(Bloomberg) — Coinbase Global Inc. has gone from one of the stock market’s most hotly anticipated debuts to one of its most spectacular crashes in a little more than a year, leaving some analysts and investors bewildered by poor execution at the largest US cryptocurrency exchange.

Most Read from Bloomberg

Broadcom in Talks to Acquire Cloud Company VMware

Stocks Climb in Risk-On Day While Bonds Decline: Markets Wrap

Biden Misspeaks on Taiwan, Says US Military Would Intervene

Walmart’s Troubles Should Have Everyone on High Alert

Goldman’s Solomon Says Subway Shooting of Employee a ‘Senseless Tragedy’

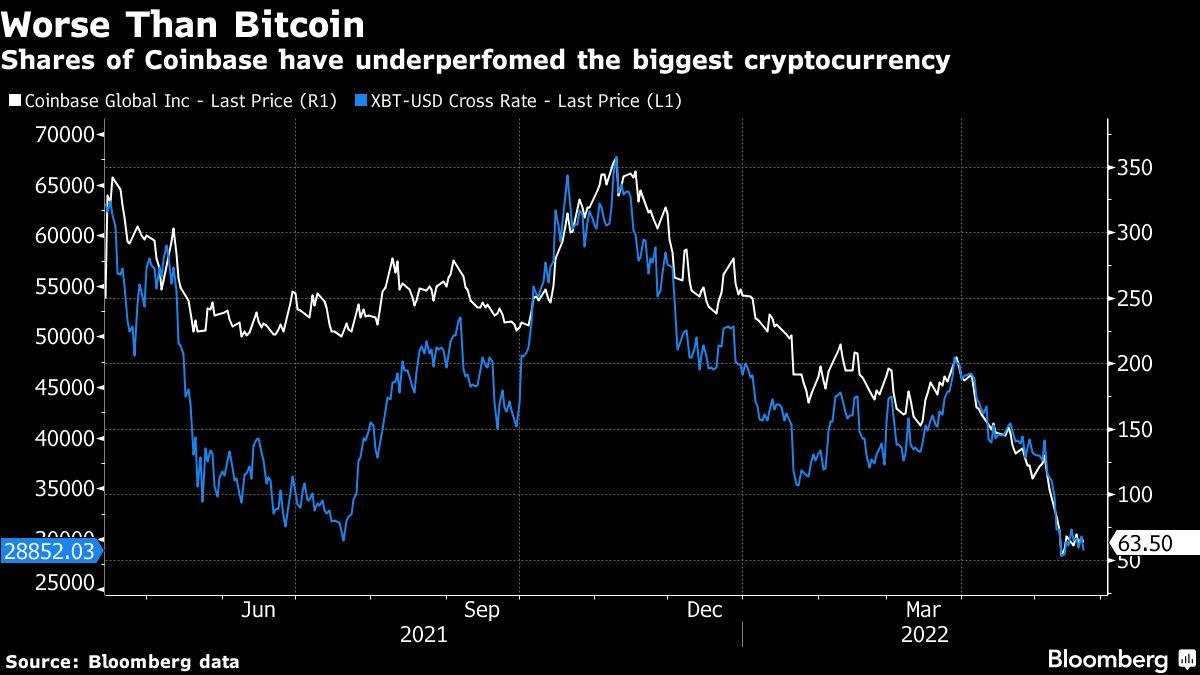

The firm’s market value has shrunk by about $51 billion since the end of its first day of trading last April. Coinbase shares fell to an all-time low earlier in May, and even after recovering somewhat are still down about 80% from their debut. That’s a steeper drop than Bitcoin’s 53% slump in the same period.

The recent bear market and regulatory pressure in crypto have played a big role. Last year, a promising yield-account product called Lend drew ire from the Securities and Exchange Commission, leading the company to scrap it and prompting a public rant by Chief Executive Officer Brian Armstrong. And as crypto prices crashed in the past six months, trading volumes dropped across most exchanges.

But poor execution played a part as well. Coinbase’s new nonfungible-token marketplace took months to launch — then fizzled. The company missed analysts’ revenue projections in the first three months of the year and guided for sequentially declining trading volume this quarter — in part because it has lost ground to rivals. Coinbase’s market share slipped to 4.8% of monthly crypto trading volume currently from 7.1% in November, as some users went to rivals such as DigiFinex and FTX US, according to researcher CryptoCompare.

