Where is the market heading? Come to DAS to hear from the industry’s leaders

The fourth annual NFT.NYC conference gathered thousands of Web3 and crypto enthusiasts in New York City last week

From Snoop Dogg impersonators walking around Times Square to staged anti-NFT protests, the NFT.NYC conference was designed to market Web3 brands and convene as many people as possible in the Big Apple.

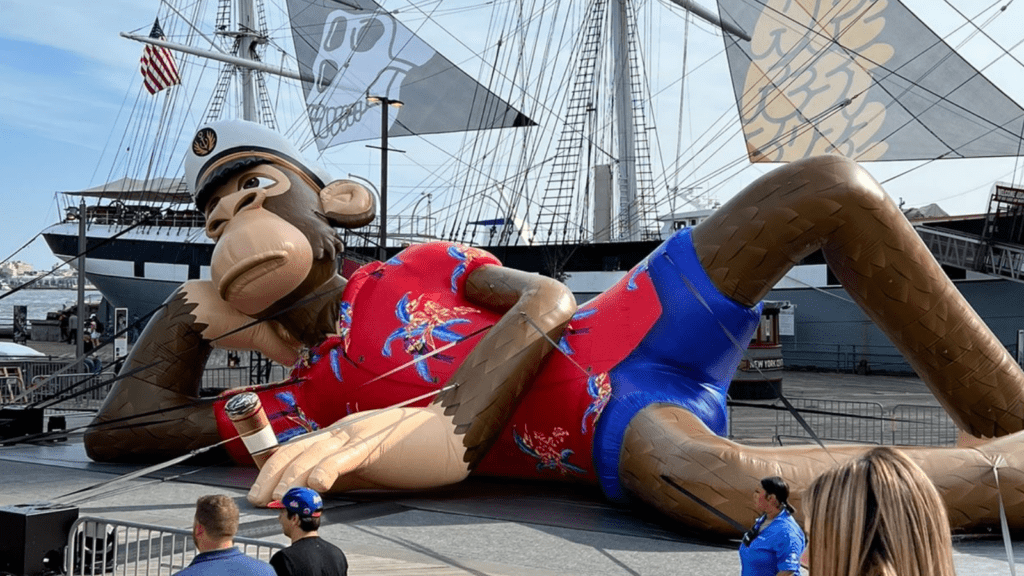

Members from top-tier communities such as Bored Ape Yacht Club and Doodles showed up in full force to one of the largest NFT (non-fungible token) events.

Bored Ape Yacht Club (BAYC) hosted the members-only ApeFest jamboree at Pier 17 with appearances from comedian Amy Schumer and performances from rappers Eminem and Snoop Dogg, who also premiered a music video featuring their BAYC avatars.

The founders of BAYC-creator Yuga Labs on Friday published a letter on Medium in response to the backlash from a recent investigative video on YouTube called the Bored Ape Nazi Club that made conspiracy claims and accused the team of having cult associations.

Doodles further permeated pop culture with a real-life setup of the Doodles world and a number of announcements, including Doodles 2, an upcoming collection of animated profile picture NFTs. Pharrel Williams was also announced as the company’s new chief brand officer. The Doodles Dooplicator project, which was airdropped to holders in May, became the most traded project on OpenSea during the 48 hours following the news.

Title sponsors for NFT.NYC 2022 included blockchain network Polygon and crypto payments provider MoonPay, which debuted its own NFT minting service called HyperMint.

Throughout the event, Blockworks interviewed developers, collectors, founders and analysts. Here are some of the notable themes from the week.

Various companies are working to make the metaverse a reality, specifically a 3D interoperable open metaverse — this means bridging virtual worlds that serve as gamified social networks, and merging our physical and digital identities.

“The future we are fighting for involves breaking virtual walls and connecting the world,” said Timmu Toke, the chief executive officer of Ready Player Me, a platform that creates metaverse-ready avatars with a selfie that are compatible across apps and games.

Interoperability in the metaverse is comparable to an open free trade market “that isn’t controlled by anyone,” Toke said. And an open system is simply “better business.”

Avatars are the most important element to an open and scalable metaverse, according to Toke, and interoperable avatars will generate more sales of digital assets “because people will place more value on avatars that can be used everywhere, not just in one game.”

