in the IBAT presale, readers are urged to perform additional research via the Battle Infinity website. The Battle Infinity Telegram channel is also worth joining.

Battle Infinity fundamentals:

Your capital is at risk. Crypto asset investments are highly volatile and speculative.  Lucky Block is one of the most notable success stories in recent years, not least because in early 2022, it became the fastest crypto token to hit a market capitalization of $1 billion. Launched in January 2022, Lucky Block is a global crypto game.

Lucky Block is one of the most notable success stories in recent years, not least because in early 2022, it became the fastest crypto token to hit a market capitalization of $1 billion. Launched in January 2022, Lucky Block is a global crypto game.

More specifically, the platform offers daily and weekly prize draws on a global basis. Numbers are drawn randomly via a smart contract and winning tickets will receive a percentage of the total prize pot.

Due to the decentralized nature of the underlying smart contract and blockchain, all Lucky Block games are guaranteed for fairness. People from all over the world can enter a Lucky Block prize draw for a chance of winning, and a single ticket costs just $1.

The minimum number of tickets that can be purchased to enter a Lucky Block game is just 5. Those successful in winning a draw will receive their prize in LBLOCK – which is the native crypto token of the Lucky Block ecosystem.

This digital asset is also one of the best crypto winter tokens for those on a budget. The reason for this is that as of writing, a single LBLOCK token can be purchased for less than $0.001. As such, a capital outlay of just $100 would translate to more than 100,000 tokens.

In terms of upside potential, LBLOCK was trading at over $0.009 before the crypto winter came into full force. And therefore, at current pricing levels, this offers an upside target of over 800% – should LBLOCK regain its prior highs.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.  Another top-rated project that firmly makes our list of the best crypto winter tokens is DeFi Coin. This project was launched in mid-2021, albeit, since then, the team has been working hard on the underlying product – a decentralized exchange.

Another top-rated project that firmly makes our list of the best crypto winter tokens is DeFi Coin. This project was launched in mid-2021, albeit, since then, the team has been working hard on the underlying product – a decentralized exchange.

The DeFi Swap exchange will initially allow users to buy and sell tokens listed on the Binance Smart Chain in an anonymous manner. There is no requirement to open an account with DeFi Swap nor provide any personal data.

On the contrary, users can trade tokens instantly simply by connecting their wallet to the DeFi Swap website. In the coming months, DeFi Swap will support cross-chain functionality. This means that in addition to the Binance Smart Chain, other networks will be supported.

For example, a user might decide to swap Shiba Inu (SHIB) for BUSD via the DeFi Swap platform. And, in doing so, there is no requirement to transfer tokens in and out of a centralized exchange.

Furthermore, DeFi Swap has also built a solid crypto staking tool that allows users to earn interest on idle tokens. Another way to generate a yield on DeFi Swap is via its yield farming service. This will see the user lend their tokens to the DeFi Swap liquidity pool.

In turn, on each token exchange that is executed on DeFi Swap, the investor will receive a small percentage of the collected fee. An NFT marketplace is also being built by the DeFi Swap team, as is a fully-fledged mobile crypto app for both iOS and Android.

Those who believe in the future of decentralized financial services and thus – DeFi Swap, can invest in this project with ease. This is because DeFi Coin sits at the heart of the DeFi Swap ecosystem.

As per all of the other crypto winter tokens that we discuss today, DeFi Coin is arguably the most undervalued crypto right now. In fact, the token is trading at just a fraction of its prior high. Therefore, this crypto winter token will suit those targeting a sizable upside.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

