Advertisement

Supported by

Why would anyone spend that much for a virtual shoe?

Send any friend a story

As a subscriber, you have 10 gift articles to give each month. Anyone can read what you share.

The market for collectible sneakers has skyrocketed in recent years. And until recently, so had the market for NFTs, or nonfungible tokens, which function as digital certificates of ownership for works of art as well as tattoo designs and virtual real estate.

It was only matter of time before the two hypebeast markets collided.

In April, Nike released its first collection of virtual sneakers, called Cryptokicks, which comprised 20,000 NFTs, including one designed by the artist Takashi Murakami that was bought by someone named AliSajwani for $134,000.

“The mechanics around NFTs and sneakers are pretty similar,” said Jurgen Alker, who runs the NFT studio for Highsnobiety, the lifestyle site that covers streetwear and sneakers. “Both are created around scarcity and drops. It is about community, status and belonging to something.”

This is Nike’s first entry into the market and its first release with RTFKT (pronounced “artifact”), a company it bought last December that had stoked a market for virtual sneakers.

Other sneaker giants also have gotten involved. Last December, Adidas released an NFT collection called Into the Metaverse that gave buyers access to limited-edition streetwear including hoodies and tracksuits (but no sneakers). Made in partnership with the Bored Ape Yacht Club, Punks Comic and the crypto evangelist GMoney, it was essentially a digital drop for NFT-savvy Adidas collectors and netted more than $22 million in the first afternoon, according to The Verge.

Asics, the Japanese athletic brand, recently created 1,000 NFT sneakers in collaboration with STEPN, a fitness app that rewards runners with cryptocurrency for each step they take (think of it as a combination of Pokemon GO and Strava). The virtual sneaker can be worn in the app, and features “gamification” features including sneaker leveling, shoe-minting and NFT customization, said Yawn Rong, one of the founders of STEPN.

In one sense, virtual sneakers offer the same bragging rights as the real thing. Collectors can show them off on social media or in NFT exchanges like OpenSea.

Skeptics, however, believe that NFT sneakers represent a cynical money grab, both by brands and investors looking to make a quick buck.

“Once sneakers became a commodity and were getting bought and sold by people who didn’t really care about the sneaker itself, it only makes sense to do away with the physical product,” said Russ Bengtson, a former Complex editor who is writing a book about sneakers. “But the thing is, there’s still a lot of people who would rather show them off on their feet than on social media. For us, sneaker NFTs serve no purpose. If I’m hungry, I don’t want an NFT of a burger.”

So what do the buyers of the Nike Cryptokicks actually own? It’s not entirely clear.

The rollout was shrouded in mystery. In February, RTFKT released 20,000 NFTs of a mysterious box called MNLTH, pronounced “monolith” (vowels, apparently, are for noobs in the NFT world). The only clue about what was inside was the Nike Swoosh and RTFKT’s lightning bolt logo.

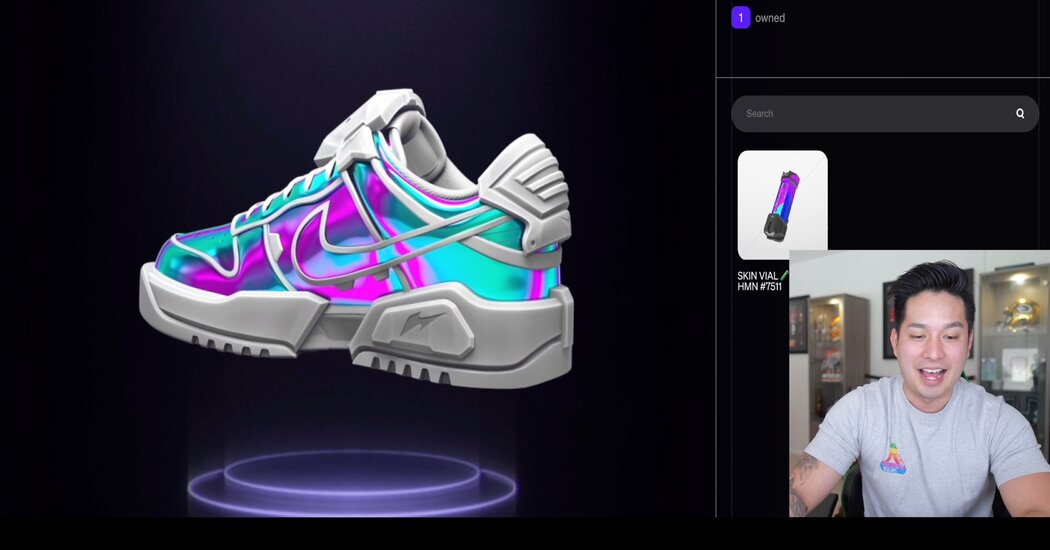

Some 8,100 people who owned an NFT from one of RTFKT’s earlier collections received a MNLTH for no additional cost, said Joe Chui, 39, an NFT analyst in San Francisco who runs the YouTube channel RealTalkFIRE, and who received two. Everyone else could buy one on OpenSea, starting around 5 Ether (about $15,000 at the time), although no one knew what was inside. (Nike did not respond to multiple requests for comment.)

That didn’t stop Bryson Honjo, 31, who lives in Honolulu and runs UntiedHawaii, a YouTube sneaker channel, from paying 5 Ether apiece for two MNLTH boxes. “You have to believe that this is going to be another revolutionary sneaker, akin to the 1985 Air Jordan 1,” Mr. Honjo said.

On April 22, after months of speculation, Nike announced on Twitter, Discord and other social media platforms that owners could connect their crypto wallets, where they stored the NFTs, to the RTFKT site to “open” their boxes, Mr. Chui said.

Inside, owners found a digital image of a generic basketball shoe called a Nike Dunk Genesis Cryptokick, along with a virtual “skin vial”— a glowing canister that, once inserted into a port on the virtual sneaker’s tongue, gives the sneaker its final look.

The skins also determine the sneaker’s worth. Owners were randomly assigned one of eight skins, ranging from the most common, “Human,” with its fuchsia and black colorway, to the rarest, “Alien,” in purple and green.

Their value on the secondary market varies widely, according to scarcity. As of this writing, there are 5,661 Human vials available on OpenSea, with a floor price of 0.59 Ether (about $1,154, although crypto prices have been fluctuating wildly). There are only 18 Alien vials on the market, with a floor price of 90 Ether (about $176,000).

For now, the Cryptokicks only exist in digital form, viewable on OpenSea or the RTFKT site. But owners are hoping they eventually will be able to modify them as new skins are released, and also wear them in online games and in the metaverse.

“It will be huge if Nike can get their NFT sneakers into games like Fortnite or GTA6,” Mr. Alker of Highsnobiety said, referring to Grand Theft Auto VI. “Then you can flex your sneakers in games, and not only on the street.”

Others are hoping to be able to redeem their NFTs for a physical version. But a physical version is almost beside the point for Mr. Honjo.

“The most expensive physical sneaker I ever owned was a pair of Nike Air Yeezy 2 Red Octobers, which I sold for $9,000,” Mr. Honjo said. “In the four years that I owned them, I wore them a whopping two times. So with that in mind, is a shoe that is basically only displayed even really a shoe anymore?”

Mr. Chui feels the same way. For him, the Cryptokicks are much more than a virtual sneaker.

“The thing that gets me most excited is going through this renaissance,” said Mr. Chui, who has two pairs of Cryptokicks. “We’re experiencing this intersection of the physical, the virtual, the gaming world and the investing world in real time.”

Advertisement

Author

Administraroot