It could have been me. I’m glad it wasn’t me.

Updated at 6:10 p.m. ET on May 18, 2022

“What do you think of this company Netscape?” my parents asked. It was 1995, and they had called me on the landline, which back then just meant the telephone. Netscape was a company that made a graphical web browser—the web browser, really—but gave it away for free. Its income statement showed only modest revenue (and substantial losses). The web was new and exciting but unproven, so I steered my folks away from Netscape’s IPO.

Hahaha. Netscape stock doubled its $28 offering price the day it went public, making its founders half billionaires and ushering in the dot-com era. By the end of the year, the stock hit $174, and when AOL acquired the company in 1999, just before the dot-com crash, the deal was worth $10 billion.

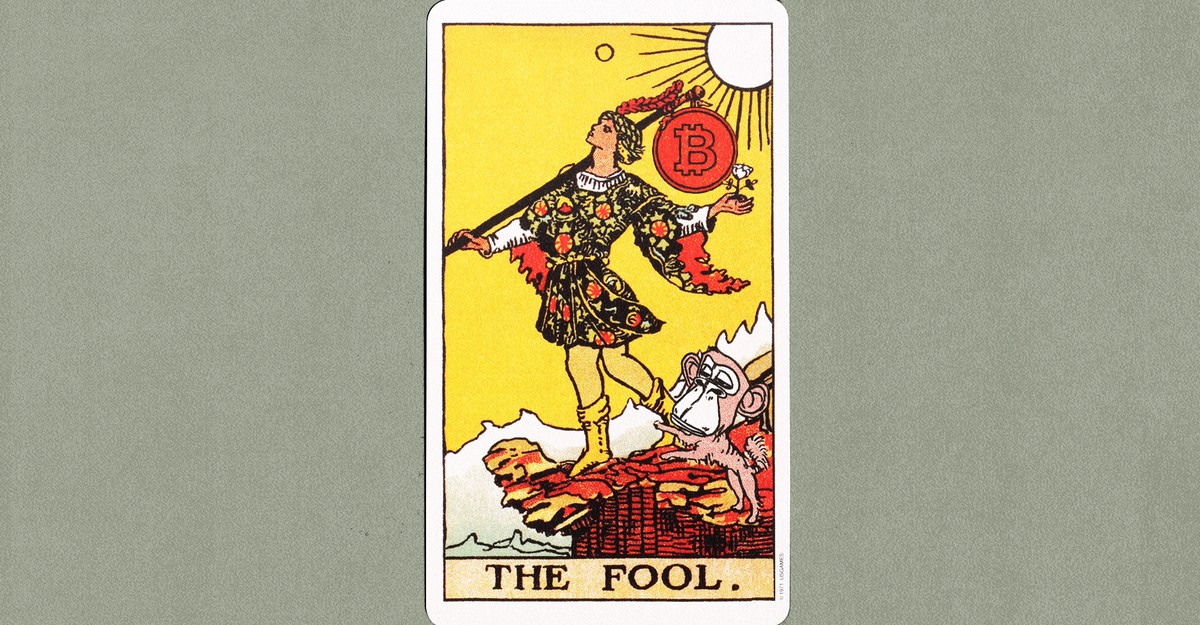

A decade and a bit later, a new digital “currency” called bitcoin, meted out by computers that solved math problems, was worth less than a dime. Even that price seemed too high. Bitcoin didn’t really exist, nobody accepted it for payments, and it was almost impossible to create, store, and trade. How stupid, I thought. If my parents had called me up again to ask whether they should buy in, I would have told them no again. But $1,000 “invested” in bitcoin at the right moment in 2010 turned into $625 million last year, when the ur-cryptocurrency hit $50,000. Even now, as the cryptocurrency market recovers from this month’s big collapse, that $1,000 would still be worth more than $350 million.

A special, acid feeling wells up when you realize that you’ve passed up the opportunity to get rich with no effort whatsoever. Denser than jealousy but lighter than regret, it is a nausea of the spirit rather than the gut. Netscape and bitcoin (and GameStop and perhaps even Tesla) are windfall fantasies. In hindsight, only an idiot would have missed the boat had they been on its gangway at the crucial moment.