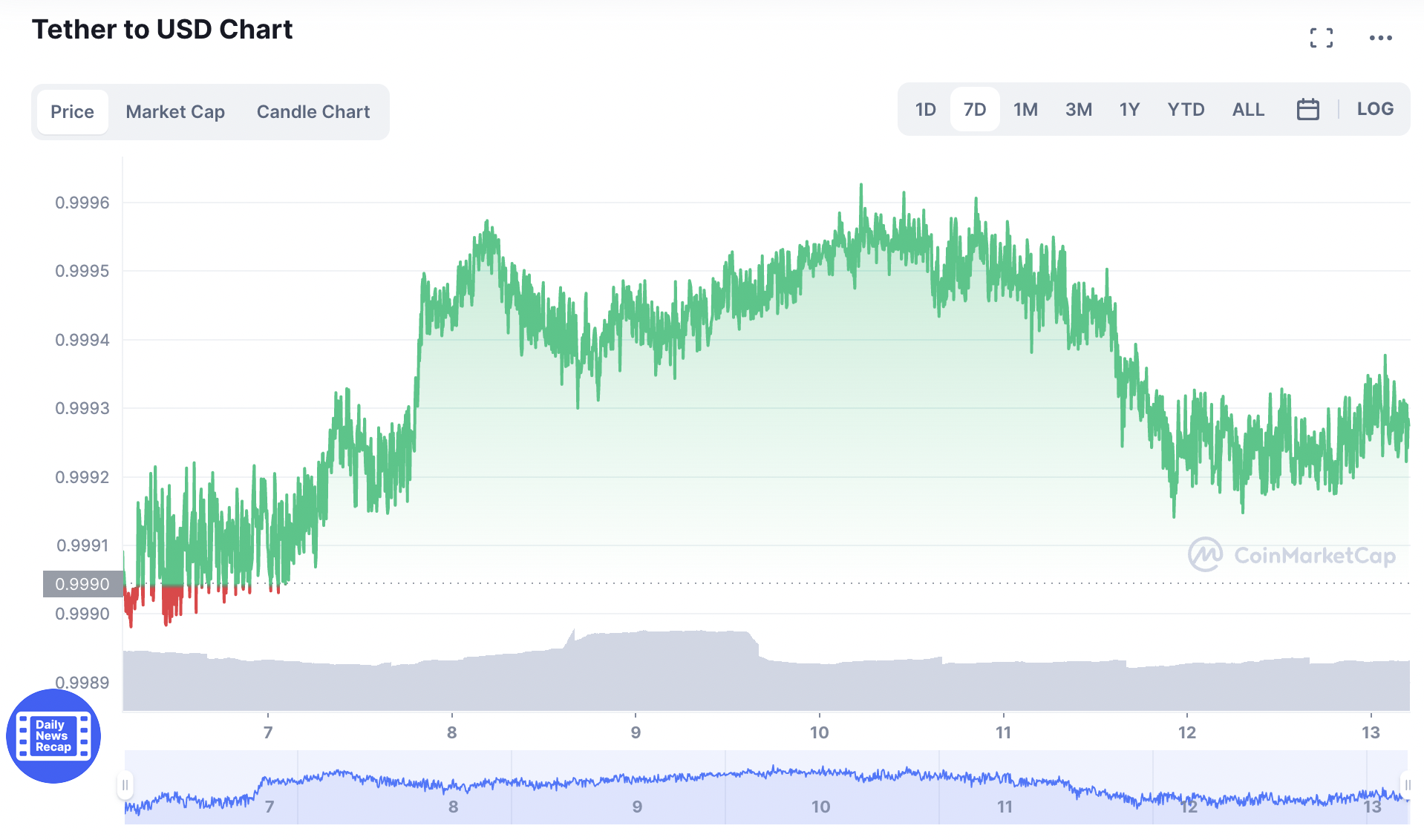

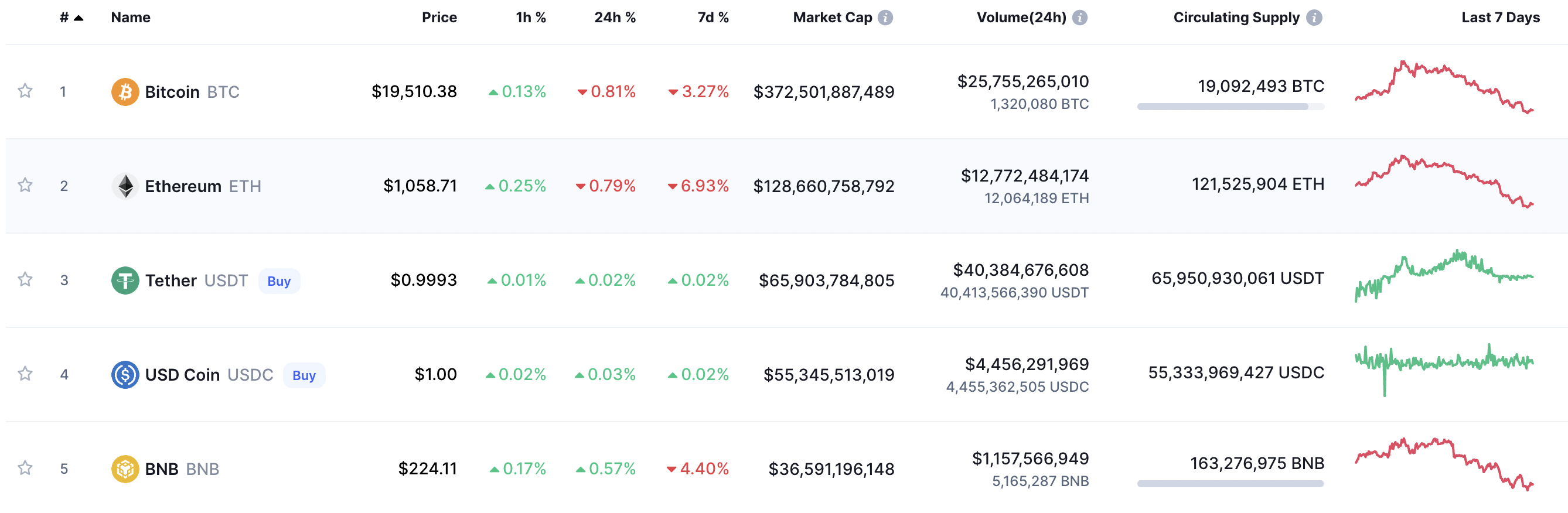

Tether – more commonly referred to as USDT, is a stablecoin pegged to the US dollar. This means that in theory, for every one USDT held, this can be exchanged for one USD. While this stablecoin has experienced the occasional de-pegging, USDT has largely remained solid.

Those wondering why a stablecoin pegged to the US dollar has made our list of the best crypto winter tokens should remember that this marketplace can be super-volatile. As such, risk-averse investors might choose to sit out trading days that appear more volatile than usual.

And, by holding USDT, this will enable the investor to enter and exit a market at the click of a button – without fear of liquidity issues. After all, USDT often attracts more trading volume than any other digital asset in this space – including Bitcoin.

For example, in the 24 hours prior to writing, USDT and Bitcoin have attracted approximately $40 billion and $26 billion in trading volume respectively. Another reason that USDT is one of the best stablecoins to earn interest on during the crypto winter.

There are many third-party platforms that support Tether interest accounts, some of which offer attractive interest rates. For example, when meeting certain conditions, Crypto.com offers an optimized APY of 7.20% on USDT deposits.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

