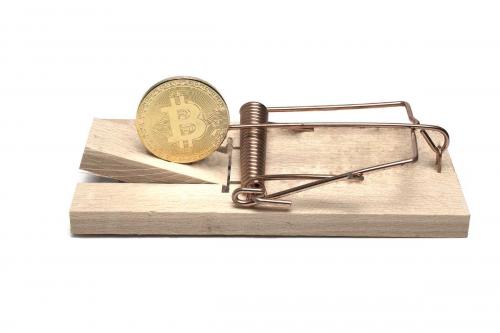

In the wake of the drawn out cryptocurrency market downturn, increased regulation of the sector seems inevitable. With nearly one million Australians transacting in cryptocurrencies last year, there have been widespread calls to enact additional protections for retail investors.

This table outlines key regulatory developments from Australian financial regulators on possible treatment of crypto-assets.

Regulator

Current Work

Timeline

Treasury

Considering the introduction of new licensing and custody requirements for businesses providing services related to crypto-assets (such as exchanges and other intermediaries).

Public consultations recently concluded. Any reforms are likely to include a substantial transition period for existing operators

ACCC

Establishing mechanisms that allow ACCC to take action under Australian Consumer Law to protect consumers.

Ongoing

APRA

Preparing an internationally aligned prudential framework on crypto-assets and related activities.

Effective by 2025

ASIC

Continues to apply the current regulatory regime, awaiting any developments from Treasury.

See above

RBA

Reviewing the introduction of a Central Bank Digital Currency.

Ongoing

The key priorities for regulators appear to be the protection of consumers, maintenance of a fair and efficient financial system (including in respect of crypto-assets), and the promotion of innovation and foreign investment in Australia. Accordingly, the Financial Services Minister, Stephen Jones, has recently suggested that the new government will be reviewing crypto regulation as part of the larger digital payments system overhaul.

The key challenges for regulators will be delivering on these contrasting and somewhat competing objectives. The existing framework for financial markets is unlikely to translate well into crypto exchanges. A more tailored approach will be necessary in order to deliver on both the consumer protection and competition aims.

The Council of Financial Regulators has also explicitly advised banks against de-banking the crypto space and recognised the importance of a robust regulatory framework for this market. Further, in its first interim report on financial services legislation reform, the Australian Law Reform Commission briefly recognised cryptocurrencies as a new market in Australia.

With more Australians exposed to this volatile sector than ever before, there is no doubt that crypto-assets are now part of the mainstream financial system (and perhaps less uncorrelated as was once thought), and many organisations see benefits in applying more traditional regulatory supervision to this asset class.

The last few months of crypto volatility has been instructive – showing that market risks are real and cannot be ignored.

About this Author

Mr. Knight is a commercial and regulatory lawyer with a focus on the financial services industry. He advises a range of wholesale and retail fund managers, banks, financial advisers, superannuation fund trustees and other financial services firms.

Mr. Knight concentrates on commercial transactions in the industry and on advising clients about Australian licensing, disclosure, and compliance obligations. He regularly advises international fund managers about offering their products in Australia.

Mr. Knight also has…

Kithmin Ranamukhaarachchi is a Melbourne based lawyer at K&L Gates in the Asset Management and Investment Funds (AMIF) team. He has experience assisting fintechs and superannuation funds on regulatory and compliance matters, including advising on Consumer Data Right (Open Banking).

Kithmin joined K&L Gates in 2021 and rotated through the AMIF, Finance and Health Care and FDA teams during his graduate year.

You are responsible for reading, understanding and agreeing to the National Law Review’s (NLR’s) and the National Law Forum LLC’s Terms of Use and Privacy Policy before using the National Law Review website. The National Law Review is a free to use, no-log in database of legal and business articles. The content and links on www.NatLawReview.com are intended for general information purposes only. Any legal analysis, legislative updates or other content and links should not be construed as legal or professional advice or a substitute for such advice. No attorney-client or confidential relationship is formed by the transmission of information between you and the National Law Review website or any of the law firms, attorneys or other professionals or organizations who include content on the National Law Review website. If you require legal or professional advice, kindly contact an attorney or other suitable professional advisor.

Some states have laws and ethical rules regarding solicitation and advertisement practices by attorneys and/or other professionals. The National Law Review is not a law firm nor is www.NatLawReview.com intended to be a referral service for attorneys and/or other professionals. The NLR does not wish, nor does it intend, to solicit the business of anyone or to refer anyone to an attorney or other professional. NLR does not answer legal questions nor will we refer you to an attorney or other professional if you request such information from us.

Under certain state laws the following statements may be required on this website and we have included them in order to be in full compliance with these rules. The choice of a lawyer or other professional is an important decision and should not be based solely upon advertisements. Attorney Advertising Notice: Prior results do not guarantee a similar outcome. Statement in compliance with Texas Rules of Professional Conduct. Unless otherwise noted, attorneys are not certified by the Texas Board of Legal Specialization, nor can NLR attest to the accuracy of any notation of Legal Specialization or other Professional Credentials.

The National Law Review – National Law Forum LLC 3 Grant Square #141 Hinsdale, IL 60521 Telephone (708) 357-3317 or toll free (877) 357-3317. If you would ike to contact us via email please click here.