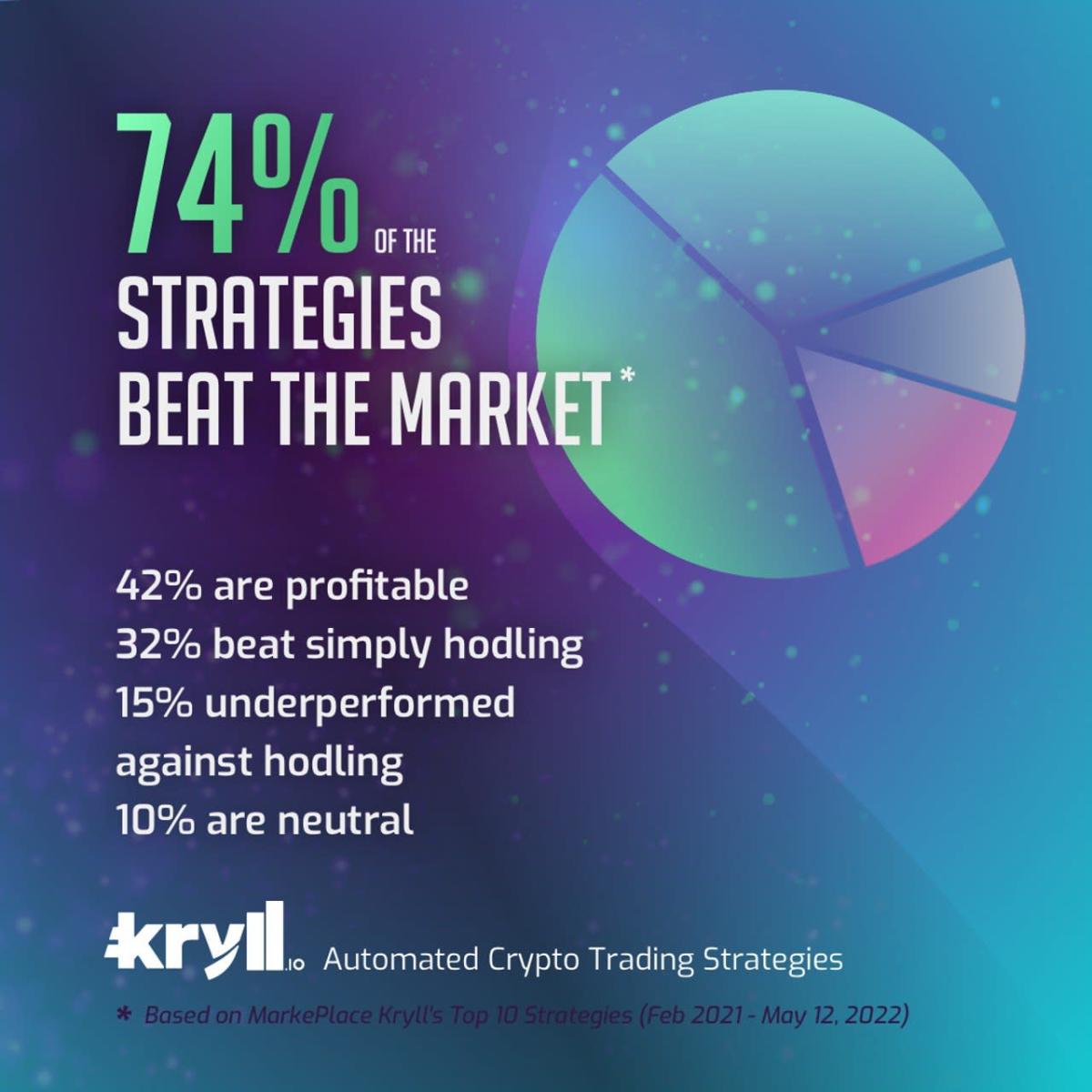

74% of platform’s trading strategies generate profits or outperform simply hodling.