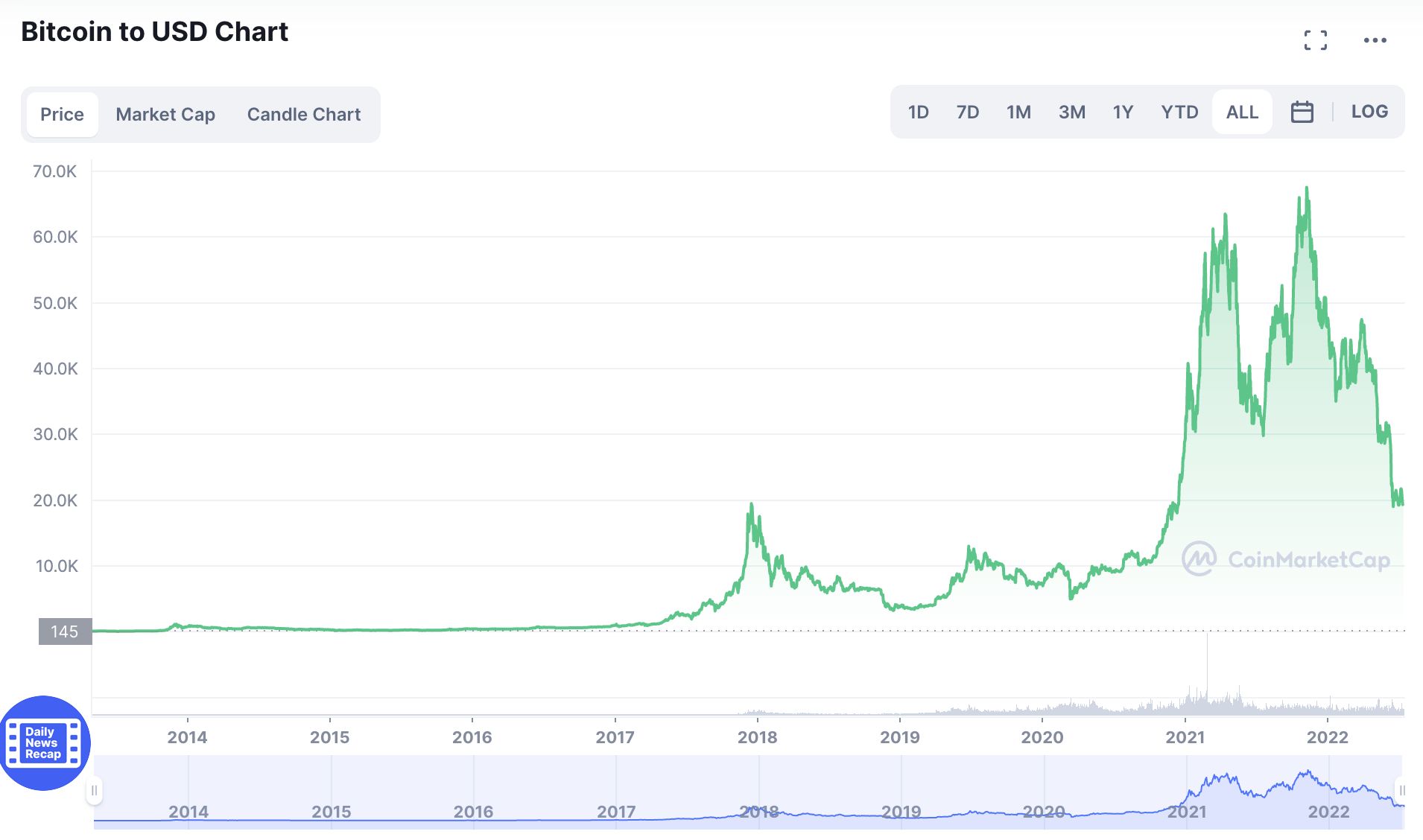

While the likes of Battle Infinity, Lucky Block, and DeFi Coin each should be classed as growth tokens for the sizeable upside potential they offer, all investment portfolios require stability. And at the forefront of this in the crypto space is Bitcoin.

Launched in 2009, Bitcoin is the first and largest crypto token in this market. Even those who are new to crypto are likely to have heard of Bitcoin and the token is even represented by a fully-fledged futures market on Wall Street.

However, much like the vast bulk of other crypto tokens, Bitcoin has also witnessed a major trend shift in 2022. Towards the close of 2021, Bitcoin peaked at an all-time high of over $68,000. Since then, Bitcoin has dropped below the all-important $20,000 level.

However, proponents of Bitcoin will argue that this is just a result of a much broader market correction. After all, Bitcoin went from $5,000 to $68,000 in a prolonged run of form that lasted almost 18 months.

As such, like any other overheated asset class, Bitcoin had to at some point enter a sizable correction – as it has done many times before. Crucially, those adding Bitcoin to an investment portfolio at the $20,000-ish level will secure a discount of 70% from the prior high.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

The best coins to invest in during the crypto winter are those that offer a product or service that is proprietary. Moreover, this should offer an innovative solution to a real-world problem. In this regard, Cosmos is well worth considering.