When it comes to digital identity, Danny Greene, the general manager of the MeebitsDAO, believes that identity is “not monolithic,” but rather fluid. “Expressing ourselves in the metaverse is distinctly different from the experience [in real life] where ingrained prejudices have a direct impact on how one is perceived,” he said.

“The avatar you choose, the wearables that you wear, the spaces you occupy are a signal about what is important to you, what you stand for,” Greene added.

Last week over 30 tech giants including Meta, Microsoft and Epic Games formed a standards organization called the Metaverse Standards Forum (MSF) to define the priorities and principles behind technologies created for the metaverse, including virtual reality and augmented reality.

When it comes to play-to-earn gaming, Grant Haseley, founder of play-to-earn crypto game Undead Blocks, said the future of play-to-earn games will depend on “shifting the paradigm from pointing and clicking and being able to earn decentralized yield farming.”

Esports tournaments and NFTs may give players the opportunity to win big, he said, but rewards should go to those who really want to be a member of the community.

“If you’re a top player, and you’re committed, driven and driving value back to those games and those ecosystems, then you should earn some rare assets.”

Dylan Bushnell, the vice president of game design for publisher Atmos Labs, spoke about the need for horizontal integration and the value of customization in blockchain gaming.

Blockchain games have done well when it comes to replicating collector mechanics, but they continue to attract only niche audiences, according to Bushnell, adding that gamers want to play in a universe that reflects whoever they want to be.

“Your identity within a game is only as meaningful as the amount of variation, as how much we empower you with customization” from performance to skins, Bushnell said.

He added that publishers need to give people the choice to make their characters or avatars that they’ve spent time building and competing with a part of their identity, without limiting performance.

There are multiple motivations to take out a collateralized NFT loan, from gaining leverage to be able to buy more NFTs to obtaining liquidity needed for some other purpose.

A big use case now during a bear market, according to Gabe Frank, the CEO at peer-to-peer NFT lending platform Arcade, is for NFT borrowers to hedge their NFT exposure.

Comparing taking out a loan on an NFT to buying a put option, Gabe explained that if the collateral value drops below the market value, “the borrower doesn’t need to pay back the loan. So you basically have the right to sell it. It’s a way to hedge downside risk.”

He also expects to see more defaults in the coming months and stated that lenders are steering clear of artwork NFTs, as opposed to PFPs or collectibles because they are less liquid. However, Frank is bullish on CryptoPunks: “The floor is going to be 10 million in 10 years.”

CryptoPunks’ floor is up from the low 50s in terms of ether during the week of the TerraUSD crash, to 66 ETH at the time of publication, although that represents a decline of around $10,000 in US dollars as the price of ether has fallen from $1,700 to $1,100 in the same period.

On the other hand, Stephen Young, CEO at rival peer-to-peer lending platform NFTfi, considers CryptoPunks to be artwork.

“The 10 million PFP projects that all launched at the same time are all just kind of falling through the floor. And people are rushing to the assets that are showing real value and staying power.”

Young believes CryptoPunks, as well as on-chain generative art such as Autoglyphs or Art Blocks collections such as Squiggles, Fidenza and Ringers, may appeal now more than ever to traditional art collectors given the adverse market conditions. $60,000 for a Punk is “all of a sudden actually affordable” to fine art collectors, Young said.

“First prices fall all the way along with [ether] until we get to the bottom, and then you’ll see quality projects start to rise in terms of ether prices again,” he added. “Because, at some point, they’re cheap.”

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.

Goldman Sachs analysts expect lower cryptocurrency trading volumes will drag Coinbase revenues down more than 60% this year

Executives at Celsius believe most users would prefer the troubled cryptocurrency lender avoid the uphill task of bankruptcy

A desire to work with the hacker still remains though the investigation into the theft continues until the matter is resolved, Harmony said.

The token will have a 20% yield, and, if the full amount of $47 million is raised, all CoinFLEX users will be able to withdraw their funds in full

The regulator is set to rule on the digital currency asset manager’s proposal to convert its bitcoin trust to an ETF by July 6

Author

Administraroot