PARIS, FRANCE / ACCESSWIRE / July 5, 2022 / Despite the crypto bear market, automated crypto trading strategies building platform Kryll.io has just broken past 100,000 registered users and challenges the ethos of “hodling” as its strategies outperform the market.

In a down market like we’ve seen in recent months, most crypto traders wind up losing funds. However, Kryll offers traders an edge that could help turn the tables. According to recently compiled data, most Kryll traders are outperforming retail traders. Seventy-four percent of Kryll.io’s strategies have either been profitable, or outperformed simply hodling.

Kryll makes this possible through its large community of strategy publishers who have automated some of the best crypto trading strategies on the platform. Kryll’s trading bots are used, reviewed, and commented on by the Kryllian community, who advise users on which strategies work with which pairs and provide insights into market conditions.

It has an expanding international team, and has been in talks with partnering with some of the biggest names in crypto. Recently, Kryll has been expanding into providing its automation service to traditional finance players as well as integrating into decentralized exchanges.

The Kryll platform allows users to safely connect their exchange accounts through an API from one place in order to manage their trades more efficiently, without taking custody of the users’ funds. Kryll users no longer have to spend time connecting separately to Coinbase, FTX, Binance, Kucoin and so on to manage trades, instead they can do it securely from one place. Once Kryll integrates with traditional finance and Web3 DEX’s, it will become a secure, one-stop-shop for trading and managing funds.

Kryll’s recently-released Marketplace V2 allows users to find and filter through hundreds of trading bots based on their risk profile, profitability, investment horizon and trading history. Users can then choose a bot whose trades they wish to copy and then easily automate their portfolios. Kryll offers options and day-trading strategies designed for both crypto newbies and pro traders who are looking for an edge.

The platform has been actively adopted and integrated by some of the largest exchanges in the industry. Its popularity is due in part to its ability to maximize trading volume through automation, offering consistency and peace of mind to traders.

About Kryll.io

Since launching its ICO in 2018, Kryll.io has seen more than $4 billion traded using automated strategies available on its platform. Users have nearly 300 verified strategies to copy trades from, and the platform recently surpassed 100,000 registered users. Kryll offers a professional marketplace and a community of experienced traders who are ready to offer their insights about individual investments and market conditions as a whole. According to recent internal research, 74% of Kryll.io’s trading strategies either generated profits or outperformed simply hodling, even in the recent crypto bear market.

CONTACT:

support@kryll.io

Telegram

SOURCE: Kryll

View source version on accesswire.com:

https://www.accesswire.com/707300/Automated-Crypto-Strategies-Building-Platform-Kryllio-Surpasses-100000-Registered-Users

The tech billionaire keeps plowing millions into this asset class.

Anyone positioning their portfolio for a recession could be making a big mistake.

Now that we’re into the second half of 2022, with the Independence Day holiday behind us, we can take stock of the changes that the last six months have brought. And those changes have been dramatic. As this year got started, the S&P 500 was coming off of a 27% annual gain. Today, the index is down 20%, putting it into a bear market. The losses have been broad-based, and have left many otherwise sound equities languishing at low prices. It’s a circumstance that has a lot of unhappy investors won

(Bloomberg) — Bridgewater Associates posted a 32% return for its flagship hedge fund through the first half of 2022 as it benefited from increased market volatility, according to a person familiar with the performance.Most Read from BloombergNatural Gas Soars 700%, Becoming Driving Force in the New Cold WarCiti Says Oil May Collapse to $65 by the Year-End on RecessionOil Plummets Below $100 as Recession Risks Come to ForefrontUS Wants Dutch Supplier to Stop Selling Chipmaking Gear to ChinaUkrai

Yahoo Finance Live anchors discuss Mark Zuckerberg's economic warning to Meta employees, the average monthly care payment crossing the $700 mark, and AMC announcing $5 Tuesdays through the end of October.

For high-growth, profit-less growth stocks, bad news on the economy could be good news for their shares.