In a nutshell, the Cosmos business model is that of blockchain interoperability. This is a term that refers to the ability for two or more blockchain networks to ‘speak’ with one another. This is something that was previously not possible.

But, when blockchains partner with Cosmos, cross-chain transactions are entirely feasible. A simplistic example of this is a Bitcoin transaction appearing on the Ethereum network, or BNB data being exchanged with XRP.

Either way, Cosmos and its underlying interoperability solutions has the potential to take the blockchain revolution to the very next level. Cosmos, like all blockchain networks, is also behind a solid crypto token – ATOM.

According to data extracted from CoinMarketCap, ATOM was first launched to the public in 2019 at a cost price of $7.50. In early 2022, Cosmos hit a 52-week high of nearly $45. This means that in less than three years of trading, ATOM increased in value by almost 500%.

While this does not represent above-average gains when compared to the broader market, this is because Cosmos is still firmly within the development stage. Therefore, the ATOM token should be viewed as a long-term investment.

In terms of pricing, the crypto winter has resulted in ATOM dropping to 52-week lows of $5.59. This means that when compared to its prior 2022 price, ATOM can be purchased at a sizable discount of over 85%.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

After Bitcoin, Ethereum is the world’s second-largest digital asset for market capitalization. Founded in 2015, Ethereum has revolutionized how transactions are executed, insofar that its blockchain framework supports smart contracts.

In their most basic form, smart contracts allow users from all over the world to engage in agreement without there needing to be an element of trust. This is because smart contracts are only executed when the underlying code has been triggered.

On the one hand, there are many other smart contract projects now in the market – some of which are referred to as ‘Ethereum Killers’. Moreover, many of these competitors offer faster and more scalable transactions.

However, Ethereum dominates the smart contract industry by a considerable amount. This is fully supported by the many thousands of crypto tokens that operate on top of the Ethereum blockchain.

Notable examples here include Decentraland, Shiba Inu, the Graph, the Sandbox, DAI, and more. Crucially, projects prefer Ethereum for the reputation that it has for quality over quantity. This is why it has taken so long for the much-anticipated ETH 2.0 upgrade.

Once the upgrade does come to fruition, this could result in other smart contract platforms becoming redundant. After all, the expectation is that Ethereum will go from a maximum of 15/16 transactions per second to over 100,000.

Furthermore, ETH 2.0 is expected to resolve the platform’s high transaction fee problems. In terms of performance, Ethereum has increased in value by over more than 8,700% since it was launched.

However, when compared to its prior peak of nearly $5,000, Ethereum has since hit lows of under $1,000 in 2022. As a result, those buying Ethereum for the very first time at current pricing levels have an 80% discount on offer.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