Coinbase is expected to lose about $1.4 billion this year, according to analysts in a Bloomberg survey. Financial performance at some rivals has held up better, and competition from other exchanges is heating up.

“FTX’s revenues have not declined,” Sam Bankman-Fried, CEO of the exchange, said in an email. “Partially this is because of longstanding market-share growth, partially FTX has been more conservative on expenses, and will remain strongly net profitable this year.”

Some analysts believe Coinbase’s costs are too high. The company recently said it will slow down its hiring, and it could perhaps pause its expansion of sales and support staffs, John Todaro, an analyst at Needham & Co., said in an interview. Coinbase has ballooned to 4,948 full-time employees, from about 1,700 just a year ago. Hiring helped drive the company’s total operating costs to $1.7 billion in the first quarter, up 9% from the previous three months.

“They’ve grown expenses quite a bit,” Todaro said. “And I think the market was giving a little bit of an unfavorable reaction. If we are in a crypto winter, you don’t want to be going into that doubling, tripling the headcount. I think Coinbase management understood that.”

‘Slowing Down’

While Coinbase “may be slowing down our hiring, we have no intention of slowing our pace of product development,” a spokesperson said in an email.

In a memo to employees on May 17, Coinbase’s chief product officer, Surojit Chatterjee, said the company will be increasing its focus “on critical revenue-generating products” — a possible indication it’s backpedaling from its strategy of diversifying away from trading fees. Coinbase will double down on core products while seeking improvements in developer productivity, he said.

“This does not mean we plan to stop investing in strategic and venture projects,” Chatterjee said in a tweet about the memo. “We believe the down market is a great time to build for the longer term.” Coinbase is continuing to support at least one part of its diversification strategy, staking, which lets people earn yields on their digital coins.

The company’s new NFT marketplace — which was supposed to fuel growth through a new revenue stream — hasn’t gained traction. After attracting $75,000 in trading volume when it opened to all users on May 4, activity has since dropped, with volume of just $17,000 on May 19, according to tracker Dune. (All major NFT marketplaces have seen a decline in trading volume, however.) Coinbase’s marketplace has about 2,900 active unique users, according to Dune.

“Very little” of Coinbase’s NFT marketplace activity can be captured by tools like Dune, a company executive said during its latest earnings call.

Nick Tomaino, an early Coinbase employee who is now founder of venture fund 1confirmation, said on Twitter this month that he would consider selling his Coinbase shares if the company doesn’t make a strong move in NFTs in the coming year.

In a recent filing, the company said that customers could be treated as “general unsecured creditors” in the event of a bankruptcy, prompting concern from investors that the topic was even raised. CEO Armstrong said on Twitter that his company included the language in response to new regulatory requirements, and that “we have no risk of bankruptcy.”

Coinbase, in trying to come back from its stock slump, has two big strikes against it, said Chris Brendler, an analyst at D.A. Davidson Cos. “It has the dual problem of being not profitable on a consistent basis, and it’s also in crypto, which is also an area the market doesn’t like today,” he said.

Still, the company may be able to bounce back — as long as the rest of the market does as well.

“If it’s just a mild crypto winter, they could probably weather the storm,” said Mizuho Securities analyst Dan Dolev. “It really depends on how low crypto and Bitcoin goes.”

Most Read from Bloomberg Businessweek

The Thrill of Better Office Wi-Fi

Compensation Is Becoming an Even Bigger Headache in the Remote-Work Era

The Math Prodigy Whose Hack Upended DeFi Won’t Give Back His Millions

A $60 Billion Crypto Collapse Reveals a New Kind of Bank Run

Used Cars Become an Expensive Problem for Online Dealers Like Carvana

©2022 Bloomberg L.P.

Related Quotes

(Bloomberg Law) — A Big Law associate who drew the ire of Elon Musk for his prior work at the U.S. Securities and Exchange Commission has left Cooley for an assistant general counsel position at the online trading platform Robinhood Markets Inc.Most Read from BloombergElon Musk Says Bill Gates Has ‘Multi-Billion Dollar’ Tesla Short PositionElizabeth Holmes Urges Judge to Overturn Verdict and Acquit HerWalmart, Gap and Others Amass $45 Billion in Extra Stuff to SellUkraine Latest: EU Leaders Tal

When Buffett buys, the market listens.

