When Britain voted for Brexit, Macron boasted that Paris would eat the City of London’s lunch. It didn’t quite work out that way, with most league tables continuing to put London as the number one or two financial centre, with not a single EU city in the top ten. Emmanuel Macron's government has now announced that it has invited Binance, a crypto exchange site, to set up a European HQ in Paris. You have to ask: has Macron leapt on a bandwagon which has already started to lose its wheels?

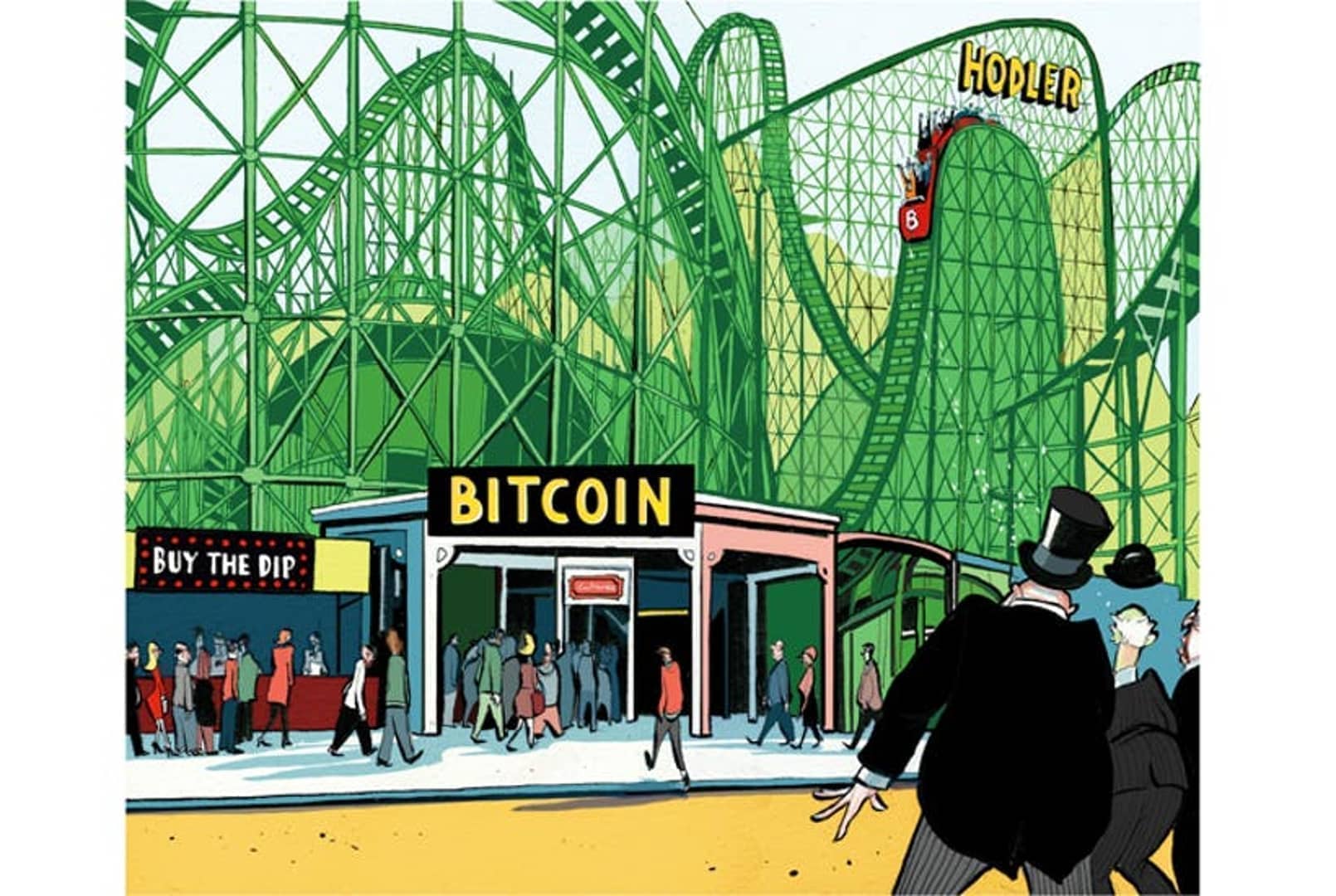

The warning sign for cryptocurrencies is not so much that they have crashed – Bitcoin is down 50 per cent from its peak last November – but that they have become boring. Bitcoin has suffered many a crash before, yet bottom-feeders quickly rushed into the market and sent the price rebounding. This time around there is little sign of any enthusiastic speculation. On the contrary, a brief rally in March fizzled out as quickly as it had begun. Bitcoin now looks set to plunge below its previous peak of 31,776 reached last July.

Many thought that Bitcoin and other cryptocurrencies could turn out to be a hedge against inflation. Those hopes have been dashed. While most currencies have been devaluing against real-world assets, cryptocurrencies have been falling in value faster. As for the other long-term incentive to hold Bitcoin – that it might provide a stable wealth store from the prying eyes of government – that started to decay a while ago as governments got better at tracking down cryptocurrencies.

So cryptocurrencies are no longer making anyone rapid fortunes, are no longer protecting against inflation, and governments are working out how to find them. What exactly is the attraction? They are clearly little more than a pyramid scheme: machines for redistributing wealth from players who are late into the gold rush to those who were early. And like all other pyramid schemes, they have a brief and finite life. Many of these new get-rich-quick schemes – like NFTs – have already come and gone.

Cryptocurrencies face not so much a rapid crash as a slide into nothingness. That a cryptocurrency exchange should want to take shelter in Macron's France, which is bound to end up regulating it to death, is the biggest ‘sell’ sign yet.

Ross Clark is a leader writer and columnist who, besides three decades with The Spectator, writes for the Daily Telegraph and several other newspapers