![]() Mike “Mish” Shedlock’s

Mike “Mish” Shedlock’s

Sitka Pacific Capital Management,Llc

The entire crypto universe is crashing. I am told that I am an idiot for confusing Bitcoin with Crypto.

Image from Michael Saylor's Twitter Profile

The entire crypto market cap including Bitcoin is $834.54B as I type out. At it's peak, the entire space was worth $2.9 trillion.

I mentioned the words "crypto" and "bitcoin" in the same sentence the other day to be informed that I was an idiot for confusing the two.

The newly circulated idea of the day looks like this: 1 BTC = 1 BTC.

I have seen that in perhaps a hundred Tweets recently. Yes, truly genius. And one US digital dollar = one US digital dollar. They are all alike.

$1 = $1 is equally brilliant.

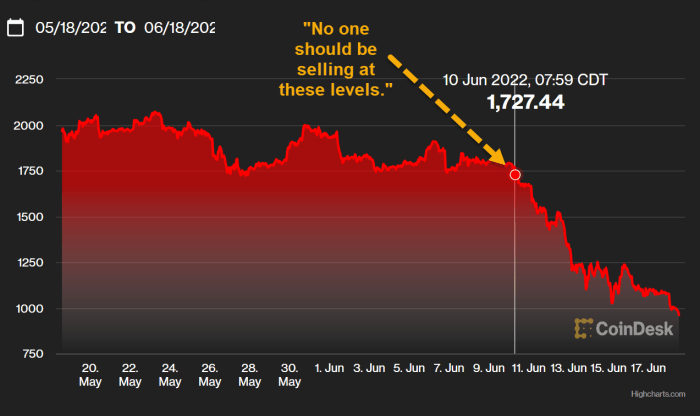

That is another one I heard repeatedly regarding Bitcoin when it fell from $69,000 to $50,000. I heard it again at $45,000, at $40,000, at $30,000, at $25,000, and at $20,000.

Clearly, it was not insane to sell at any of those prices.

But it was insane to tell everyone who sold that the sellers were insane.

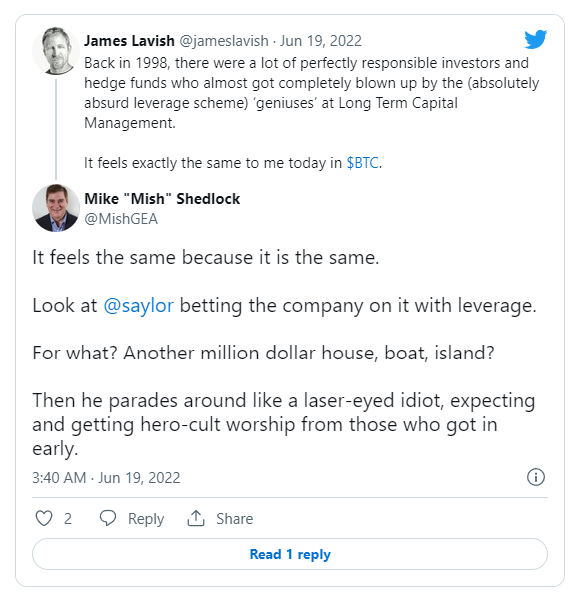

Last week on Twitter when I noted Saylor would get a margin call at $21,000 I was blasted in two different ways.

Several people Tweeted Bitcoin could not possibly dip below $20,000 because they have seen the order flows.

Damn, it seems the order flows did not care what those fools thought.

That brings to mind yet another meme I heard at lest 20 times on Twitter.

That's true of course, given that Bitcoin cannot think at all.

Here's another "brilliant" truism.

The Bitcoin does not care where Bitcoin believers think the price of Bitcoin is headed.