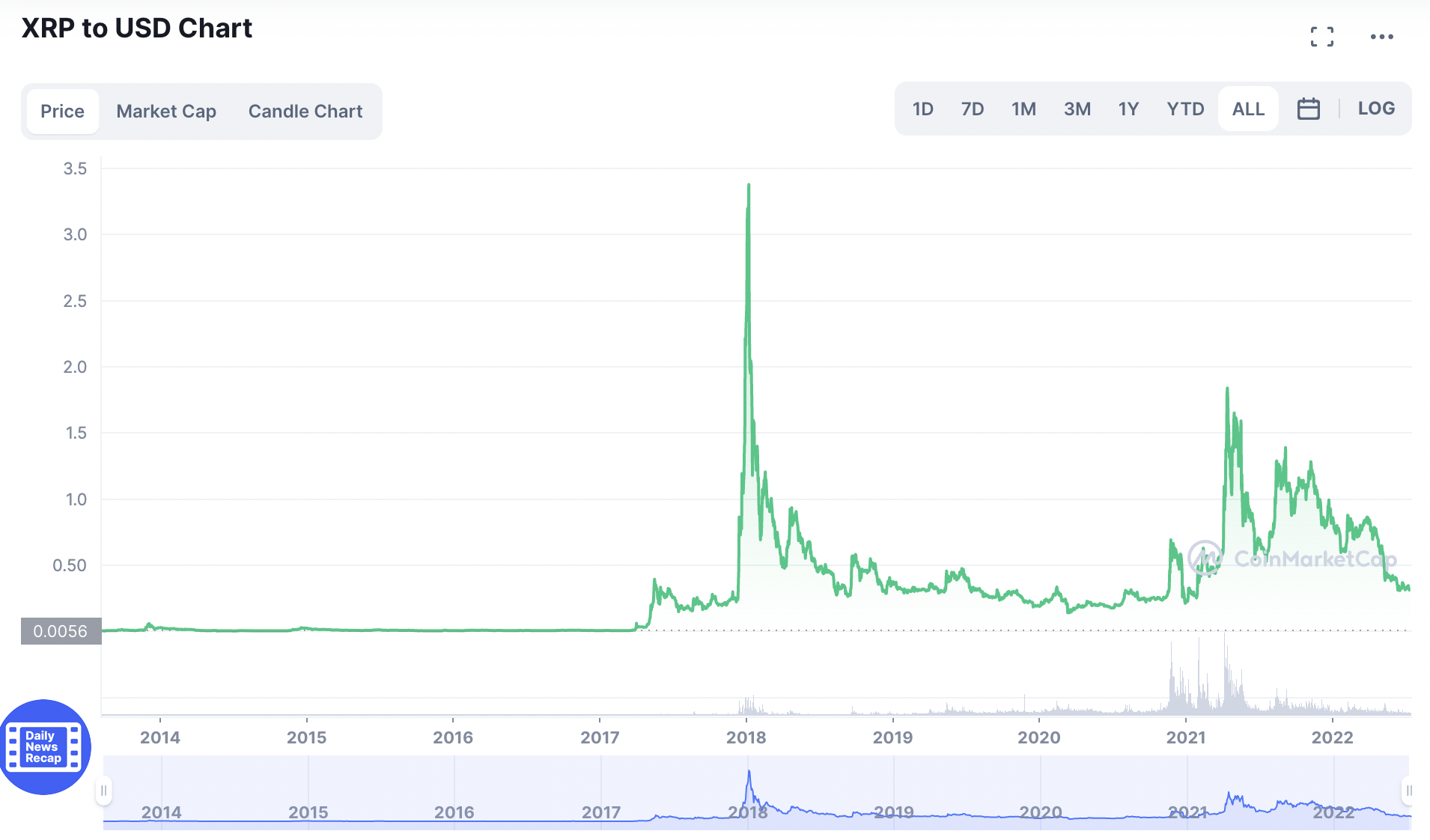

Just like Cosmos, Ripple is behind proprietary blockchain technology that solves real-world issues. In this case, Ripple offers a solid framework for large banks to transact on a cross-border basis across competing currencies.

Currently, the interbank industry is still dominated by SWIFT – which is a centralized third party that connects financial institutions from all over the world. However, not only is SWIFT expensive and fraught with red tape, transactions can be extremely slow.

Furthermore, when financial institutions from emerging countries wish access to the SWIFT network, this often requires the use of correspondent banks. In comparison, Ripple enables banks to transfer funds in a matter of seconds.

The average transaction cost is just $0.02 and this is the case regardless of how much capital is being transferred. Perhaps most innovatively, Ripple provides instant liquidity for banks in emerging countries that wish to transfer low-demand currencies.

It does this via its native digital token – XRP. It remains one of the most valuable crypto projects by market capitalization, albeit, its value has also plummeted as a result of the current bear market.

As of writing, XRP is trading at the $0.30 level. This is a far cry from its 52-week high of $1.41. On the flip side, the benefit here for investors is that it is possible to buy XRP at a discount of nearly 80%. As such, it’s one of the best crypto winter tokens to consider today.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

Uniswap is a popular decentralized exchange that has been built on top of the Ethereum blockchain. This project – which allows users to trade crypto tokens without a third party, utilizes an innovative automated market maker (AMM) model.