Shares of Ford (NYSE: F) were falling today after the company reported second-quarter vehicle-sales results. While vehicle sales increased 1.8% over the period to 483,688, they fell far short of analysts' average estimate for an increase of 4.2% from the year-ago quarter. Ford filed its latest vehicle-delivery figures with the SEC today, and the company reported a 31.5% increase for its June deliveries, year over year.

The first half ended last week, and the S&P 500 is now firmly stuck in a bear. The rapid change from record high levels at the end of last year, to a 20%+ drop in these past six months has pummeled investors, who have had to cope with shrinking share values, increased volatility, and an unpredictable and risky equity environment. The most serious issue facing economists and traders right now is the possibility of recession in the near term. The US GDP contracted by 1.6% in Q1, and preliminary da

Now that we’re into the third quarter, we’re stating to see the pundits sound off on what the Q2 economic data will show – and some of them are openly saying that second quarter GDP will record a contraction. Coming on the heels of the 1.6% contraction in Q1, this will put the US in a technical recession. Along with rising inflation and the Fed’s turn to higher rates and monetary tightening, this adds up a darkening economic picture. But Jim Cramer, the well-known host of CNBC’s ‘Mad Money’ prog

The Dow Jones fell despite Apple stock rising. Tesla stock rose despite disappointing delivery data. A Warren Buffett stock fell.

He also predicts a ‘more significant pullback’ if this one thing happens.

Apple and other techs led a big rally off morning lows as oil prices and bond yields dived. Markets see Fed rate hikes ending this year.

Insiders buy shares for only one reason: they think the price is going up.

In this article, we discuss the 10 best monthly dividend stocks to buy in July. You can skip our detailed analysis of dividend stocks and their past performance and go directly to the 5 Best Monthly Dividend Stocks to Buy in July. The emergence of dividend investing opened new avenues for income and corporate investors […]

With the year’s first half done and dusted, companies will now begin dialing in the latest quarter’s financial statements. Next month, Alibaba (BABA) will deliver its earnings report for first quarter of fiscal year 2023 (June quarter). In recent times, the slowing demand amongst consumers, rising competition and the uncertain macro picture have all impacted Alibaba’s top-line. In fact, 4QF22 amounted to the slowest quarterly revenue growth since the Chinese ecommerce behemoth became a public en

Some storm clouds are appearing on the horizon for Tesla bulls after a respectable second quarter.

In this article, we discuss 10 best buy-the-dip consumer stocks to consider. If you want to see more stocks in this list, check out 5 Best Buy-The-Dip Consumer Stocks to Consider. Consumer stocks have lost about $1.8 trillion in market value so far in 2022, according to a recent Bloomberg report. This comes in light […]

Shares of PayPal Holdings (NASDAQ: PYPL) fell 18% in June, according to data provided by S&P Global Market Intelligence. The stock's movements completely correlated with the moves of other financial-technology (fintech) stocks during the month, showing that investors aren't interested in stocks like PayPal right now. For the fintech sector, you could look at The Global X FinTech ETF (NASDAQ: FINX), in which PayPal stock has a nearly 6% allocation.

In this article, we discuss the Dow 30 stocks and their rank according to the 2022 hedge fund bullishness index. If you want to skip our review of these stocks and the latest market situation, go directly to 15 Dow Stocks Listed and Ranked By 2022 Hedge Fund Bullishness Index. The Dow Jones Industrial Average, […]

(Bloomberg) — The US economy is firmly in the middle of a slowdown that’s turning out to be worse than expected amid the war in Ukraine and China’s Covid Zero policy, according to Morgan Stanley strategists.Most Read from BloombergPerson of Interest in July 4 Parade Shooting That Killed Six in Police CustodyBezos Slams Biden Over Call for Lowering of Gas PricesTesla Pauses Plants After Ending Shaky Quarter With a Production MilestoneNatural Gas Soars 700%, Becoming Driving Force in the New Cold