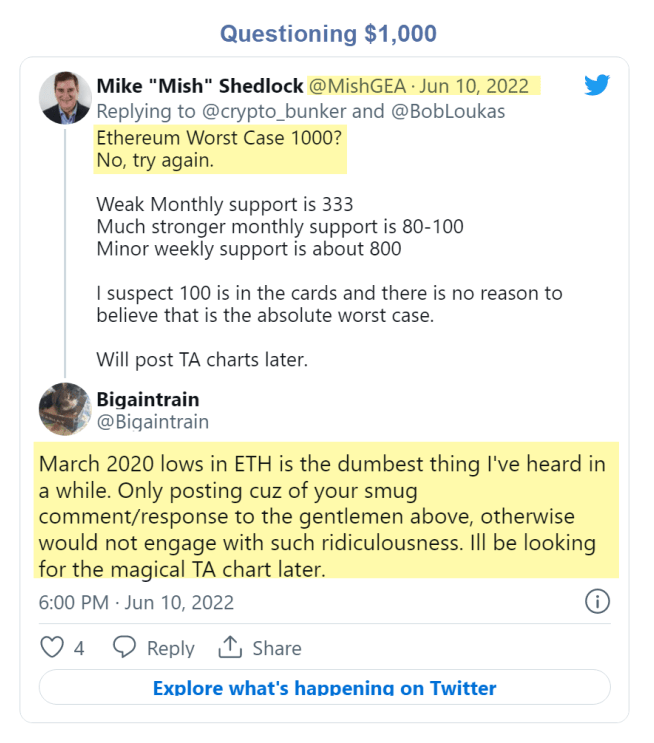

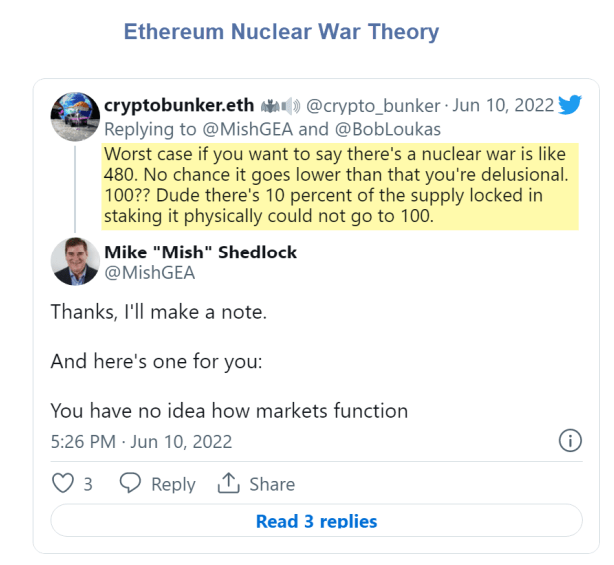

The Ethereum Nuclear War theory new worst case is $480.

I have to post captured images instead of Tweets because I have been blocked from reading these threads.

That's OK. I made notes.

But let's discuss this new idea. "Ethereum cannot go to $100 because of physical staking".

This guy clearly has no idea how markets work.

And a second irony is staking is one of the things contributing to the crash.

Please consider Staked Ethereum (stETH) Could Cause A Crypto Crash, Here’s How

Celsius, stETH, AAVE, Lido, and Ethereum are all in the mix.

Yet, I have countless Tweets all telling me why I am wrong and why whatever the hell they believe in is different.

The allegedly stable coin LUNA went to $0.

Many more are headed that way.

There's a big debate over margin calls. Judging from the number of inane Tweets I conclude most people have no idea what it means. Alternatively, those who know the least are the most vocal.

A margin call is triggered when someone has to post more margin as collateral for a loan drops.

A key margin call is in play because Microstrategy CEO Michael Saylor borrowed money, posting Bitcoin as collateral to buy more Bitcoin.

His average price is over $30,000.

I wrote about margin calls on May 8 in As Bitcoin Breaks Support, Bulls and Bears Pretend to Know the Unknowable.

Let's tune into what I said then.

There is no reason, fundamental or technical, for a bounce at the $32,000 level to hold. And if it doesn't, the next support is at the $19,000 level.

The $19,000 level is an interesting level because margin calls are in play.

The casino is clearly open folks, and MicroStrategy has morphed into a leveraged speculative play on Bitcoin. A margin call awaits at $21,000 with support at $19,000.