In a nutshell, the AMM model ensures that traders have access to a fully-functioning market without the need to use a traditional order book. Instead, real-time token pricing is determined by a variety of metrics – such as market capitalization, volume, depth, and more.

Uniswap also offers a variety of decentralized financial services. This includes the ability to lend out funds in return for an attractive APY. Users can also utilize Uniswap to borrow capital against their current crypto holdings.

Uniswap has since facilitated more than $1 trillion in trading volume across more than 102 million positions. As such, it is one of the most sought-after exchanges for decentralized trading.

The Uniswap ecosystem is backed by its native digital currency – UNI. This crypto token, as per CoinMarketCap, was first launched in 2020 at a cost price of just under $7. The UNI token has since gone on to hit heights of over $43.

However, those investing during the crypto winter market have the chance to grab a much lower valuation of $5-ish. This means that from its prior all-time high, UNI is trading at a discount of nearly 90%.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

BNB is the native digital currency of the Binance exchange, which, incidentally, is by far the largest platform of its kind. For instance, in the prior 24 hours to writing, the Binance exchange has facilitated more than $10 billion in trading volume.

The next largest exchange in terms of volume managed just over $1.5 billion over the same period. Those buying and holding BNB tokens will have access to a 25% discount on Binance trading fees. Binance has since expanded the use case of BNB.

At the forefront of this is the Binance Smart Chain, which is often the go-to network for newly launched projects. When users buy and sell tokens listed on this network, fees must be paid in BNB.

Furthermore, tokens on the Binance Smart Chain are paired with BNB, so again, this ensures that the token remains in demand. Another thing to note about BNB is that it has generated unprecedented returns since it was launched in 2017.

According to data extracted from CoinMarketCap, this amounts to growth of over 608,000%. This is even more impressive considering that when compared to its prior all-time high before the crypto winter, BNB is trading at a discount of over 65%.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

The crypto winter is a term used to describe a digital asset bear market. This means that there is a prolonged period whereby the broader crypto markets decline in value.

The overarching reason for this is that market sentiment is weak, which results in a major sell-off. In turn, trading volumes decline, and ultimately, portfolio values suffer. However, it is important to recognize we have witnessed several crypto winters in the past.

The same could happen again this time around, albeit, nobody quite knows. Nonetheless, the most important thing to remember is that Bitcoin, alongside many other digital currencies, survived the most recent crypto winter.

This time around, it is hard to imagine the same thing failing to happen again. However, crypto investors should be prepared for more collapses in addition to what we have already seen.

This is inclusive of Terra Luna and Terra USD, as well as the likes of Celcius suspending account withdrawals. As a result, while the best crypto winter tokens offer the chance to invest at a huge discount, this market cycle is still very risky.

It is also important to note that the broader crypto market will move in tandem. That is to say, during a crypto winter, the vast majority of tokens will witness a decline in valuation. The same can be said during bullish markets – but in reverse.

Crypto winters and bear markets offer both opportunities and risks. On the one hand, there will always be casualties during bear markets, and this is not exclusive to crypto.

On the contrary, in the traditional stock markets, many large-cap stocks have ceased to exist after a broader recession.

In recent times, this includes the likes of the Lehman Brothers. As noted earlier, the same happened to Terra Luna and Terra USD – both of which have since lost more than 99% of their value.

In addition to established tokens like Bitcoin and Ethereum, it is also worth looking out for undervalued growth stocks with a solid business model.

For example, Battle Infinity is building a crypto ecosystem that not only offers players rewards via a fantasy sports game in conjunction with the metaverse, but also a DEX and the ability to earn NFTs.

Ultimately, when investing in crypto tokens during a market crash, it is wise to diversify across multiple projects. This will reduce the risk of loss, insofar that if one token does not quite recover, there is every chance that the rest of the portfolio will perform well.

Those that have never previously experienced a crypto winter might need some tips on how to strategize for maximum gains.

Below, we offer some insight into how to take advantage of the current crypto bear market.

Dollar-cost averaging (DCA) is perhaps the best strategy that an investor can take during the crypto winter. This is a classic investment strategy that aims to reduce the risk of being overexposed to a single cost price.