With inflation sky high and the Federal Reserve tightening monetary policy in response, 2022 is sure to be one of the more volatile years for the stock market in at least the last decade. Three Motley Fool.com contributors think Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), Universal Display (NASDAQ: OLED), and Kulicke and Soffa Industries (NASDAQ: KLIC) are cash cows ideally positioned to thrive. The "Snap" that broke the camel's back?

Markets are shaky. Your income stream doesn’t have to be.

‘Both are insistent that I'm taking money that is morally theirs. There's no changing their mind.’

Meanwhile, the growth-stock-focused Nasdaq Composite is off 30% from its November record closing high. Going shopping during steep corrections and bear markets offers investors the opportunity to buy innovative growth stocks that can deliver transformational wealth…with some patience, of course. What follows are five examples of growth stocks with supercharged return potential that can, over many years or decades, put investors on a path to complete financial independence.

These rapidly growing stocks are begging to be bought following a more than 30% peak decline in the Nasdaq.

Dividends are the bread and butter of income investors. You don't need to sell your assets or spend hours every day managing your accounts. Instead, dividend stocks simply generate income on their own. Putting together a portfolio that generates at least … Continue reading → The post How to Make $1,000 a Month in Dividends appeared first on SmartAsset Blog.

Real estate mogul Barbara Corcoran didn't mince words when asked about Tesla (TSLA) CEO Elon Musk's recent behavior.

If we can find high-quality stocks with high dividend yields, all the better. In this article, we'll take a look at three high-yield stocks that are also attractive on a total return basis. The company targets the lower end of the market with smaller, more attainable single-family homes in 15 states in the U.S. In addition, it has a mortgage-origination business for its homebuyers, insurance coverage for the homes it sells, and related products and services.

The stock market selloff has made many stocks look cheap—but smart investors need to be selective. Here are six high-quality companies that trade at reasonable valuations.

There’s more evidence that the economic narrative could be undergoing a major shift.

After snapping their longest losing streak in over 20 years, U.S. stocks will look build on these gains in a short trading week.

(Bloomberg) — Goldman Sachs Group Inc. said the price of three key battery metals — cobalt, lithium and nickel — will drop over the next two years after investors wanting exposure to the green-energy transition piled in too quickly.Most Read from BloombergElon Musk Says Bill Gates Has ‘Multi-Billion Dollar’ Tesla Short PositionElizabeth Holmes Urges Judge to Overturn Verdict and Acquit HerWalmart, Gap and Others Amass $45 Billion in Extra Stuff to SellUkraine Latest: EU Leaders Talk to Putin;

The stock market ended its multiweek losing streak, and like a sports team that finally got a win, it’s worth celebrating. It just doesn’t mean the team—or this stock market—is any good. “Stocks finally enjoyed a strong bounce this week,” writes Canaccord Genuity analyst Martin Roberge.

Inflation and supply chain issues have cast a dark shadow over retail stocks. Never mind that people still need to eat even when prices go up, Target TGT stock has dropped 26.9% over the past month and Walmart WMT shares are down 16% during that same time period. Walmart and Target have leverage when it comes to the supply chain.

There are many ways to start generating some passive income. Investing in dividend stocks is one tried-and-true method. Pipeline stocks are some of the best because they offer high dividend yields and steady growth.

‘I have made an earnest attempt to get the bank to take their money back, so I was wondering if at any point or time the money would become legally mine.’

It’s difficult for most stocks to make any headway in 2022. Inflation, rising interest rates and Russia’s ongoing war on Ukraine have dragged down even those with minimal exposure to the macro headwinds. For Novavax (NVAX), these worries have been amplified by other considerations. First, there is the prospect of dwindling global demand for Covid-19 vaccines, what with the virus on the backfoot in many parts of the world and there being an oversupply in selected regions. Secondly, in the U.S. at

In this article, we will discuss some of the notable stocks analysts are upgrading today. To take a look at some more stocks that are being upgraded, go to Analysts Are Upgrading These 5 Stocks on Friday. The US market closed in the green for the first time in the last seven weeks as positive […]

Author

Administraroot