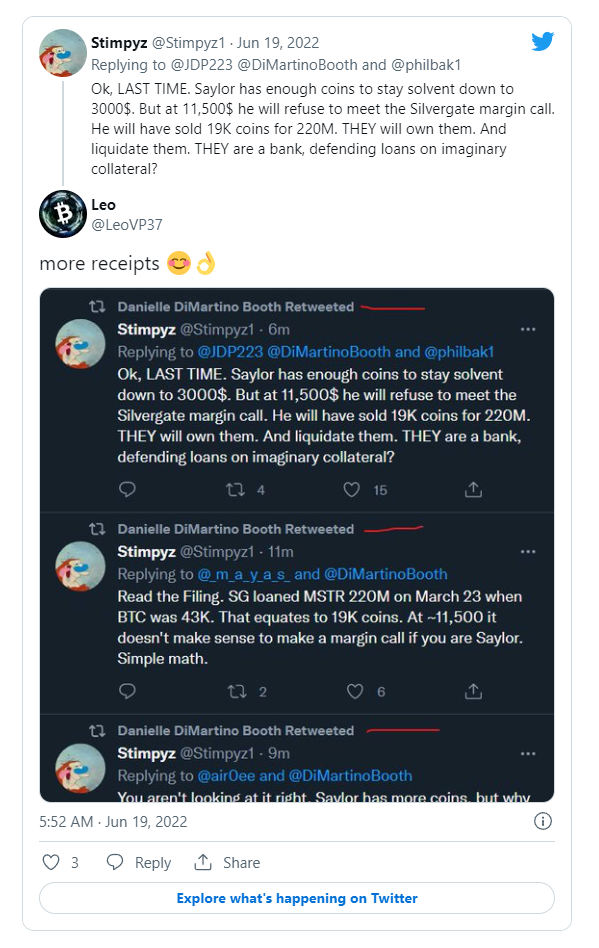

There was a margin call at $21,000 assuming the level given by the MicroStrategy CFO in a conference call was accurate.

Yet, despite that message from the company, countless people have said there is no margin call at that level because Saylor can keep pledging more and more Bitcoin as collateral all the way down to $3,500 (yet another level that allegedly "cannot" happen).