This means that instead of investing one lump sump into a crypto token, it is more risk-averse to buy at smaller amounts, but at fixed, regular intervals.

On the other hand, had the investor opted to allocate the entire $10,000 and they paid a price of $20,000 per Bitcoin, in the following month they would have been looking at losses of 50% – with no further capital available.

In addition to DCA, another tried and tested strategy to take advantage of the crypto winter is to create a diversified portfolio.

This is why the 10 best crypto winter tokens that we discussed today are different from the next.

For example, while Battle Infinity is building a fantasy sporting game via the metaverse, DeFi Coin is involved in decentralized financial services.

Similarly, Cosmos offers blockchain interoperability solutions while XRP provides a framework for interbank transactions.

Ultimately, diversification is a risk-averse way to approach a bear market, insofar that it allows investors to buy cheap assets. But, at the same time, it protects the investor from being overexposed to a single niche market.

While prices continue to decline during a bear market, this isn’t to say that money cannot be made. On the contrary, the crypto winter is a great time to think about generating a yield on idle tokens.

Perhaps the best way to achieve this goal is via a staking tool. This means that the investor will deposit their crypto tokens into a staking smart contract for a fixed number of days.

Once the term concludes, the investor will receive their tokens back – plus interest. As a prime example, DeFi Swap offers an APY of 75% when staking DeFi Coin for 12 months.

Make no mistake about it – leverage can be a risky tool even during a bull market. However, the risks are amplified considerably during a crypto winter.

The key reason for this is that crypto prices are even more volatile than normal. This means that there is an increased risk that the leveraged position will become liquidated.

If this happens, the investor will lose their entire stake – sometimes more if the platform does not offer negative balance protection.

As a result, investors are advised to avoid leverage at all costs when the markets are bearish.

The 10 best crypto winter tokens to buy right now have been ranked and analyzed in this market insight.

In addition to DeFi Coin and Lucky Block, we found that Battle Infinity is one of the most undervalued tokens to consider purchasing today.

Battle Infinity is building a metaverse gaming ecosystem with a focus on fantasy sports drafts. Users can win IBAT tokens and even NFTs for progressing through the game.

As of writing, the project is still offering access to its IBAT token via a presale launch that comes with preferential pricing for early-bird investors.

Your capital is at risk. Crypto asset investments are highly volatile and speculative.

Crypto winter is another term to describe a bear market. Just like in the traditional stock markets, a crypto winter will result in a prolonged decline in token valuations. The prior crypto market began in late 2017 when Bitcoin hit a then all-time high of $20,000. It wasn’t until late 2020 that Bitcoin regain its prior peak. As such, the crypto winter lasted for nearly three years.

It is more of a probability than a possibility that the crypto winter has arrived. Consider that Bitcoin was priced at nearly $69,000 in late 2021, only to drop to lows of $20,000 just six months later. This amounts to a decline of over 70%. In addition to Bitcoin, pretty much the entire crypto market is down by a considerable amount in 2022.

Crypto winters can last anywhere between a few months and several years. As a result, there is no knowing when the markets will recover. This is why the best way to approach a crypto winter is to dollar-cost average and ensure that portfolios are well diversified.

The crypto winter prior to the one we are currently in began in late 2017 and concluded in late 2020. Therefore, the most recent crypto winter lasted for three years. However, this does not mean that the current crypto winter will last this long. How long, though, remains to be seen.

This article was written for Business 2 Community by Kane Pepi.

Learn how to publish your content on B2C

Kane Pepi is an experienced financial and cryptocurrency writer with over 2,000+ published articles, guides, and market insights in the public domain. Expert niche subjects include asset valuation and analysis, portfolio management, and the prevention of financial crime. Kane is particularly skilled in explaining complex financial topics in a user-friendly… View full profile ›

Join over 100,000 of your peers and receive our weekly newsletter which features the top trends, news and expert analysis to help keep you ahead of the curve

Note that the content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This website is free for you to use but we may receive commission from the companies we feature on this site.