SINGAPORE — Non-Fungible Tokens, or NFTs for short, are digital assets that everyone seems to want to own these days. But are they really a good thing, or is it just going to be a passing trend?

This is part of a series where Yahoo Finance Singapore will focus on different aspects of millennials and their finances. In this second part, we discover whether it’s good for millennials to invest in NFTs.

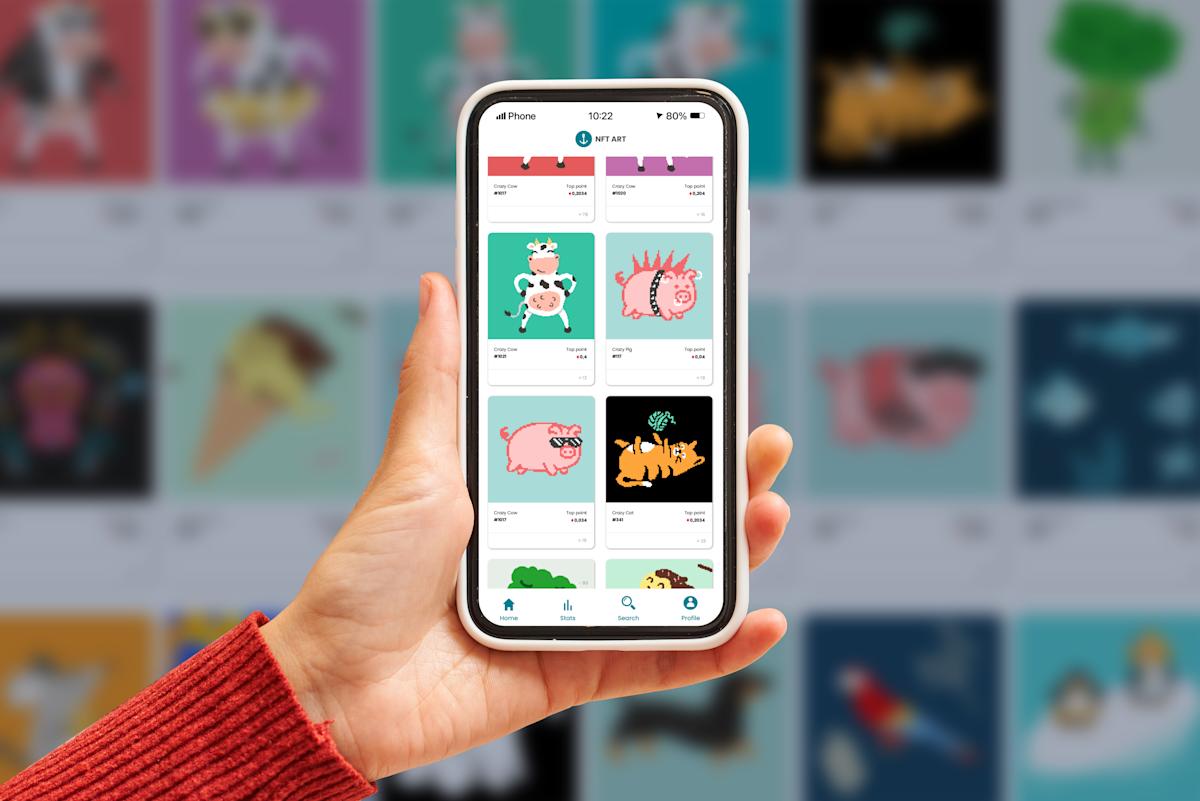

For the uninitiated, NFTs are basically certificates of digital ownership which have gained huge traction in recent years. The certificates have a unique record that is written into the fixed code (that cannot be changed) of a blockchain at time of creation or minting, which makes it a cryptographic asset. This can take the form of anything from digital art pieces, in-game items, music, fashion items and even virtual land.

To put it simply, NFTs are crypto assets that record the ownership of a digital file such as an image, video or text. Anyone can create, or “mint”, an NFT, and ownership of the token does not usually confer ownership of the underlying item.

Profits are generated when one sell’s the NFT to someone else who wants it more and is willing to pay a higher price, usually paid with cryptocurrency. Since it lies in the hope of selling it at a higher price to a willing buyer, the value of NFTs is heavily driven by sentiment and hype. This exposes sellers to the risk of price manipulation.