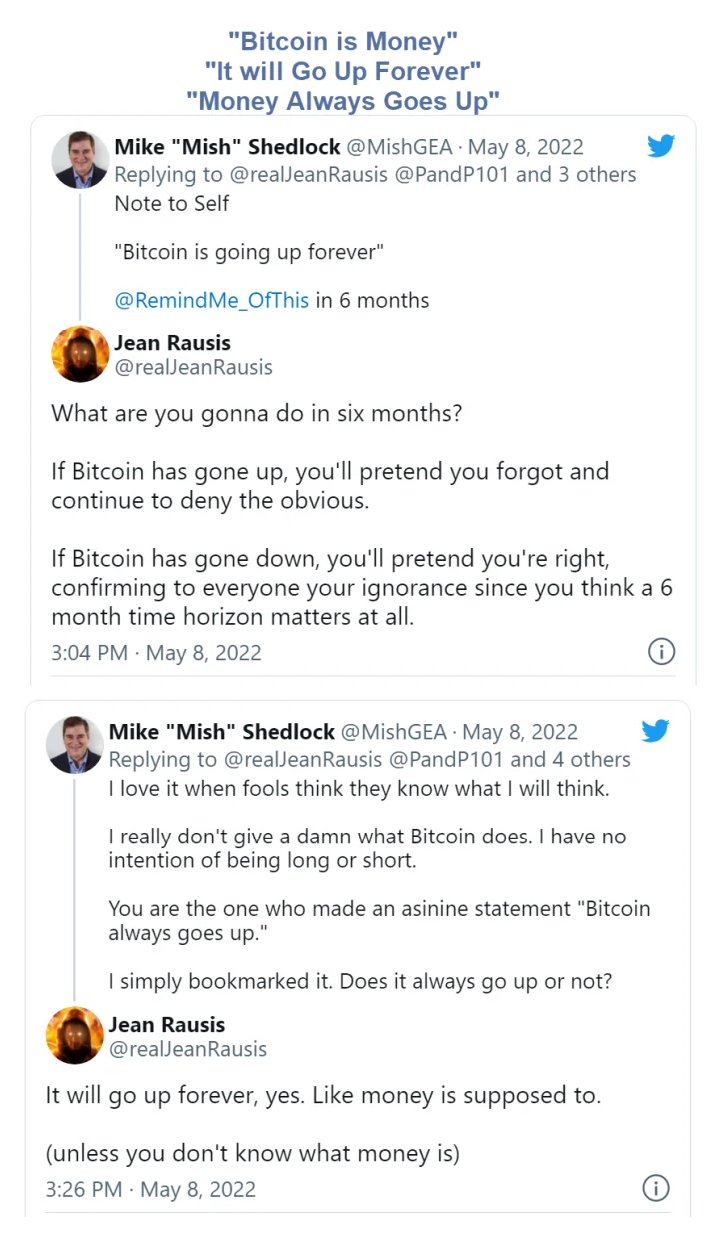

This triggered yet another ridiculous set of responses, this time from people who think they know what I think, what money is, and what money always does.

I cannot keep up with all the events. I do not know if it's even possible.

But I can tell you two trading platforms have halted withdrawals and anyone on those platforms is likely to be wiped out (lose everything or nearly everything).

Fortune reports A major crypto hedge fund is wobbling as $10 billion Three Arrows Capital Sees a Spate of Liquidations

After $400 million in liquidations, a major hedge fund in the space, Singapore-based Three Arrows Capital, or 3AC, is reportedly facing insolvency, and many dominos look likely to fall next.

Cryptocurrency lender BlockFi is among the most recent to liquidate some of 3AC’s positions, according to the Financial Times. BlockFi CEO Zac Prince confirmed its exit in a Thursday tweet: “BlockFi can confirm that we exercised our best business judgment recently with a large client that failed to meet its obligations on an overcollateralized margin loan. We fully accelerated the loan and fully liquidated or hedged all the associated collateral.”

Since then, others with exposure to 3AC have come forward. Finblox, a platform offering users up to 90% yield to deposit their cryptocurrency, reduced its withdrawal limits by two-thirds and cited its relationship with 3AC.

On Twitter, Deribit, a cryptocurrency derivatives exchange, claimed on Thursday that 3AC is a shareholder of its parent company, adding that Deribit has “a small number of accounts that have a net debt to us that we consider as potentially distressed.”

Danny Yuan, chief executive officer of cryptocurrency trading firm 8 Blocks Capital, also claimed to have been impacted by 3AC. “We trade in one of 3AC’s trading accounts. This morning they took about [$1 million] out of our accounts. I hope you pay us back asap,” he tweeted on Tuesday.

Since the Terra ecosystem collapsed, with failed algorithmic stablecoin TerraUSD (UST) and cryptocurrency Luna (LUNC) becoming nearly worthless, there has been a ripple effect throughout the space. One of the cryptocurrency market’s biggest lending platforms, Celsius Network, paused its withdrawals on Sunday, sparking rumors of bankruptcy. Reports concerning the state of 3AC followed soon after, pushing further fears of contagion and systemic risk.

3AC reportedly owned LUNC alongside other cryptocurrencies, and it was a hefty investor in the Grayscale Bitcoin Trust, or GBTC, the largest Bitcoin fund. According to a January 2021 SEC filing, 3AC owned almost 39 million units of GBTC at the end of 2020.

“A lot of people have reached out about what they know—many of whom have direct relationships with 3AC as well. What we learned is that they were leveraged long everywhere and were getting margin-called,” Yuan wrote on Twitter. “Instead of answering the margin calls, they ghosted everyone. The platforms had no choice but to liquidate their positions, causing the markets to further dump.”

3AC, Celsius, Finblox, GBTC, UST, LUNC, BlockFi, Deribit (a derivitaves exchange), and 8 Blocks Capital are all involved in this mess.

Let's take one statement and sum it all up: "I hope you pay us back asap."

A telling note on the likelihood of that comes from Finblox which is offering an amazing "90% interest" on asset pledges. That's an indication of something headed to zero sooner than than later.