Now all the losers—the ones like me and my parents (sorry, Mom)—are standing on the shore with our binoculars, wondering if the USS Crypto is about to sink into the sea. This month’s crash occurred, at least in a proximate sense, when a so-called stablecoin named terra lost its peg to the U.S. dollar, an event you don’t really need to understand to continue reading this article. The ultimate causes were more numerous: inflation and rising interest rates have destabilized financial markets on the whole, and tech securities have been especially volatile. Bitcoin’s value has now degraded to just half of what it was last fall. Many of the people who bought in recently have lost their shirts. Many of the people who put their money into other cryptocurrencies have lost a whole lot more.

Alas, but also: hurrah. I have empathy for individuals who are suffering, but in the broader sense, the frustration of “It could have been me” has been swapped for the dark pleasure and relief of “I’m glad it wasn’t me.” It’s the same schadenfreude that arrives when an Antiques Roadshow expert tells some schlemiel that the disposed dust sleeve of a rare book meant the difference between a six-figure auction and a pittance. It’s too bad, really, but it’s also just too good.

You can tell I didn’t buy (and hold) bitcoin at $0.08, because I’m writing articles on the internet instead of polishing the gilded fixtures of my yacht. To live with this folly, I have told myself many stories. For one, I am proud to have been uninvolved in underwriting the scams perpetrated by bitcoin aficionados. For another, I am glad to have avoided contributing directly to the energy consumption required to operate the blockchain. For a third, I am happy to be spared participation in the overall crypto subculture, a community one would, presumably, be tempted to honor had it been the source of massive personal wealth.

Read: The internet is just investment banking now

But mostly, I take glee in the certainty that, had I actually figured out how to create and store circa-2010 bitcoins in an online “wallet,” I surely, without a doubt, would have stored that wallet on a hard drive that ended up malfunctioning, or lost the cryptographic key needed to unlock it. To lose $350 million down a storm drain would be far worse than never having had it in the first place.

I’m sorry—also glad—to say that the crypto crash has spread to other online assets, too. Non-fungible tokens are also in distress. The blue-chip NFTs, such as Bored Apes, have lost half their hypothetical value, while other, less popular issues are falling even faster, and trades of these digital goods are slowing overall. Here again, schadenfreude is selling high. Whether all this pleasure taken at the expense of rubes who bought in only to lose out will continue expanding in the weeks ahead—or if it’s just a short-term bubble of its own—remains to be determined. The collapse of cryptocurrencies could reverse into another boom at any moment. It’s happened before. Proponents urge their fellow believers to “buy the dip” and keep the faith, and that faith has sometimes been rewarded.

Whatever happens, though, the jagged history of crypto shows that foolish risk creates its own aesthetics. The crypto-bro investor does not evoke vicarious excitement, like a stuntman jumping motorcycles or a daredevil mountaineer, because his antics at the keyboard don’t appear to take much skill. He’s more like a bettor at the track who picks the winning horse at random, or a country-club jerk who hits a lucky hole in one. Watching him may elicit wonder at his cosmic luck—a mathematical sublimity. But no one would describe his victory as a beautiful achievement.

That’s why we end up feeling nauseated at the crypto bro’s success: It’s so unearned, it makes us sick. But our schadenfreude is a product of the same illusion. We’re not reveling in our prudence, so much as we’re indulging in an even lamer form of grandiosity. “It could have been me” was a lie from the start: Sure, we might have profited 10,000-fold—and then lost everything a few years later—but probably not. If my folks and I had purchased Netscape at its IPO, we wouldn’t now be plutocrats. We’d have put a few thousand dollars in, at most, and then sold off our stocks when their value had tripled or quadrupled. We’d have made a little money and been glad. As for crypto, I bought a thousand bucks’ worth a while back and am down by half. Whatever. The fantasy of failing to achieve a massive gain, and then also of averting bankruptcy, flatters us twice over. The truth is more banal: It could never have been me.

This article originally stated that the crash occurred when a stablecoin called tether lost its peg to the U.S. dollar. The crash had more to do with another stablecoin, terra, that also lost its peg.

Author

Administraroot