Also read: What should millennials invest in — stocks or cryptocurrency?

Also read: Millennial Money: How much do I need for my first HDB flat?

Also read: Millennial Money: How much do I need to spend on my wedding?

For instance, Twitter CEO Jack Dorsey created an NFT out of his first tweet and sold it for US$2.9 million in early 2021. Digital artist Beeple sold an NFT of his work for US$69 million, making him one of the most valuable living artists.

The utility of NFTs varies massively across the globe too. For example, there can be security tokens (to prove your identity) and even governance tokens (to indicate the right to vote). One can buy a NFT with crypto coins and NFTs can also represent a store of value, with some tokens worth more than others.

In fact, NFT sales volume totalled US$24.9 billion in 2021, compared to just US$94.9 million the year before, according to market tracker DappRadar.

Despite the huge number of people turning to NFTs, financial experts warn that unlike traditional financial assets, there is little or no basis for the valuation of NFTs.

This is because the asset prices of NFTs are determined by demand and supply. Meanwhile, traditional financial assets have some kind of yield or value being created. For example, if you invest into stocks of a company, and it has a business model that is growing, the value of your investment will grow along with it as well.

“NFTs do not have an underlying economic return based on economic activity of companies or countries. Their payoff structure is speculative and volatile: You can win astronomically but you can also lose everything”, said Chuin Ting Weber, CEO of MoneyOwl, a bionic financial advisor.

As such, Weber recommends that millennials look into buying NFTs mainly as a bet or venture. This means keeping the invested amount small and only putting in only what you are prepared to lose.

Providing a similar analogy, Gavin Chia, Head of Managed Investments and Investment Advisory of Standard Chartered Bank Singapore, said: “NFTs are a little bit more like buying a luxury car or watch, which is something that is sought after but doesn’t actually create value or yield a return.”

Financial experts warn that because NFTs are speculative in nature, the hope of attaining financial freedom through investing in NFTs is not a plan for financial success.

“Regardless of one’s age, speculative investing products should not dominate your investment portfolio,” said Gregory Van, CEO of Endowus, a Singapore-based financial technology company.

“It is crucial to build your core wealth through an investing strategy that is strategic to your goals and passive in asset allocation while being globally diversified and low in cost,” he added.

Van also advised that millennials do their research and verify the information they find online before taking action, especially when it comes to riskier investments like NFTs.

While the Monetary Authority of Singapore currently doesn’t regulate activities related to NFTs, it has reminded consumers that investments in digital tokens, including NFTs, are not suitable for retail investors, Senior Minister Tharman Shanmugaratnam said in a written reply to a parliamentary question on 15 February.

“For NFTs in particular, their perceived uniqueness, combined with speculative demand, has served to inflate prices. This potentially puts investors at risk of outsized losses should speculative fervour abate,” said Tharman, who is also chairman of the Monetary Authority of Singapore. He noted there are significant legal complexities and risks involved in NFTs.

Despite the lack of regulation, some Singapore companies are quick to jump on the bandwagon.

Singaporean ride-hailing app, Ryde, launched its first NFT project in April this year. Called “RydePals”, the NFTs will give owners exclusive in-app rewards and benefits like discounted rides and cashbacks. The RydePals NFTs can also be traded on secondary NFT exchanges like OpenSea.

“We want to deploy NFTs in a way that generates more real world value, especially for the rapidly growing market segment of Singaporeans who hold crypto”, says Terence Zou, founder and chief executive of Ryde.

Stay in the know on-the-go: Join Yahoo Singapore’s Telegram channel at http://t.me/YahooSingapore

Yahoo Finance’s David Hollerith joins the Live show to discuss former OpenSea executive potentially facing 20 years in prison after being charged in an alleged NFT insider trading scheme.