I am also amused by BlockFi's statement "We fully accelerated the loan and fully liquidated or hedged all the associated collateral.”

I highlighted the word "or hedged".

Question: How good are those hedges? What bankrupt firm will pay them?

CryptoBriefing reports 3AC co-founder Su Zhu published a Twitter statement Wednesday stating 3AC is “communicating with relevant parties and fully committed to working this out.”

3AC is one of the largest investment firms in the crypto industry. It has made investments in blockchain projects including Bitcoin and Ethereum and has invested in DeFi platforms such as Aave and Balancer. It has even invested in the NFT game Axie Infinity.

Oops.

I need to expand my list of comingled parties to 3AC, Celsius, Finblox, GBTC, UST, LUNC, BlockFi, Deribit, 8 Blocks Capital, Bitcoin, Ethereum, Aave, Balancer, and Axie Infinity.

Any more?

Founded in 2018, Babel Finance conducts its lending and trading business in bitcoin, ethereum, and stablecoins. It has about 500 customers, many of which are institutions, including traditional banks, investment funds, accredited investors, and family offices. The company had an outstanding loan balance of more than $3 billion at the end of 2021, it said in a May release.

In May, Babel Finance raised $80 million in a Series B round that valued the firm at $2 billion. Prominent venture capital firms including Jeneration Capital, 10T Holdings, Dragonfly Capital, and BAI Capital participated in the financing round.

If you are coming to the conclusion that it's impossible to untangle the contagion, then you are coming to the correct conclusion.

"Look at @saylor betting the company on it with leverage. For what? Another million dollar house, boat, island? Then he parades around like a laser-eyed idiot, expecting and getting hero-cult worship from those who got in early."

An ego trip and hero worship.

Meanwhile, the price of Bitcoin has fallen so much that bitcoin miners are losing money on their mining operations.

Not to worry, that's another thing I am told is virtually impossible.

This post is long enough if not too long already, but there is one more important idea to discuss.

At an individual level, "You" can still get the current quoted bid for a Bitcoin ($17,600 as I type)

But "You!" cannot get the current quoted bid. If everyone tried to sell, the price would crash to $500 or whatever the price marginal buyers are willing to pay.

Looking ahead, "You" may be able to get more than $20,000 tomorrow for a bitcoin but "You!" certainly cannot.

But hey that's OK because I have it on great authority that $1 BTC = $1 BTC and nothing else matters because "Bitcoin is Money" and "Money Always Goes Up."

"Saylor has enough coins to stay solvent down to 3000$. But at 11,500$ he will refuse to meet the Silvergate margin call. He will have sold 19K coins for 220M. THEY will own them. And liquidate them. THEY are a bank, defending loans on imaginary collateral?"

Meanwhile As Bitcoin Breaks Support, Bulls and Bears Pretend to Know the Unknowable.

My support points for Bitcoin are posted here: Fundamentally and Technically the Entire Crypto Space is a Huge Mess.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Arthur Hayes, the former CEO of BitMEX, believes forced Bitcoin liquidations have increased the selling pressure on the asset and explained the impact on BTC price. The bloodbath in crypto triggered a slew of liquidations by crypto lenders, forcing Bitcoin selling to push BTC lower.

Shiba Inu ecosystem’s governance token BONE is set to become the gas of layer-2 solution Shibarium protocol. This is a milestone upgrade for ShibArmy and the community of Shiba Inu coin holders voted on a key upgrade in BONE.

According to Korean media outlet JTBC News, prosecutors in the nation have imposed travel restrictions on Terra developers and former developers as investigations into Terra's LUNA and UST death spiral continue.

In the latest twist-and-turn of the SEC vs. Ripple case, the US Securities and Exchange Commission has hit back at Ripple, objecting to the payment giants attempts to redact certain information it deems ‘sensitive and confidential’.

Bitcoin price has gone through turbulent times over the last few months. From reaching a new all-time high to hitting yearly lows and revisiting levels since 2020, the crypto markets have been extremely volatile.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and Omissions may occur.Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, partners or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.