Designed like a boarding pass, the NFT includes an opportunity to meet Carey and fly with her to New York, when the star is inducted into the Songwriters Hall of Fame

Bored Apes, Cryptopunks and … Tweety birds? Warner Bros. is continuing its experimentation in the NFT (non-fungible token) business, with the characters from Looney Tunes being the next company IP to get the NFT treatment. The company is once again working with the NFT platform Nifty’s on the project, which will be called “Looney Tunes: […]

Johnny Depp and Amber Heard are each awarded millions in defamation lawsuits against each other, Sofia Richie celebrates engagement, Kim Kardashian shares steamy video with boyfriend Pete Davidson, and Justin Bieber posts adorable throwback photos

New York Giants veteran guard Mark Glowinski says rookie Evan Neal is "just dominant" and Saquon Barkley looks "explosive."

Yahoo Finance's Allie Canal breaks down how NFT scammers are impersonating celebrities online.

The Queen’s Platinum Jubilee celebrations kicked off on Thursday morning with a parade and flypast around Buckingham Palace, and the bittersweet acknowledgement that Britain is unlikely to experience anything quite like this ever again. The milestone marks 70 years on the throne for Queen Elizabeth II, who took the crown at just 25 years old […]

The rapper, record producer and fashion designer is seeking trademark protection for his YEEZUS name, signaling an intent to launch namesake amusement parks, non-fungible tokens (NFTs), toys and more. See related article: UK regulator slams Kim Kardashian for endorsing speculative token Fast facts Applications for 17 NFT and metaverse experience trademarks were made to the […]

The non-fungible token (NFT) market has been in more than just a lull lately. Since the January highs, the volume of daily NFT sales has plummeted from just over $6 billion to only $850 million — a nearly 90% decline. There are signs that this decrease is a part of the maturation of NFTs.

The singer's performance on the live music program originally aired on June 2, 1992.

WWE stands to pin down some extra cash — and hopes to whip up fan enthusiasm — in its first sale of NFTs featuring the wrestling entertainment company’s top stars. WWE, together with Fox Entertainment’s Blockchain Creative Labs, on Friday, June 3, plans to launch its its first NFT (nonfungible token) sale on Moonsault, WWE’s […]

The richest man in the world said he has a "super bad feeling about the economy." President Joe Biden wished him "lots of luck on his trip to the moon. I don't know."

Fed Vice Chair Lael Brainard told CNBC it's "very hard to see the case" to pause its interest rate hikes until inflation is tamed.

Although Congress has not taken action to make one available, millions of people will still be getting a payment this month. Two states are currently scheduled to send out stimulus payments to their residents in June: Maine and New Mexico. In Maine, payments will be available to those who filed their 2021 state tax returns.

(Bloomberg) — China has sentenced a former Communist Party city chief and securities regulator to death with a two-year reprieve for bribery and insider trading, state broadcaster CCTV reported.Most Read from BloombergOne-Third of Americans Making $250,000 Live Paycheck-to-Paycheck, Survey FindsTesla Pauses Hiring as Musk Aims for 10% Staff Cut, Reuters SaysElon Musk’s Ultimatum to Tesla Execs: Return to the Office or Get OutApple Plans to Make the iPad More Like a Laptop and Less Like a PhoneU

When you're in your 20s or 30s, your net worth may not be something you're so fixated on. In fact, your 60s are a great time to assess your net worth and figure out what options it gives you within the context of retirement. Now the good news is that people in their 60s tend to have a higher net worth than people in any other decade, according to recent data from Personal Capital.

Even if you can't make the full contribution now, smaller contributions are still better than nothing.

MarketWatch Picks has highlighted these products and services because we think readers will find them useful; the MarketWatch News staff is not involved in creating this content. The next thing to know: Keep your expectations at bay.

In the world of stock legends, Ken Fisher stands out. The legendary investor founded his private financial advisory firm, Fisher Investments, in 1979, with just $250 in seed money. Today, Fisher’s company manages over $195 billion in total assets, and his personal net work exceeds $5 billion. Fisher has cast his eye on current market conditions. In recent published note, Fisher points out the obvious headwinds in the current environment: “Fear of the impact of the tragic, grinding war in Ukraine

The Carolina Panthers' proposed $800 million practice facility project in Rock Hill, South Carolina, is officially dead after team owner David Tepper’s real estate company filed for Chapter 11 bankruptcy protection in Delaware on Wednesday night. Tepper, who made billions in hedge funds, is the NFL’s wealthiest owner. The filing will not affect the NFL’s Panthers or Major League Soccer’s Charlotte FC in any way.

Author

Administraroot